Bank of England Holds Interest Rate at Record-Low 0.5%; £325bn Quantitative Easing Target Unchanged

Bank of England rate-setters have held the base interest rate at its record-low of 0.5 percent for the 37th consecutive month, and left their £325bn quantitative easing (QE) target unchanged.

The Bank's Monetary Policy Committee (MPC), made up of nine economists appointed by the Chancellor of the Exchequer, took the decision at its monthly meeting Thursday.

They are chasing the government's 2 percent target for inflation, which was at 3.4 percent in February.

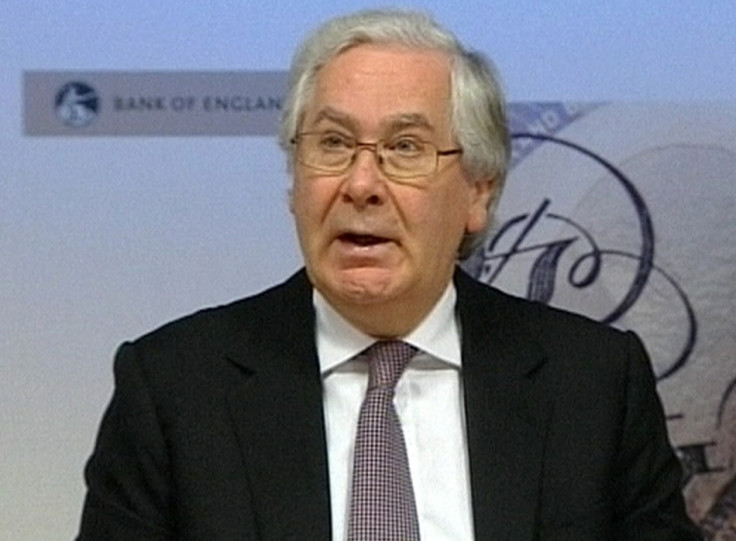

Sir Mervyn King, the Bank's governor, has said he expects inflation to hit its target by the end of the year.

"There was little uncertainty around this month's MPC decision, as the latest extension of QE runs until May. The focus therefore remains on whether further asset purchases will be announced next month," Ian McCafferty, Confederation of British Industry chief economic adviser, said

"It's a difficult judgement call, but on balance we're not expecting a further extension next month.

"Recent economic data has been more encouraging, and with oil prices high, there's now less certainty around how far and how fast inflation will fall."

Recent purchasing managers index data from the UK showed increased activity in the services, construction, and manufacturing sectors in the first three months of 2012, indicating the country will avoid a recession after a 0.3 percent GDP contraction in the last quarter of 2011.

A Reuters poll of economists revealed most think this means the Bank will hold off expanding its quantitative easing programme, known as the asset purchase facility, which sees it plough hundreds of billions of pounds into buying gilts to improve liquidity in the markets.

They already increased the value of the programme, which started in January 2009 with a £200bn target, twice.

In February £50bn was added to the target after an October boost of £75bn.

© Copyright IBTimes 2024. All rights reserved.