Asian Currencies at New Low as US Fed Prepares to Complete Tapering

Asian currencies have fallen to new lows as the market braces for the September policy meeting of the US Federal Reserve, which is aims to complete the winding up of its asset purchase program by the next month.

Charles Plosser, president of the Philadelphia Federal Reserve said the central bank must acknowledge and prepare the markets for the fact that interest rates may begin to increase sooner than previously anticipated.

Plosser shrugged off the weaker-than-expected August jobs data saying the longer-term picture is promising. He criticised the Fed's forward guidance regarding the expected timing for raising the funds rate and asked the central bank to be data-dependent.

"Appropriate monetary policy must respond to the data. By indicating that the FOMC continues to anticipate that it will be a "considerable time" before it is likely that the Committee will raise interest rates does not reflect the significant progress toward our goals," Plosser said.

FOMC and US Data

The FOMC meets on 17 September. Major data releases from the US after the 22 August speech of the Fed Chair Yellen were largely on the positive side, increasing the expectations of a statement biased to the hawkish side this time.

Durable goods orders soared 22.6% in July, compared to the previous month's 2.7% and the market consensus of 7.5%, data on 26 August showed. The US consumer confidence rose to 92.4 from 90.3, when analysts were expecting a drop t0 89.0.

Then the GDP data on 28 August showed that the world's largest economy expanded 4.2% in the second quarter, after contracting 2.1% in the first quarter, beating analysts' forecast of 3.9% growth.

On 2 September, the Institute of Supply Management (ISM) said the purchasing managers' index for manufacturing has risen to 59.0 for August from 57.1 in the previous month when the market was looking for a drop to 56.8. The ISM non-manufacturing PMI also rose, to 59.6 from 58.7, again contrary to the expectations of a fall.

The dollar index, the gauge that measure's the greenback's strength against a basket of six major currencies on a trade-weighted basis, has skyrocketed to a 14-month high of 84.5 on 9 September.

The index that has been up for third straight month, saw some profit taking after hitting the peak but has been closing higher again, since Wednesday. It traded as high as 84.36 on Friday.

At the high of 9 September, the USD index was up 2.13% from end-August and 5.9% from end-June.

Asian Currencies vs US Dollar

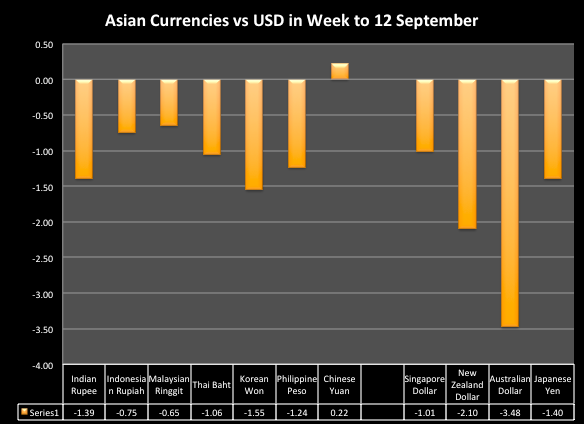

All the Asian currencies except the Chinese yuan have fallen against the US dollar in the week to 12 September. (See the IBTimes UK chart.)

The yuan is supported by the Chinese central bank policy of gradual appreciation of the currency and upbeat data. The bank said on 12 September that new yuan-denominated loans issued to consumers and businesses increased to 702.5 billion in August from 385.2 billion in the previous month.

Currencies of the developed world such as the New Zealand and Australian dollars and the Japanese yen have dropped more drastically while Indonesian and Malaysian units fared reasonably well with less than 1% fall.

The Indian rupee fell 1.4% and the Korean won was down 1.5% at the high of this week. Philippine peso and Thai baht were down 1.24% and 1.06% respectively at the weakest point of the week.

While the Chinese yuan is trading at a six-month high against the dollar, the Singapore currency has fallen to a six-month low against the greenback.

The rupee, won, peso, ringgit and the baht are trading near one-month lows versus the US dollar and the Indonesian unit has dropped to a two-month low.

© Copyright IBTimes 2024. All rights reserved.