Edmund Shing: Forget Greek debt woes and buy into the European market recovery

I have to admit it - I am sick of being asked over and over again for my opinion on Greece.

Will it stay in the Eurozone or will it be forced to leave? Is the Greek drachma going to come back? And so on and so on...

Here is what I really think deep down: whether Greece stays in the Eurozone or not, I believe that you should be investing in Eurozone stocks anyway.

I have three reasons for believing this:

1. The European economy is improving and Greece is small

Greece is the 13th-largest economy in the EU (out of 28 member states) and only contributes 1.3% to the EU by Gross Domestic Product (GDP), the classical measure of economic output.

So it frankly hardly moves the needle compared heavyweights such as the UK, Germany, France and Italy.

European economies are improving. Not just the UK's, which we can all see through the lens of the employment and property markets, but also in Continental Europe. In Germany, unemployment rates remain at generational lows. Wage growth is now starting to pick up, giving employees more purchasing power.

At the same time, the cost of living in the UK is staying low, thanks to the fall in oil and petrol prices plus subdued food prices. The cost of eating is being depressed in large part by ongoing price wars between supermarket chains and discounters like Aldi and Lidl.

Finally, the weaker euro has helped boost exports from Germany, Ireland and Spain to the rest of the world (while the strong pound is making the UK's exports relatively more expensive).

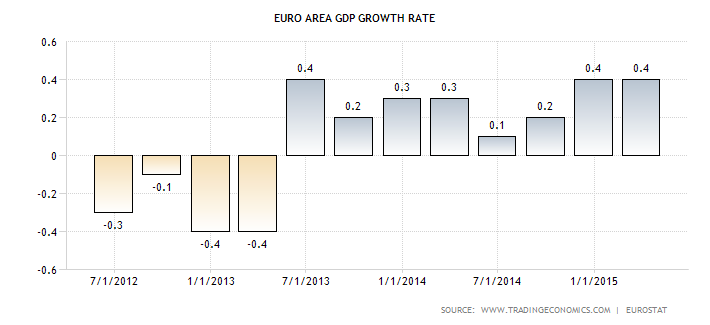

All of this has boosted the Euro zone's economic growth rate, as measured by GDP.

2. Reforms are boosting both economies and company profits

Ireland, Spain, Portugal, France and Italy have made varying degrees of progress in lifting regulations and easing job-market rules, changes that can lead to better growth. Ireland and Spain are now the fastest-growing economies in the EU, and even Portugal is improving.

At the company level, investors are seeing a whole host of reforms too. Companies have become much keener on cost-cutting and are targeting their investments on good growth prospects. It has become somewhat easier to hire and fire employees, an essential reform to encourage companies to employ more people to boost sales and profit growth in the long-term.

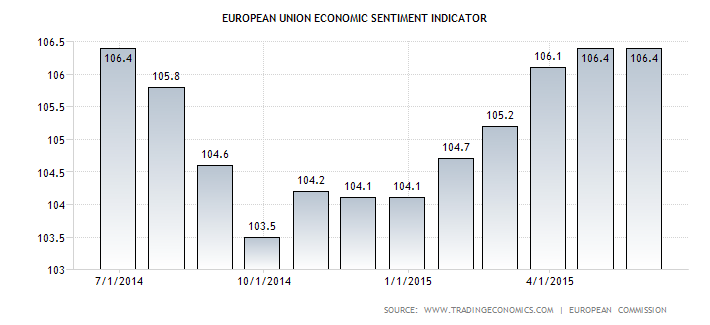

This corporate strength is reflected in the very high levels of business confidence seen across the European Union today, with companies looking to invest for future growth.

The result is that the profitability of European companies has surged over the past few years. Even banks, which have been under the regulators' cosh since the 'Great Financial Crisis' are now starting to see growth in profits, which is translating into growth in dividends too.

3. European shares are cheap

At 15 times price/earnings ratio, the European stock market is cheap relative to other large stock markets such as the US. Shares in countries such as Spain and Italy look particularly cheap. And European stock markets are also cheap relative to their own history, if you compare today to the last 30 years.

At the same time, European companies pay out an average dividend yield of well over 3%, which is an income which is not to be sniffed at in these times of near-zero interest rates.

With the improvement in the underlying Euro economy continuing, European companies should continue to produce strong profit growth; thus an attractive combination of growth and value, which is what experienced investors look for.

What to buy? The direct way via an exchange-traded fund

The easy way to buy into European value and profit recovery is through a fund: I would recommend a cheap exchange-traded fund (ETF) such as the db x-trackers MSCI EMU Index UCITS ETF (code: XD5S).

This is an ETF that is:

- cheap (they only charge investors a management fee of 0.25% per year);

- priced in pounds sterling (current price £18.09); and

- currency-hedged so that investors do not suffer from any weakness of the euro currency against the pound sterling.

What to buy? The indirect way via UK stock which is heavily exposed to Europe

The second option is to buy shares in a UK company that has a heavy exposure to Continental Europe, and which should thus benefit from future Euro area growth.

European companies offer an attractive combination of growth and value, which is what experienced investors look for.

I would look at Sky (code: SKY). We all know and love Sky for providing us with satellite TV (namely sports, movies and of course not-to-be-missed series such as Game of Thrones), but Sky has also recently integrated Sky Deutschland (its German + Austrian equivalent) and also Sky Italia (Sky in Italy).

In all three countries, Sky is the dominant satellite TV provider. Sky is an excellent company which is dominant in a number of the largest countries in Europe. It will thus benefit from higher consumer spending in Continental Europe.

As an additional inducement, remember that the Rupert Murdoch-controlled US-based Fox network still owns 39% of Sky's shares, and have recently rebuffed two offers to buy this Sky stake from Vodafone and from France's Vivendi.

Perhaps Murdoch is thinking of buying out the 61% of Sky's shares he doesn't own in the near future?

All in all, the bottom line is that Greek concerns should not dissuade you from investing in European recovery, whether via an exchange-traded fund or via Sky.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2024. All rights reserved.