Gold Prices To Rise on Bullish Technical Charts

Gold prices are set to rise further next week, supported by bullish technical charts.

As many as 19 of 23 analysts polled in a Kitco Gold Survey said they expected gold prices to rise, while two predicted that prices would drop and two forecast prices to remain unchanged.

Ralph Preston, principal, Heritage West Financial, listed several technical-chart points -- The double bottom lows from July and December 2013, gold rising above $1,280 and breaking the downward sloping trend-line drawn over the peaks of August at $1,430 and October at $1,375, and the metal rising above the 200-day moving average, which comes in Friday at $1,308.80, Preston told Kitco on 21 February.

Adrian Day, chief executive at Adrian Day Asset Management, said the change in sentiment for gold, which compelled formerly bearish traders to scramble, also helped the metal.

Kevin Grady, of Phoenix Futures and Options, said: "We continue to see tightness in the forward markets which I feel will spill over into the futures. Although the jewelers do not appear to be buying at these levels, there continues to be a bid under the market. This leads me to believe that we may be seeing some central-bank buying.

"A key factor for gold this week was the release of the Federal Reserve minutes. Although the verbiage led us to believe that the current tapering plan would continue, the gold price held up under immediate pressure. The 200-day moving average comes in around $1,305. We need to hold this area for gold to attract new buyers," Grady said.

Commerzbank Corporates & Markets said in a 21 February note to clients: "The price of gold has recently climbed to its highest level since October 2013, the main reasons being a weaker dollar, speculative buying and lower outflows from gold ETFs. Last year, investors took some 900 tonnes of gold out of ETFs and contributed significantly to the slump in prices.

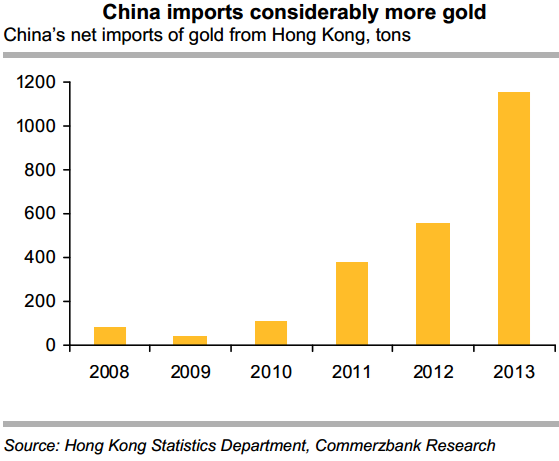

"Strong physical demand from China in particular should continue to support the price of gold in the medium term. The January figures from Hong Kong's Statistics Department on gold trade with China, due out next week, should confirm high Chinese buying interest. That said, the potential is limited in the short term."

Commerzbank Corporates & Markets said in a separate note: "For the first time since 1980, Switzerland [on 20 February] published detailed statistics regarding its gold trading activities, showing that around 85 tons of gold were exported to Hong Kong in January; this accounted for almost half of the country's total gold exports. The gold is likely to have been shipped on to China, which points to continuing high gold demand there. The Census and Statistics Department of the Hong Kong government will be reporting during the course of next week on its trading activities with the Chinese mainland.

"Other major buyers of the Swiss gold were India, Singapore and the United Arab Emirates. Switzerland does not produce the gold itself, however; it imports it from other countries and then melts it down to sell to Asian buyers in smaller units. By far the largest quantity of gold (119 tons) was imported from Great Britain - part of this total is likely to have come from sold ETF holdings. This underpins the gold flow from west to east that has been underway for months now."

Gold Ends Higher

Spot gold inched up 0.2% to $1,324 an ounce on 21 February, down from the three-and-a-half month high of $1,332.10 struck on 18 February.

US gold futures for delivery in April finished $6.70 higher at $1,323.60 an ounce on 21 February.

For the week as a whole, futures added 0.38%.

Bullion prices have risen over 9% so far this year as concerns about global economic growth boosted the precious metal's safe-haven investment allure. However, prices are still far below the record high of around $1,920 per ounce struck in 2011.

© Copyright IBTimes 2024. All rights reserved.