Gold Stays Near Three-month High Ahead of US Jobs Data

Gold traded slightly lower on 2 July with the greenback finding some support after the sharp fall in the last few days, but the metal has managed to hold near the three-month high touched recently as the market awaited crucial US rates signals from the non-farm payroll data on Thursday.

Uncertain growth signals from the world's largest economy have been keeping its currency under pressure in recent weeks, helping dollar-denominated assets like precious metals. Gold has been receiving safe-haven bids too.

Spot gold slipped to $1326 after trading as high as $1333.2 on Tuesday, which was its highest since mid-March.

The USD index, the gauge that measures the greenback's strength against the currencies of the six largest trading partners of the US, traded at 79.85 on Wednesday, only a tad above the near two-month low of 79.74 hit on Tuesday.

The US Markit manufacturing PMI (purchasing managers' index) dropped to 57.5 in May and the ISM manufacturing PMI slipped to 55.3 from 55.4, while analysts had been expecting a rise to 55.8, according to data released on Tuesday.

Weaker growth signals from the US are likely to prolong any additional tightening measures by the Federal Reserve, thereby easing dollar liquidity.

The market is now waiting for the very important US jobs data, due on Thursday, 3 July. The consensus is for a marginal drop in the non-farm payroll additions to 213,000 in June from 217,000 registered for May. The unemployment rate is estimated to be steady at 6.3%.

A significant surprise in any direction will obviously have an impact on dollar.

Gold Technicals

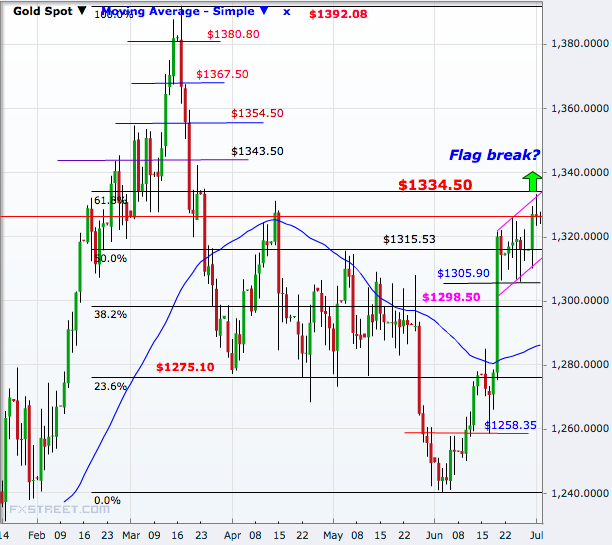

With the recent price moves, the metal has shaped a flag pattern and is now testing resistance at $1334.50, the 61.8% retracement of the March to June downtrend.

A break above that will open doors to $1343.50 and $1354.50 ahead of $1367.50 and $1380.70. Then comes the 17 March peak of $1392.

On the downside, the 50% level of $1315.50 is the first support ahead of $1305 but $1298.50, the 38.2% level, seems to be a stronger one.

That will open up $1275.10, the break of which will confirm the resumption of the downtrend.

© Copyright IBTimes 2025. All rights reserved.