New Zealand Dollar Drops to One-Month Low, Dovish RBNZ Awaited

The New Zealand dollar that rallied more than 3.5% since the June rate hike to a three-year high earlier this month, ended the week to 18 July at a one-month low, dragged by below-target inflation and strengthening of the US dollar.

The NZD/USD pair ended Friday at 0.8649, down 2.1% from the 10 July peak of 0.8838, which was a high since August 2011.

Data from New Zealand on 25 June showed that the trade balance shrank to $285mn in May from the previous month's $498mn while analysts had been expecting a more moderate narrowing to $300mn.

On 15 July, the consumer price inflation data for the second quarter surprised on the downside. The CPI inflation came in at 1.6% on the year from 1.5% in the previous quarter but trailed the market forecast of 1.8% significantly.

The Reserve Bank of New Zealand targets a CPI level of 2% for the economy, and therefore, the market started expecting a less hawkish RBNZ at the next review.

The Central Bank Stance

"Five years of stimulatory interest rates moderated New Zealand's recession in 2008 and 2009 and provided a platform for the current economic recovery," RBNZ Governor Graeme Wheeler said in the Statement of Intent for 2014-17 released on 9 July.

"We will continue to do our part to ensure economic growth is sustainable by running monetary policy so that we avoid the damaging impact of high inflation on competitiveness, real incomes and output growth."

The RBNZ is scheduled to set rates again on 23 July and despite the evidence of easing price pressures, the market expectation is for a hike to 3.5% from 3.25%, thanks to the strong growth performance.

The 18 June data showed the New Zealand economy expanded 3.8% year on year in Q1 topping expectations of 3.3% and compared with 3.1% in the previous quarter.

"Headline inflation remains moderate and tradables inflation is expected to be low for some time. However, above-trend growth has been absorbing spare capacity and adding pressure to non-tradables inflation," the central bank said in its June policy statement.

That said, the market did look at the CPI seriously and it is reflected in the selloff in the kiwi dollar since then.

A more recovery confident Janet Yellen at her semi-annual Senate testimony on 16 July added weight to the NZ dollar, pushing it down to its lowest since 18 June by Friday.

The greenback had rallied broadly following the Fed Chair's remarks, also hitting demand for risk assets globally.

A weak outlook for global dairy prices also weighs on the New Zealand economy which would further prompt the central bank to pen some dovish lines in the policy document on 23 July.

Technical Outlook

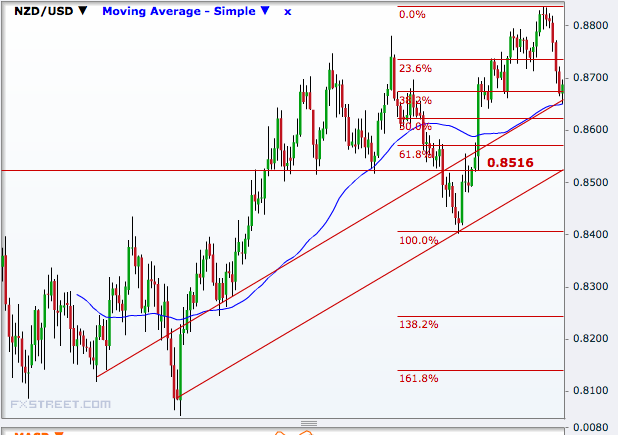

The NZD/USD pair has just touched the bottom line of an uptrend channel with the fall since 11 July, and therefore, it may see a technical rebound before a sharper move lower.

In that case, it will have its first resistance at 0.8713 and then at 0.8735, the 23.6% Fibonacci retracement of the 4 June to 1o July rally. The pair then has no stops until the July peak of 0.8838.

On the downside, the pair eyes the 50% level of 0.8620 ahead of 0.8570, the 61.8% mark. The bigger support is 0.8516, and as long as that holds, the pair will have its upside potential intact.

© Copyright IBTimes 2025. All rights reserved.