New Zealand Dollar Off Three-year High on Weak Data, Easing RBNZ Intervention Concern

The New Zealand dollar weakened on 30 June as data showed the Australia New Zealand (ANZ) Bank business confidence dropped to 42.8% from 53.5% in May and the ANZ activity outlook fell to 45.8% from 51.0%.

A separate release showed that New Zealand's M3 money supply growth slowed to 5.2% in May from 5.3% in April.

The NZD/USD fell to 0.8737 from a three-year high of 0.8796 touched on 27 June following the releases.

New Zealand has no additional data scheduled for the week to 4 July except for the less significant ANZ commodity price index on 2 July, and therefore, the Kiwi dollar will be tracking the overall dollar and commodities strength as well as risk sentiment for its course during the week.

The recent sharp rally in the NZ dollar had raised concerns of central bank intervention in the forex market as the yield-seeking rally into the local unit is considered bad for the country's exports.

Intervention Warning

The Kiwi dollar has been on the rise in June, and from a three-month low of 0.8401 touched in the first week, it had rallied more than 4.6% to last Friday's three-year high. Strong economic data points and overall weakness in the greenback helped the recent rally in the NZ dollar.

The 6.8% rally in the first four months of 2014 had forced Reserve Bank of New Zealand governor Graeme Wheeler to warn against likely central bank intervention to keep the currency's export competitiveness.

"If the currency remains high in the face of worsening fundamentals, such as a continued weakening in export prices, it would become more opportune for the Reserve Bank to intervene in the currency market to sell New Zealand dollars," Wheeler said in a speech to a dairy farming conference on 6 May, according to a Reuters report.

The NZD had reversed most of the gains since January following the remarks resulting in an over 4.3% drop against the greenback to a three-month low of 0.8401 on 4 June.

Policy Implications

At the conference, Wheeler had also said the currency strength would be one of the factors deciding the RBNZ monetary policy.

He said a stubbornly strong New Zealand dollar "will be a factor in our assessment of the extent and speed with which the Official Cash Rate needs to be raised".

After keeping its official cash rate target at a record low of 2.5% for almost three years, the RBNZ had started hiking the key rate by 25 basis points since the March review this year. And now with the third instalment on 12 June, the rate stands at 3.25%.

Even though analysts expect more hikes in the coming reviews, the high-flying Kiwi dollar has been a factor weakening the prospects for the currency.

Now that a data point has helped to prevent a touch of the psychologically important 0.8800 mark, 50 cents above the level which governor Wheeler once indicated as a tolerable level before considering intervention, concerns of FX market intervention by the RBNZ and a pause in its tightening cycle have eased.

Technical Outlook

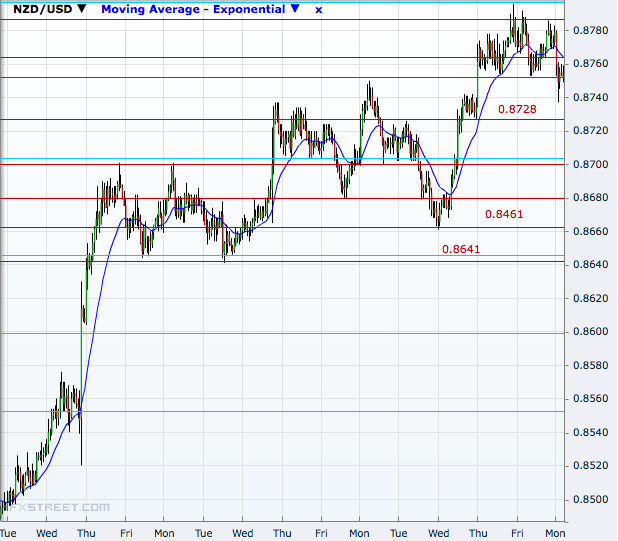

The NZD/USD has only had a minor fall on Monday is now testing a support of 0.8728 on the hourly chart.

Important milestones further south are 0.8701, the 23.6% Fibonacci retracement of the 4 June to 26 June uptrend and then 0.8641, the 38.2% level. A break of that will weaken the uptrend and increase risks of the resumption of the downtrend.

The levels further down are 0.8600 and 0.8550, the 50% and 61.8% levels, ahead of 0.8480 and the June trough of 0.8401.

On the higher side, the 50-hour moving average near 0.8765 is a mild resistance level ahead of 0.8786 and then 0.8796, the 27 June high.

What comes next is the August 2011 record of 0.8844.

© Copyright IBTimes 2025. All rights reserved.