Precious Metals Wrap: Palladium Outshines The Rest on Demand Outlook and Soars to 13-year High

Precious metals traded higher in the first week of July, but the performance of gold and silver was poor compared to platinum and palladium. Palladium rose to a 13-year high.

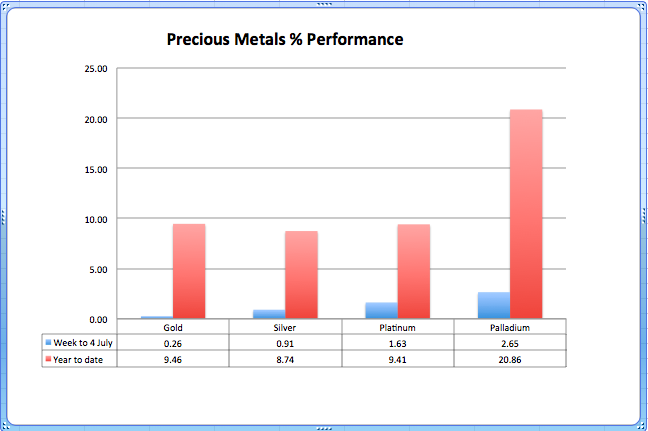

Palladium rallied most in the group, ending the week 2.65% higher. Platinum strengthened 1.63%, silver 0.91% and gold 0.26%, in the week to 4 July.

Palladium ended its third straight week higher on Friday and year-to-date, the metal has rallied more than 20%, compared to a near 9% rise for each in the rest of the group.

The exceptional rally in palladium was triggered by the concern that its demand from the automobile industry will increase when supply was already hit by extended strike days in South African mines, the world's second largest producer of platinum.

Gold ended at $1319.30 from the previous week's close of $1315.87 and sliver moved to $21.14 from $20.95. Platinum strengthened to $1496.50 from $14r72.50 and palladium to $860.50 from $838.25.

Technical Outlook

The flag pattern formed since the FOMC date is now testing the 61.8% Fibonacci retracement of the March-June selloff and a strong break above that will open the doors to $1360 ahead of $1392.0, the mid-March high.

On the downside, the metal has its first level at $1298, the 38.2% level and then $1275, the 23.6% mark. A break of that will reverse the uptrend since June and target $1240 ahead of $1182, the December 2013 low.

The silver chart too has formed a flag pattern with the metal's reaction to the FOMC on 18 June. But the move has broken above the 61.8% retracement of the February-May selloff in the metal.

The next target seen is $21.77 and then comes $22.17, the highest so far this year, touched in February.

On the downside, Fibonacci levels, $20.38, $20.0 and $19.42 are the levels to watch ahead of the 30 May low of $18.61.

© Copyright IBTimes 2025. All rights reserved.