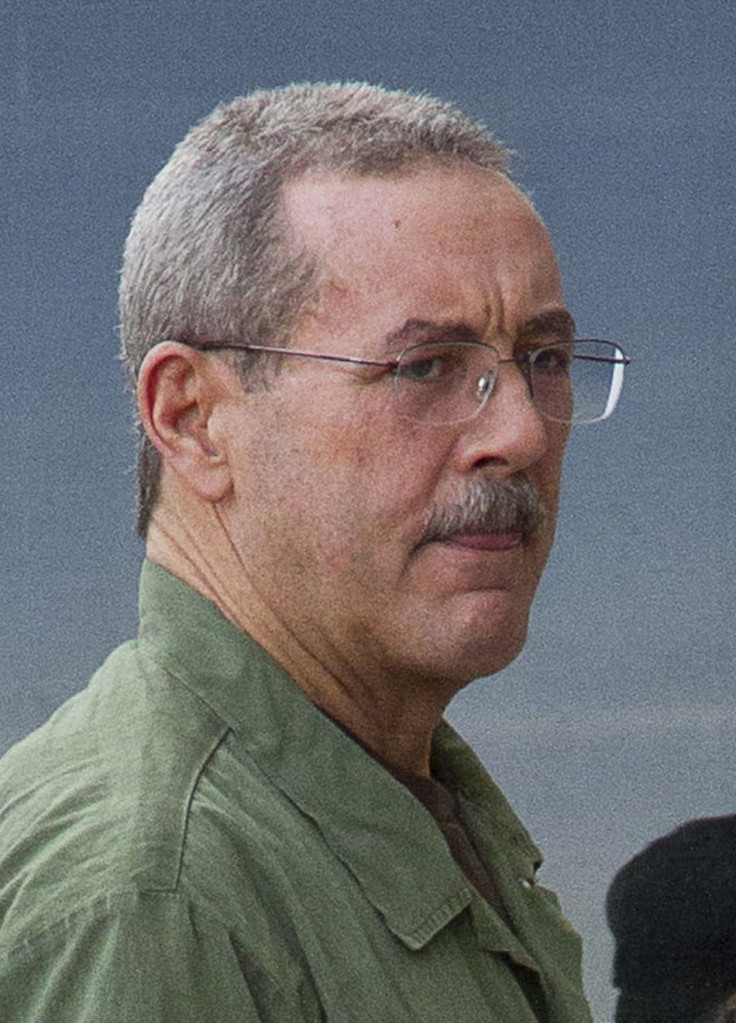

Allen Stanford: Prison Beating Casts Shadow over Multibillion Dollar Fraud Trial

A Texas businessman accused of orchestrating a 10-year-long, $7bn Ponzi scheme has appeared in court despite claiming that a prison beating left him with amnesia and he could not remember events around the allegations.

The trial of Allen Stanford, accused of defrauding more than 20,000 people through allegedly bogus certificates of deposit at Antigua-based Stanford International Bank (SIB( Ltd), has started in Houston.

The 61-year-old suspect, who handed himself in in 2009 vowing to prove his innocence, suffered broken facial bones in the beating by another inmate. He became addicted to anti-anxiety pills and went through eight months of rehab. He claimed the attack had left him with amnesia over earlier events but was still ruled competent to stand trial.

A judge ruled Stanford, the largest private landowner in Antigua, competent in December.

Prosecutors insist Stanford is lying and claim that he skimmed more than $1 billion in investor deposits, rather than putting the money in the safe and liquid assets that SIB's marketing advertised.

The money was allegedly used to fund a lavish lifestyle including his own Caribbean Island, yachts and fleet of jets, as well as several women. Stanford was known as "Sir Allen" after being knighted by Antigua's former prime minister.

Stanford's defence claim the financier had no intention of defrauding anyone. Customers lost their investments only when the business was seized by the government during the global financial crisis of 2008.

Stanford's trial is expected to last at least a month.

What is a Ponzi scheme?

The term Ponzi scheme is used to describe a fraudulent investment company that draws in new investors with the promise of major payouts.

The money for these payouts is generated by other investors who later join the business. Therefore it usually offers huge, almost immediate rewards in order to constantly attract new money.

However the system is innately unstable, as it can only be sustained by a constant stream of new investors to keep it running.

A Ponzi scheme is named after Charles Ponzi, who operated a profit-making scam in 1918 by encouraging investors to buy postal coupons with borrowed money.

The scheme became huge, making Ponzi as much as $250,000 dollars a day until it collapsed following press inquiries.

The collapse of the scheme brought down several banks, costing investors the equivalent of $225m.

The largest Ponzi scheme on record was orchestrated by Bernard Madoff, the former non-executive chairman of Nasdaq. He was sentenced to 150 years in prison in 2009 for a scheme that is thought to have a net loss to investors of around $10 billion.

© Copyright IBTimes 2024. All rights reserved.