Swedish Krona Set to End Fifth Straight Month of Losses as Data Shows Recovery is Slow

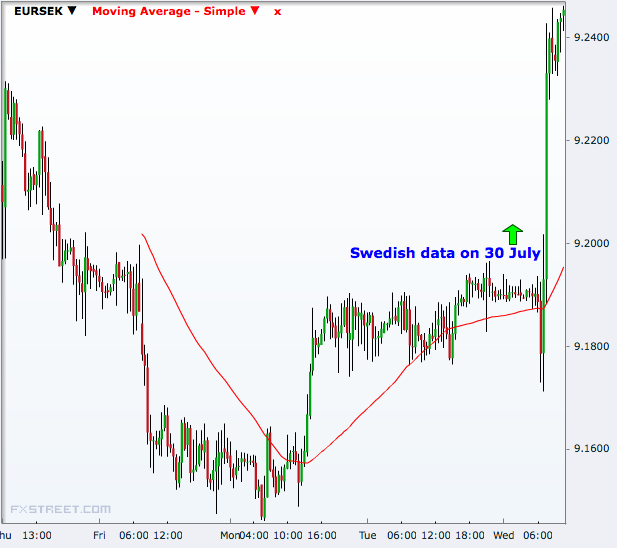

The Swedish krona fell sharply against the euro on 30 July after a key survey showed the economic recovery is slow, mainly dragged by the drop in consumer and services sector indicators.

The krona is set to end the fifth straight month of losses in July, which saw an unexpected rate cut by the Riksbank - by 50 basis points to 0.25% on 3 July.

After the rate cut that saw a 2.5% rally in the cross, a positive surprise in consumer price inflation helped improve the sentiment for the krona, but the jump in the unemployment rate to 9.2% in June from 8% in the previous month, as per the data on 25 July, aided the recent fall in the Swedish currency.

A survey by the National Institute of Economic Research showed the economic tendency indicator has fallen 0.9 points to 100.4 in July from 101.3 in June, due primarily to the services indicator falling 2.2 points and the consumer indicator 1.4 points.

EUR/SEK rose to 9.2450 from 9.1900 following the release.

"After the fall, the consumer confidence indicator is largely in line with the historical average. Households were more negative about their personal finances than in June but slightly more positive about the Swedish economy," the report said.

"The building and civil engineering indicator also decreased slightly, while the manufacturing and retail indicators increased somewhat."

Meanwhile GDP data on Wednesday showed the Swedish economy expanded 1.9% year-on-year in the second quarter, in line with expectations.

EUR/SEK jumped to 9.2458, an eight-day high, from the previous close of 9.1932. The cross has been trading higher over the past three sessions - it has gained 0.95% from the three-week low touched on 25 July.

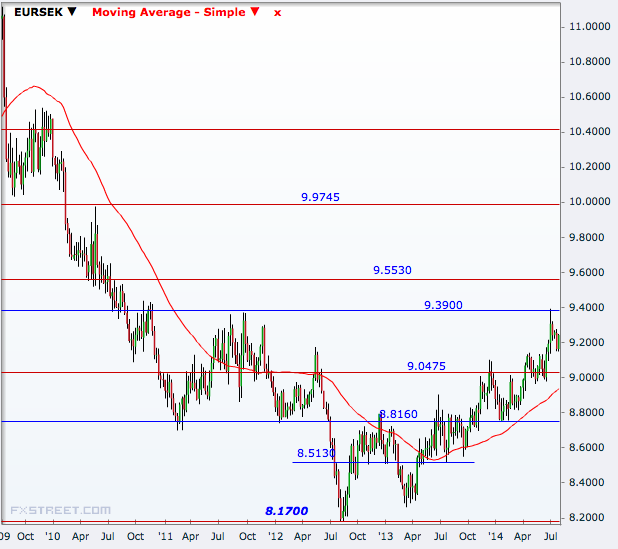

Technically, the cross has broken above the 23.6% Fibonacci retracement of the 2009-2012 sell-off and its next target is the 38.2% level at 9.5530.

A breach of this will weaken the downtrend and open doors to 9.9745, the 50% level.

On the downside, the cross will first aim at 9.0475, the 23.6% retracement and then 8.8160 and 8.5130 ahead of a retest of the 2012 low of 8.1700.

© Copyright IBTimes 2025. All rights reserved.