UBS whistleblower exposes 'political prostitution' all the way up to President Obama

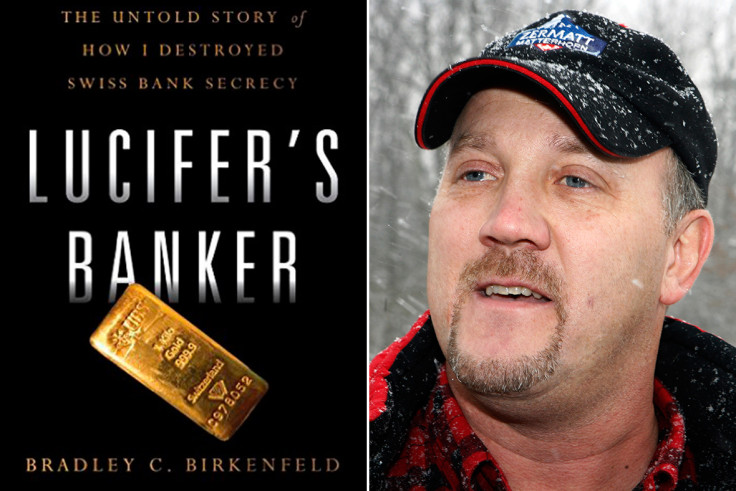

Birkenfeld's book about the UBS Swiss banking investigation, Lucifer's Banker, is published in October.

UBS, the world's largest wealth manager, is facing embarrassment over fresh revelations going back to the tax investigation that led to the collapse of Swiss banking secrecy. Two significant events are looming before UBS. The first is the possibility of a public trial in France, featuring UBS whistleblower Bradley Birkenfeld, concerning historic tax evasion allegedly orchestrated by the bank. That could happen this year.

The other is the publication this October of Birkenfeld's scathing new book, Lucifer's Banker, which covers his time at UBS.

The tax evasion controversy, which was first highlighted in 2005, subsequently involved the US Department of Justice, the State Department and Internal Revenue Service. It was prompted by disclosures made by Birkenfeld that UBS had helped wealthy US citizens evade taxes using offshore financial vehicles and Swiss-numbered accounts.

In 2009, UBS paid $780m (£588m, €693m) to US authorities to avoid prosecution.

Birkenfeld served 31 months in prison for one count of conspiracy to abet tax evasion by one of his clients. After he was released he was paid a record $104m by the IRS for helping recover unpaid taxes.

However, Birkenfeld has since said that he was systematically prevented from giving testimony in open court – but this may be about to change thanks to the French authorities.

In February 2015, under the request of a French federal subpoena, Birkenfeld was allowed to travel to Paris where he spent 10 hours with magistrates giving sworn testimony and submitting multiple UBS documents in his possession.

"Why is it that I had to travel 3,000 miles across the pond to go help a foreign government?" asks Birkenfeld. "My own government covered it up. Well now the French case is coming forward – and unlike the US they are actually holding a trial. And not only France; Germany has also contacted me to help them against UBS, as well as various other foreign governments. I have not heard from the UK, surprisingly," he said.

IBTimes UK asked HMRC if it had considered contacting Birkenfeld. It issued this statement: "HMRC doesn't discuss identifiable individuals. We are getting tougher on offshore tax evasion, securing more than £2.5bn since 2010.

"We welcome any information on potential tax fraud, and receive data from a wide range of sources, gathering hundreds of millions of items last year alone. We then analyse the data using some of the world's most sophisticated systems to identify tax dodgers."

Birkenfeld points out that there is €1.1bn in escrow as bail to cover a potential penalty for UBS in the French case. He adds: "UBS offered €200m but said they won't plead guilty and the French refused to accept such a pathetic offer, so UBS pulled the €200m off the table and then the French kicked it up to €1.1bn.

"The French have a moral standard and they firmly stand up on issues that are important to them. There is a moral DNA within the society of the French people."

UBS declined to comment on either a possible trial in France or the release of Birkenfeld's book.

'James Bond' bankers

The standard defence among UBS top brass in wealth management was that they didn't know what their large teams of bankers were getting up to. It certainly was a secretive business, which made use of untraceable SIM cards and encrypted laptops. Private bankers would be sent to the US on a quarterly basis to court high net-worth clients at events such as Art Basel in Miami and other soirees, most of them sponsored by UBS.

"We would work with US UBS offices to see what VIP events they can get you into, and who they could actually refer from the bank. That was covered by something we called the 'referral programme' and involved a complex and sophisticated system of remuneration for both sides," said Birkenfeld.

"If you sent a client to me and they put bankable assets you would get 50% of the revenue generated. So they incentivised you and that's against the law because you are aiding and abetting clients to evade their tax obligations."

Politically exposed persons

Birkenfeld claims the UBS cover-up stretches to the highest levels of the US establishment, where an additional layer of secrecy covered the accounts of bank's politically exposed persons (PEPs).

He promises four big names will be exposed in his book.

He said: "A lot of PEPs were kept under secret, secret status. Swiss banking was secret, but then PEPs were even more secret. This was just too sensitive. They had a desk in Zurich dedicated to PEPs out of Washington, DC.

"It could be politicians, or it could be someone who was very close to political circles or doing some dodgy work maybe in Nigeria or somewhere else in the world.

UBS and Obama

Birkenfeld claims there was a glaring conflict of interest involving then Senator Barack Obama, which essentially placed him on the UBS payroll. He said UBS was an enthusiastic fundraiser for Obama for his 2008 election campaign and senior executives at the bank bundled campaign contributions. Bundlers are expected to raise in excess of $500,000 each for the US president's re-election effort. UBS also advised the president on investments and strategy for the country. Birkenfeld states that when he gave testimony about UBS to the Senate Committee in late 2007, Senator Obama was conspicuously absent.

Birkenfeld said: "When I went to give this information to the US Senate Committee they provided me a subpoena to testify, as the DOJ refused to do this. At this time Senator Obama was an active member of that committee and he never showed up for any of those hearings. Not one.

"But at the same time he was taking millions of dollars from UBS in campaign contributions. That's the ultimate conflict of interest because he should have been there helping to investigate UBS on behalf of the American taxpayers, but instead he was taking money from UBS. I call it political prostitution. He is taking millions of dollars from a criminally corrupt bank in direct violation to his oath of office."

"Why wasn't I allowed to testify in public? They stopped it. Why wasn't I allowed to testify at Raoul Weil's trial? They stopped it. I had to fight to go find the French magistrate to help them.

"We are dealing here with the corruption of US government and people like Barack Obama and the corruption of big banks like UBS. These are people that have really betrayed their country."

Bradley Birkenfeld's book Lucifer's Banker: The Untold Story of How I Destroyed Swiss Bank Secrecy is published by Greenleaf on 18 October 2016.

© Copyright IBTimes 2025. All rights reserved.