Don't Listen to Vince Cable: Sterling Strength Needn't Weaken Business

The relative strength of sterling against the Euro and US dollar will have been welcome news to UK holidaymakers and expats over the last few months.

However, this surge in value will not have been viewed so favourably by British companies exporting overseas, who will have been hit by losses from the negative impact on foreign exchange rates.

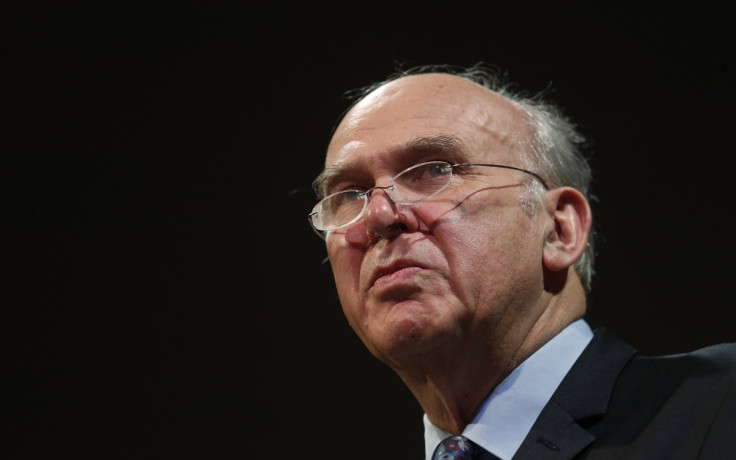

Vince Cable will echo these concerns in his speech to the Social Market Foundation later on 10 July, as he urges policymakers and industry to take action.

You don't have to cast your mind too far back to remember headlines of large businesses suffering at the hands of foreign currency volatility – publishing giant Pearson recently suffered losses of up to 6%, while Burberry has just today announced that its profits are under significant pressure from currency losses.

If even large businesses fall foul of these foreign exchange (FX) movements, it goes without saying that the impact on a smaller business and mid-sized firms could be catastrophic.

Without access to an in-house FX expert, or even dedicated CFO, quantifying and managing FX exposure can be extremely daunting for a smaller company.

That said, controlling the strength of the pound will not be an overnight operation – so what can business owners do to mitigate the negative impact of the strong pound in the meantime?

Businesses cannot 'hide' from the strength of the pound, so the solution is to factor it into the business strategy.

It's Not About the Price Tag

Exporters have a simple choice – either absorb a probable loss of custom from international customers who will be reluctant to part with their money for 'less', or lower their prices. Of course, lowering prices can be a difficult decision to take, though is a sensible strategy to take in the short term.

Shorter profit margins are preferable to lost clients.

This compromise on price can actually provide a valuable opportunity for businesses to move their focus away from price, and channel their energy into product improvement. This could even be seen as an opportune moment to 'go the extra mile' for clients, who will likely appreciate the effort to accommodate the price fluctuation.

Happy clients make for a profitable and sustainable business in the long run.

Incomings and Outgoings

As a growing business, it's easy to get fixated by exports. With greater buying power from the strong pound, companies that import to the UK will see increased savings on their orders.

Take the opportunity to think strategically, and use the economic environment to your advantage – consider bulk-buying in preparation for future (less favourable) market movements. Who knows when the currency will be so strong again?

This logic also applies to those continuing to export, who have the opportunity to improve their business by investing capital in foreign services or products. Now is the time for businesses to update their technologies, facilities or invest in foreign market expansion, for instance.

At first glance, the rising value of sterling is a real blow for UK exporters.

However, successful businesses are those that are able to accept and react to market changes around them, whether it be related to the economy, consumer behaviour, technological advances, or new competition.

Small businesses have agility on their side, and must seek the opportunities to capitalise on their nimbleness. In the case of FX risk exposure, their survival may well depend on it.

Philippe Gelis is the CEO and co-founder of business FX services firm Kantox.

© Copyright IBTimes 2025. All rights reserved.