Fed economists still expect 'mild recession,' May minutes show

All 11 voting members of the Federal Open Market Committee (FOMC) were in favor of lifting the Fed's benchmark lending rate by 25 basis points

US Federal Reserve economists still expected a "mild recession" at the most recent interest-rate meeting earlier this month, according to minutes of the meeting published Wednesday.

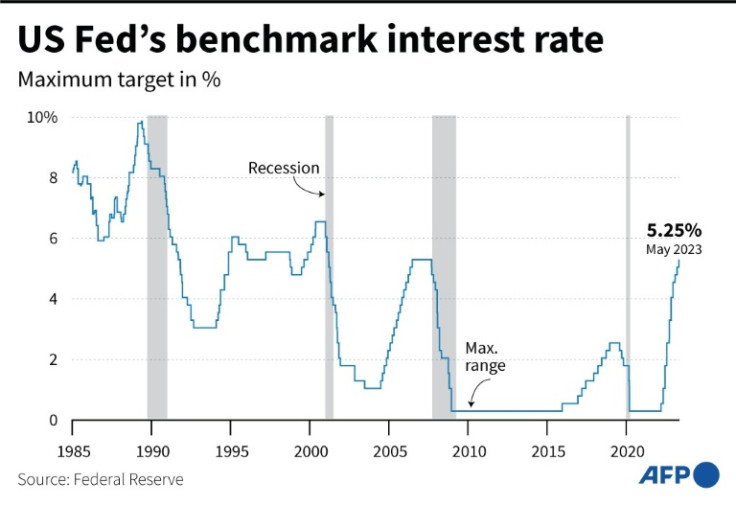

The Fed voted to raise interest rates for a 10th consecutive time following the most recent meetings on May 2-3 in order to tackle high inflation, which remains stubbornly above its long-term target of two percent.

The economic forecast prepared by Fed staff ahead of the meeting continued to assume tight financial conditions "would lead to a mild recession starting later this year, followed by a moderately paced recovery," the minutes showed.

"Real GDP was projected to decelerate over the next two quarters before declining modestly in both the fourth quarter of this year and the first quarter of next year," according to the Fed.

All 11 voting members of the Federal Open Market Committee (FOMC) were in favor of lifting the Fed's benchmark lending rate by 25 basis points to between 5.0-5.25 percent, although there was disagreement about what to do next.

"Some participants commented that, based on their expectations that progress in returning inflation to 2 percent could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings," the minutes showed.

But "several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary."

The views highlighted in the minutes align with the public statements given by voting FOMC members since the interest-rate decision earlier this month.

Some, including Fed chair Jerome Powell, have suggested rates may have risen far enough to bring inflation down, while others, like Dallas Fed president Lorie Logan, have indicated their preference for another rate hike at the next meeting in June.

Futures traders still broadly expect the Fed to announce it is pausing its aggressive cycle of interest-rates hikes on June 14, although they have slightly increased the odds of a rate increase over the last few days, according to data from CME Group.

© Copyright AFP 2025. All rights reserved.