Japan's Nikkei Drops 10% Amid China Slowdown Worries

The Japanese Nikkei share average has dropped nearly 2% and entered "technical correction" - defined as a drop of 10% or more from the preceding peak.

The drop came as investors digested corporate earnings data amid reports of slowing economic growth in China.

The benchmark Nikkei 225 finished 1.98% lower at 14,619.13, 10% lower than the previous peak reached on 30 December, 2013. The Topix index ended 1.99% lower at 1,196.32, its lowest close since 11 November, 2013.

The Nikkei Stock Average Volatility Index rose 3.9% to 30.25 on 3 February, suggesting market players expect a vacillation of 8.7% on the equity gauge over the next 30 days.

Stock Movements

Hokkaido Electric Power slumped 9% after it forecast a 77bn yen ($754m) net loss.

Daiwa Securities, Japan's second-largest brokerage, dropped 4.9% even as its third-quarter profit tripled.

Nomura Holdings, the nation's largest securities company, lost 3.3%.

China Slowdown

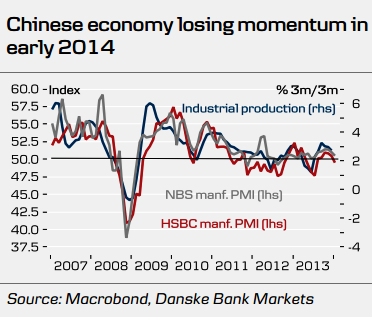

The Chinese economy started the year on a weak footing as services-sector growth and factory output weakened, two separate surveys revealed.

China's service sector growth eased to a five-year low in January, a government survey showed on 3 February. Earlier, a Market/HSBC survey showed that Chinese manufacturing activity contracted for the first time in six months in January.

The slowdown in China fuelled fears that the mild global economic recovery may not last.

"The risk-off mood is pretty strong," said Naoki Fujiwara, Tokyo-based chief fund manager at Shinkin Asset Management, which manages assets worth nearly 600bn yen.

"Individuals and hedge funds are wanting to take money off the table. Emerging-market currencies are still facing problems that started with the Fed's tapering and falling into a negative cycle. The positivity we saw at the start of the year is being corrected," Fujiwara added.

Danske Bank said in a note to clients: "The current slowdown in China is in our view driven by regulatory tightening and the de-facto monetary tightening by [the central bank] since mid-2013. We expect China's manufacturing PMIs to continue to move lower in the coming months but unless China experiences a major credit event we do not expect the slowdown to be severe."

"PBoC appears to be moving towards a slight easing bias and the outlook for exports remains relatively healthy despite the current emerging market wobbles. We expect the manufacturing PMIs to move gradually lower in H1 14, bottoming out around 48 in late Q3," the Danish bank added.

The Nikkei, which soared 57% in 2013 to its highest increase since 1972, is the worst performing stock average so far this year among 24 developed equity markets tracked by Bloomberg.

© Copyright IBTimes 2025. All rights reserved.