Analysis-Supply Chain Snags Threaten To Slow Air Industry Take-off

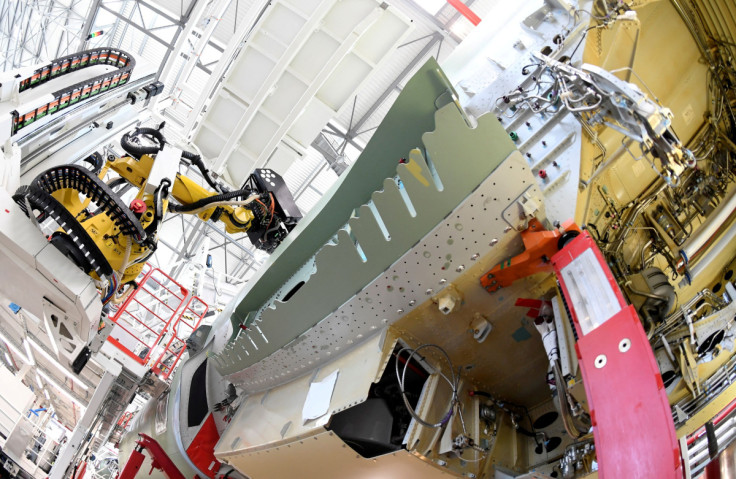

The global air industry is in the midst of a post-pandemic rebound, but supply chain problems have left suppliers and manufacturers scrambling to source everything from raw materials to small electronic components to keep production moving.

From multinationals to family-run stockists, few have been spared the impact of shortages or delays. As a result, this week's Farnborough Airshow has been more about the factory floor than the usual shop window for new orders.

"We are keeping our head above water, keeping the flow happening, but the gymnastics required to make that happen are as difficult now as they have ever been," Stephen Timm, president of industry giant Collins Aerospace, told Reuters.

At the other end of the spectrum, where suppliers lack the clout of a Collins or Honeywell, things are even more uncertain.

"At the moment it's extremely challenging because of the lack of raw materials," said Paul Wingfield, business development manager at Stokenchurch, England-based Aircraft Materials, which supplies alloys including aluminium, nickel, magnesium, titanium and nickel for the industry.

Not only are the mills that his firm works with having trouble finding raw materials, but distributors are wary of holding onto inventory when there is a risk of recession.

"Nobody knows what the economy is going to do, so nobody's willing to invest in stock at the moment," Wingfield said.

In conversations at this week's show, suppliers say material and parts delays have meant pushing manufacturers to order earlier, while manufacturers like Boeing have found themselves wading into the supply chain to keep parts flowing.

"We're going deeper into the supply chain than we've ever had to go to help our suppliers solve problems," said Cory Gionet, Boeing's vice president in charge of supply chains for commercial airplanes.

Earlier this year, Boeing said its 737 MAX aircraft production and deliveries were hit by shortages of a particular wiring connector.

Suppliers face lengthening lead times to source materials or components that can now run six months to over a year, threatening the manufacturers' plans to ramp up output.

To guarantee parts delivery, some suppliers are pushing manufacturers to order many months in advance, even if it means suppliers have to tie up capital by holding onto inventory for longer.

Switching their own suppliers can be almost impossible in a highly-regulated industry where components have to undergo rigorous approval processes.

"It's not a case of picking up and going to a different supplier, the validation process for doing that is actually often longer than the lead time," said Neil Lawrence, business development engineer at Woking, England-based Magnet Schultz.

It makes solenoids - electromagnetic valves - used in everything from airplane hydraulics controls to air conditioning. Those valves range in price from a few hundred to tens of thousands of pounds.

Shortages of electronics components mean some will not be delivered for over a year.

"We're getting terrible, terrible lead times on some parts," Lawrence said.

'NO CHANCE AT ALL'

Supply chain problems come at a time when the industry is eager to build ever more planes.

Airbus wants to raise A320 production rates to 75 single-aisle aircraft monthly over the next three years, from 50 now. But delays in engine supplies have held back aircraft deliveries.

Engine maker Pratt & Whitney, like Collins a unit of Raytheon Technologies, said this week it aimed to get its engine deliveries for the A320 back on track by early 2023 as it battles labour shortages and supply chain snags.

"Certainly we're not happy about the position that we're in right now," Pratt & Whitney president Shane Eddy said.

Even so, Airbus Chief Executive Guillaume Faury told Reuters the show had brought slightly more comfort on engine delays.

But France's Dassault Aviation told a results presentation it was "very concerned" about supply chains.

Rochford, England-based UFC Aerospace, part of the FMT Group, provides structural fasteners for airplanes and its biggest customer is Boeing.

The company has recently been quoted lead times for "S80," an aerospace-grade stainless steel alloy that contains nickel, of six months, or more than three times normal.

General manager Barry Vinneall said UFC had been communicating to customers like Boeing that they need to provide orders 12 months out to guarantee delivery.

"If we order it now, we can still deliver in March," Vinneall said. "But if you ask us in November, we've got no chance at all of having it by March."

This means that UFC has to carry more inventory, which is an additional financial strain after the coronavirus pandemic shut down air travel and hit the industry hard.

But Vinneall said UFC was financially sound enough to allow customers longer to pay off invoices.

"If all of a sudden they don't have to pay us for 90 days instead of 30, there's a good chance that we'll win more work," he said.

Magnet Schultz's Lawrence said the company had also made it clear to customers that its lead times for electronic components were now over a year.

"Understandably, they're not happy with lead times going out 50 to 60 weeks, but they're also quite in tune with the market," Lawrence said. "They know what's going on, they can see what's happening."

Copyright Thomson Reuters. All rights reserved.