APR Energy to Report Full-Year Results Amidst Contract Termination and Share Price Swings

APR Energy is scheduled to release its preliminary earnings for the fourteen month period ended December 31, 2011 on Monday as it delayed reporting a month due to complexities which resulted a fall in share price of more than 25 percent. However, the group reported a summary of preliminary results on March 20, 2012.

"It is somewhat clumsy to report prelims in this manner and we expect that the stock will be weaker. This is unfortunate and will not be well received by investors, whatever the reasoning, as it leaves more questions unanswered," said Analysts at Investec and cut the rating on the stock to 'Hold'.

The US-based temporary power firm suffered another major fall in its share when Japan's Tokyo Electric Power Co partially terminated its contract with the company at the end of March, four months earlier than scheduled.

"Given early termination contract provisions which require the payment of a substantial portion of the remaining rental fee to APR, the statement suggests that the impact on revenues for FY12E will be minimal and it is therefore not changing its market guidance," said Seymour Pierce while retaining its "Hold" rating and price target of 1,000 pence per share.

Due to current commercial activity, the group has bagged two new contracts in Angola (40MW) and Oman (24MW) during December end 2011 and March 20, 2012.

The temporary power solutions company has some existing contracts which have been extended, Argentina's five plant sites extended for 2 to 3 years each and the turbine deal in Martinique with EDF. The current order book shows an increase of 73 percent at nearly 6,500 MW-months. The group is expected to invest between $230 - $260 million in new fleet capital expenditures, as it plans to exploit its core strategy and future growth.

"The successive investments by first Soros Fund Management and Albright Capital in April last year, and then the reverse acquisition by Horizon Acquisition Company in June, have removed the cash constraint from which we suffered before and has enabled us to accelerate our growth and maintain high margins and a high return on our capital employed, through consistently pursuing our disciplined approach to investment and sales," said CEO John Campion.

For full year ending to 31 December 2011, the group reported a rise of 65 percent in its revenues. Its net cash balance stood at $63 million, with $400 million credit facility closed with expanded bank group. The board proposes an inaugural dividend of 10 pence per share.

"We have also strengthened our growth potential by completing a $400 million credit facility to add to our net cash position of $63 million and by taking key strategic steps. These include our beneficial supply partnerships with Caterpillar and Pratt & Whitney and putting in place the first two of our regional hubs, with the third due to be operational in the third quarter of this year. These steps are already standing us in good stead," added John Campion.

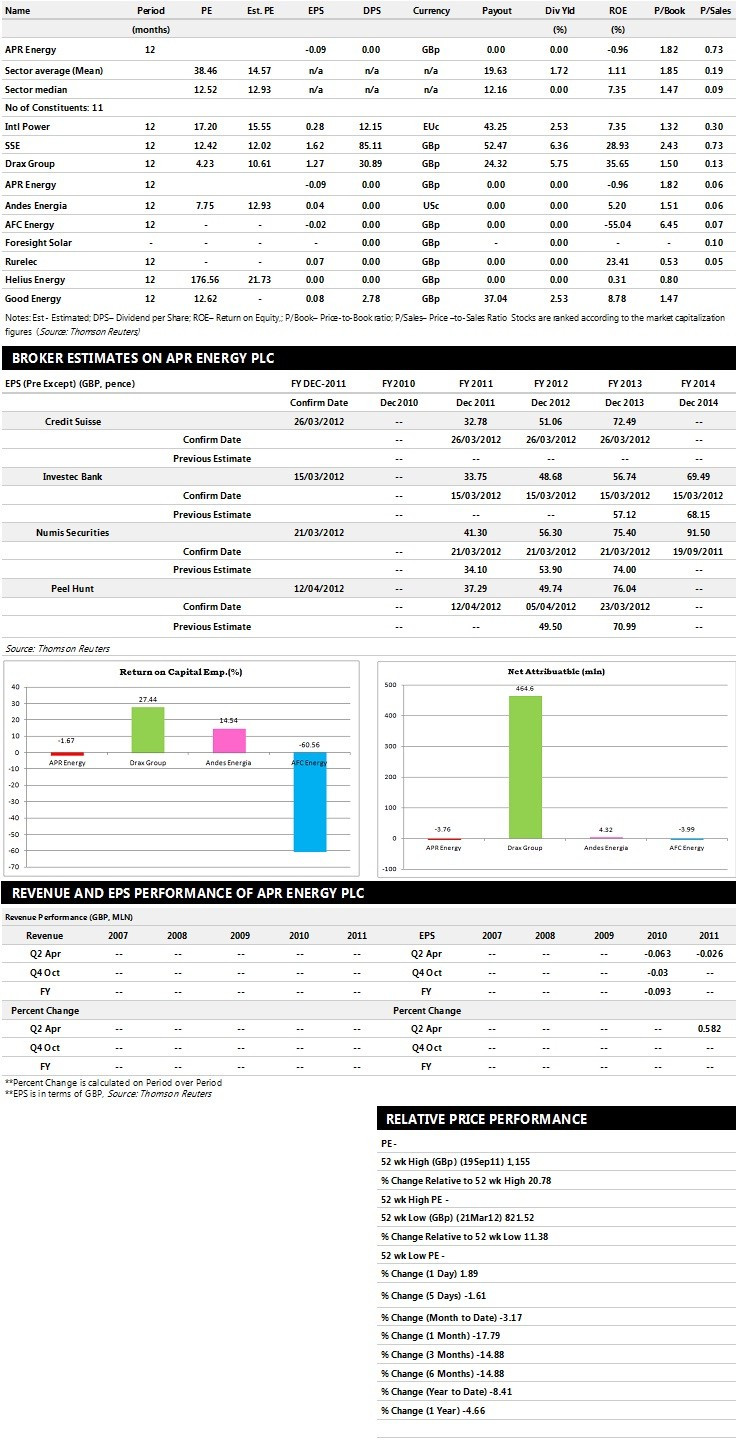

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Peel Hunt recommends 'Sell' rating on the stock

- Credit Suisse assigns 'Outperform' rating with a target price of 1300 pence per share

- Seymour Pierce gives 'Outperform' rating with a target price of 1300 pence per share

- Numis Securities assigns 'Buy' rating with a target price of 1480 pence per share

- Investec Bank gives 'Outperform' rating with a target price of 1230 pence per share

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £133.70 million and £235.83 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £35.79 million and £59.25 million. Earnings per share are projected at 37.29 pence for FY 2011 and 49.74 pence for FY 2012.

- Credit Suisse projects the company to record revenues of £131.75 million for the FY 2011 and £223.78 million for the FY 2012 with pre-tax profits (pre-except) of £35.30 million and £54.84 million respectively. Profit per share is estimated at 32.78 pence and 51.06 pence for the same periods.

- Numis Securities expects APR Energy to earn revenues of £136.77 million for the FY 2011 and £239.83 million for the FY 2012 with pre-tax profits of £36.47 million and £66.92 million respectively. EPS is projected at 41.30 pence for FY 2011 and 56.30 pence for FY 2012.

© Copyright IBTimes 2025. All rights reserved.