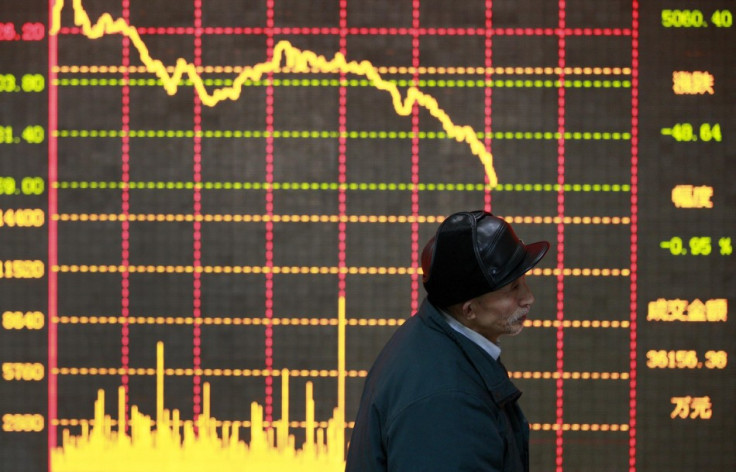

Asia Stocks Outside Japan Extend Losses as China Policy Fears Return

Most Asian markets extended losses in the morning trade with real estate curb-concerns weighing on Chinese investors, although Japanese stocks continued to remain positive on stimulus hopes.

The Nikkei average index gained 0.22 percent or 27.28 points to 12266.9 while South Korea's benchmark KOSPI was down 0.85 percent or 17.01 points to 1982.7.

In China, the Shanghai Composite Index fell 0.17 percent or 3.80 points to 2260.6. Hong Kong's Hang Seng was down 0.75 percent or 169.56 points to 22387.1.

In the US, official data released overnight showed that retail sales in the world's largest economy rose 1.1 percent in February, the biggest jump in five months. The figures beat forecasts from analysts, who had opined that the recent payroll taxes could have had a major impact on consumer spending.

Wall Street had ended moderately higher, with the Dow Jones Industrial Average continuing its strong run as the stronger-than-expected data boosted the case for a US economic recovery.

The optimism extended to Japanese markets, where investors cheered the improving economic conditions after a weak previous session. The strong US data had pushed the dollar back above the 96 yen mark during North American trading, although it slid early in the day.

The Japanese parliament is expected to approve the nomination of Haruhiko Kuroda as the next central bank governor this week. Analysts expect Kuroda to aggressively pursue the monetary easing measures to improve conditions. Bank of Japan's next policy meet is in early April and officials are gearing up for the possibility of an emergency meet once Kuroda takes office to hasten matters, according to a Reuters report.

Elsewhere in Asia, conditions were not so positive. Hong Kong investors continued to remain wary that the government may step up its real estate sector controls to cool the sector.

At a news conference earlier this week, the People's Bank of China Governor Zhou Xiaochuan said that China should be on high alert against rising prices. His comments come barely a week after official data showed that the country's inflation rates jumped more- than- expected in February. Zhou's comments are seen as an indication that government may be willing to compromise on economic expansion to keep prices under control.

In Seoul, Bank of Korea left its benchmark interest rate unchanged at 2.75 percent for the fifth straight month. Analysts suggest that the central bank could look to slash rates in the second quarter.

"There were no surprises from the BOK this morning," said Paul Gruenwald, economist at ANZ. "The BOK seems content to stay in 'wait and see' mode".

Meanwhile, Australia's official employment data released early in the day showed that the labour market rebounded in February, denting chances of further rate cuts from the Reserve Bank of Australia.

Major Movers

Exporters rebounded in Tokyo after yesterday's slide. Nikon Corp was up 3.45 percent while Advantest Corp added 1.59 percent. Toshiba gained 0.21 percent. Automobile majors Toyota and Honda traded 0.2 and 0.67 percent lower after the companies agreed to ramp up bonuses to employees as government seeks to achieve higher inflation rates.

Property stocks slid in Hong Kong. Henderson Land Development Company was down 3.80 percent while New World Development Company slipped 3.57 percent. Sun Hung Kai Properties fell 3.49 percent.

Australian mining stocks pulled the benchmark index lower. Rio Tinto was down 1.9 percent while BHP Billiton was down 1.87 percent.

© Copyright IBTimes 2025. All rights reserved.