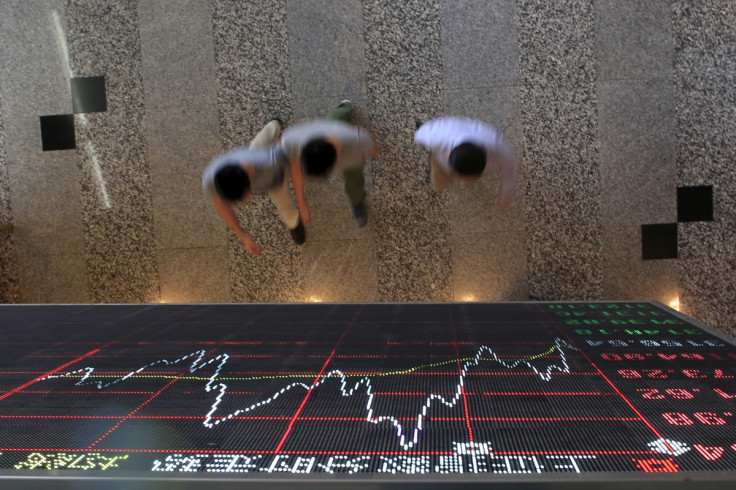

Asian markets rise on dovish Fed minutes

Stock markets across Asia rallied on 9 October as investors took cues from a positive close on Wall Street overnight. Tokyo's benchmark Nikkei share average, advanced 1.2% to 18,364.31 points at mid-day, despite data released on 8 October showed that Japanese core machinery orders unexpectedly dropped in August.

Risk sentiment was up after the US Federal Reserve said it was "prudent to wait for additional information" before raising interest rates in the minutes of its September policy meeting.

"One member, however, preferred to raise the target range for the federal funds rate at this meeting, indicating that the current low level of real interest rates was not appropriate in the context of current economic conditions," the minutes of the 16-17 September meeting read.

Angus Nicholson, analyst at trading firm IG in Melbourne, said the minutes reinforced market expectations that the central bank would hold off on raising interest rates until 2016.

"This week's rally clearly shows how much pressure the rising US dollar was putting on global markets," he said and added, "The big question now is, how far can this relief rally go for?"

Wall Street was boosted by the Fed's dovish assessment, with the Dow Jones and S&P 500 share averages both closing up nearly 1%.

Rest of asia

China's Shanghai Composite index was up by 0.7% at 3,165.27 points, extending a rally that saw it gain 3% on 8 October.

Meanwhile, International Monetary Fund managing director Christine Lagarde allayed fears of a hard landing in China, saying the outlook for the world's second largest economy was not all "doom and gloom".

Shares in Hong Kong followed the mainland higher, with the Hang Seng advancing 1.7% to 22,738.36.

Elsewhere in the region, Australia's S&P/ASX 200 rose 1.1% to 5,266.90 points led by gains in the banking and commodity sectors, while India's Sensex benchmark was also up 1.1% at the open.

South Korean markets were closed due to a public holiday.

© Copyright IBTimes 2025. All rights reserved.