AstraZeneca and Pfizer Deal: Cable Calms Fears Over Government's Intervention Powers

Britain's business secretary told a parliamentary committee that the government's ability to intervene in the potentially massive merger between Pfizer and AstraZeneca is "a tricky, complex and long process."

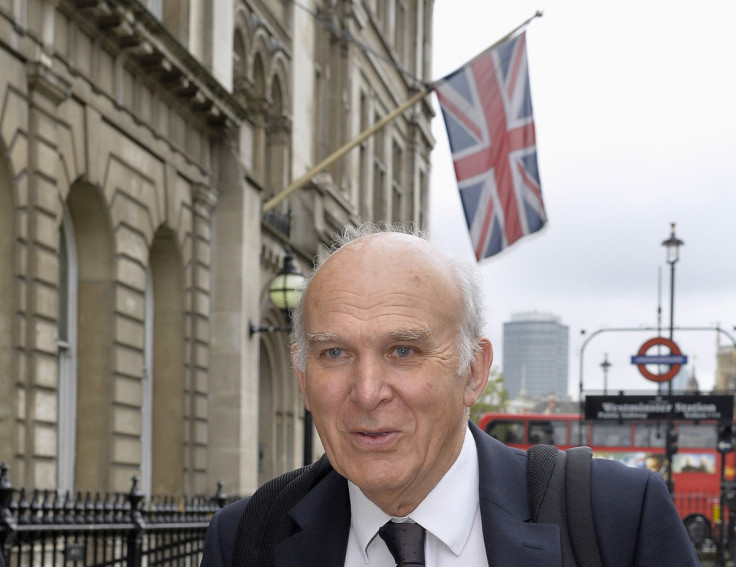

Speaking at the Business, Innovation and Skills (Bis) Committee hearing, Vince Cable said that while the government is able to help provide transparency and analysis over the major pharmaceutical tie-up, it has to strike the balance between being business-friendly while also protecting the wider interest of the country.

"The framework which we have under the act, as you know, confines the public interest test quite narrowly and, of course, all of that takes place within the framework of European merger law," said Cable.

"If the assurances by Pfizer are not satisfactory, then there is the option of secondary legislative remedies but we are not changing the Takeover Code. The option of the intervention would remain open to us. Out of all the things we are worried about, the short time in terms of the deal being proposed, isn't one of them.

"When [Pfizer's boss Ian Read] met government advisors last week, we conveyed where we were concerned and the importance over the long term commitment in R&D in the UK. The company responded with the open letter at least covered a broad area."

The UK's Takeover Code

Pfizer openly courted politicians this month, in order to win support over its bid for AstraZeneca, by claiming that the overall economic value of the merger will inject £59bn (€72bn, $100bn) into the UK's economy.

However, AstraZeneca has already rejected several bids, including the latest worth £63bn.

Pfizer said that it would commit 20% of its R&D workforce in the UK but it would not put a 'real' headcount number to that figure.

"The key issue of any proposal should be meaningful and binding," said Cable.

"However, this letter is the starting point and basis for negotiations. It is not a full proposal."

Following the controversial sale of Cadbury to US company Kraft in 2010, the coalition government created a new Panel of Takeovers and Mergers.

The Panel regulates the area of major mergers and eventually, in September 2011, made changes to the Takeover Code.

Lawmakers asked Cable if the Takeover Code would change again due to the scope and scale of this possibly massive deal.

"We wouldn't change [the Takeover Code] for the purpose [of the Pfizer / AstraZeneca deal]. There have already been a number of major reforms to the code [when the Coalition government came into power], including an obligation for parties to look at the whole bid (not just the price), the long term impact and greater transparency and commitment to employee consultation," said Cable.

"[The Bis committee panel] is rightly specifying the dilemma of being an open economy and welcoming business, while also trying to best protect the wider public interest and jobs. There is a level playing field across the EU though."

Cable is the last in a line of politicians, company executives and union leaders that has given evidence over the national impact the potential massive merger would have on the country.

AstraZeneca's boss Pascal Soriot hit back at Pfizer's attempts to take over the company after claiming the proposals undervalued the company and that a "merger of this magnitude" would substantially disrupt and damage medicine production, the workforce and reputation.

However, Pfizer's CEO Ian Read claimed that both major drug makers would significantly benefit from a complementary combination of their product pipelines.

Meanwhile, the biggest concern across all groups has been about jobs.

AstraZeneca has 7,000 jobs in the UK but unions, Unite and GMB, said Pfizer has, so far, only delivered "flimsy commitments" when it comes to safeguarding British positions and warned of "a number of loopholes" in its letter wooing the UK government into backing a merger with AstraZeneca.

© Copyright IBTimes 2025. All rights reserved.