Berkeley Group on Track to Double FY 2013 Revenues, May Return £13 Per Share Over Next 10 Years

The Berkeley Group Holdings, known for its savvy London land purchases, is confident of its ability to meet its targets, buoyed by a pipeline of forward sales that grew 15.2 percent in the six months to October 31, 2011. The group is scheduled to release its interim management statement on March 19, 2012.

Berkeley is responsive of the likely implications of the macro uncertainty that continues to provide the backdrop to the economy and the threat of short-term volatility, though demand continues for well designed homes built to a high quality in desirable locations in London and the South East. In these conditions, the group aims to invest its capital efficiently, where it can create the best long term value for shareholders and assess the level of risk accurately.

While commenting on the H1 results and outlook, Chairman A W Pidgley said: "I am delighted to report a strong performance in the first half of the year, in which basic earnings per share have increased by approximately 70% when compared with the same period a year ago. Looking forward, the further increase in forward sales and the strong balance sheet, which remains ungeared, means Berkeley is increasingly well positioned to capitalise on the current market conditions."

Revenue reported for the first half was £404.9 million, an increase of 20.4 percent compared to £336.20 million for the same period in 2010. Profit before tax rose 64.1 percent to £101.1 million with earnings per share at 56.7 pence up by 69.3 percent.

"Berkeley's first half results were broadly as expected on an underlying basis, but the £31 million profit from disposal of student accommodation means we are increasing our reported PBT forecast by 17 percent. Berkeley continues to be active in the land market and is investing in work in progress, a good indication that trading conditions remain good," Numis Securities said in a report.

Analyst Mike Bessell from Evolution Securities says: "The strong increase in operating profit combines with 7 percent further growth in the landbank gross margin to give confidence that the company will achieve its accelerated timetable and deliver a doubling of the full year 2010 earnings in the full year 2013."

Berkeley plans to return £13 per share over the next 10 years, to be paid as a series of dividends. According to the group, the H1 performance was encouraging and provided the confidence to begin a number of new developments into construction which were anticipated to give the first dividend milestone of £4.34 per share no later than 30 September 2015.

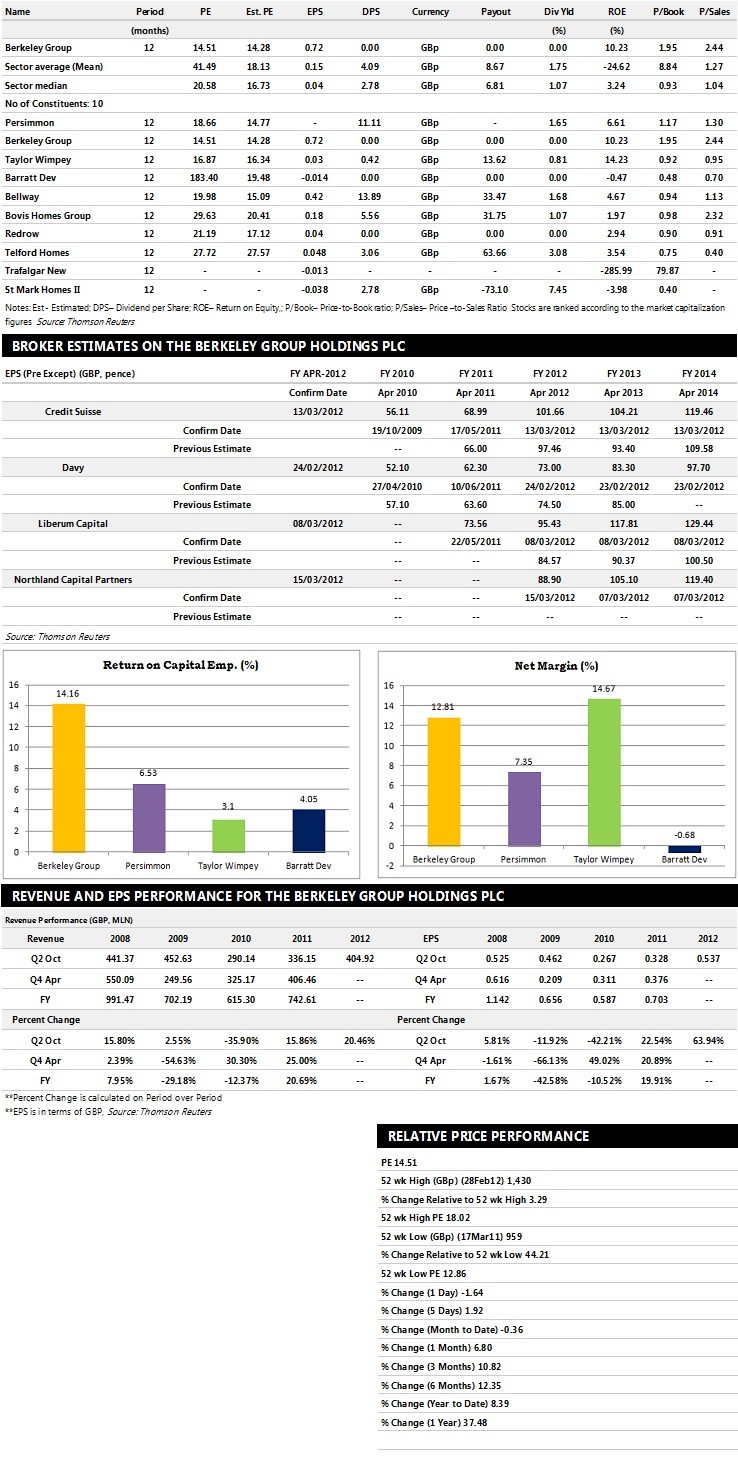

Brokers' Views:

- Northland Capital Partners recommends 'Buy' rating on the stock with a target price of 1600 pence per share

- Credit Suisse assigns 'Hold' rating

- Liberum Capital gives 'Buy' rating with a target price of 1500 pence per share

- Shore Capital Stockbrokers assigns 'Hold' rating

Earnings Outlook:

- Northland Capital Partners estimates the company to report revenues of £832.00 million and £934.70 million for the FY 2012 and FY 2013, respectively, with pre-tax profits (pre-except) of £164.00 million and £196.00 million. Earnings per share are projected at 88.90 pence for FY 2012 and 105.10 pence for FY 2013.

- Credit Suisse projects the company to record revenues of £847 million for the FY 2012 and £906 million for the FY 2013 with pre-tax profits (pre-except) of £181 million and £183 million. Profit per share is estimated at 101.66 pence and 104.21 pence for the same periods.

- Liberum Capital expects Berkeley to earn revenues of £929.50 million for the FY 2012 and £1,115.50 million for the FY 2013 respectively with pre-tax profits of £179 million and £220.98 million. EPS is projected at 95.43 pence for FY 2012 and 117.81 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.