Big oil offers big returns but keeps spending tight

The West's energy giants are set to return a record $30 billion to investors after reporting bumper profits in the second quarter of the year following a surge in energy prices.

The West's energy giants are set to return a record $30 billion to investors after reporting bumper profits in the second quarter of the year following a surge in energy prices.

But the top five Western oil and gas companies have shied away from investing more of their combined record profits of nearly $60 billion in new production as they weigh the impact of recession and climate change on future fossil fuel demand.

The reluctance to spend may exacerbate an energy supply crunch that has driven inflation to multi-decade highs and ignited calls from consumers and opposition leaders for governments to increase tax on energy companies.

The spending approach contrasts with previous cycles of high oil and gas prices, such as the boom of the late 2000s that spurred rapid spending to boost production.

"Given all the uncertainty in the world, now is not the time to lose discipline," BP Chief Executive Bernard Looney told Reuters after reporting BP's highest profit in 14 years.

The combined oil and gas output of BP, Shell, TotalEnergies, Chevron and Exxon in the first half of 2022 reached 14.6 million barrels of oil equivalent per day (boed), some 10% below its pre-pandemic levels, according to Reuters calculations.

Although some of the companies modestly increased 2022 spending plans in recent days, they remain within previous target spending ranges. Most of the extra funds are focused on projects that can start producing in a short timeframe or to accelerate starting dates for projects already under way.

TotalEnergies raised its 2022 spending guidance by $1 billion to a range of $16 billion in part to speed up field expansions in Angola, Chief Executive Officer Patrick Pouyanne told analysts last Thursday.

BP is increasing spending by $500 million this year, primarily to grow short-term production in the U.S. Hayensville onshore natural gas basin and the Gulf of Mexico, Looney told Reuters.

But BP's 2022 spending budget of $14-$15 billion will remain unchanged, and does not alter its target of reducing oil and gas output by 40% by 2030 as part of Looney's ambition to shift to renewables and low-carbon energy. Around two-thirds of BP's budget is geared towards oil and gas in 2022.

Although the energy crisis caused by major fossil fuel producer Russia's invasion of Ukraine has in the short term placed the focus on countries using all available supplies, even if that means carbon-intensive coal, Western governments longer term are striving to shift to low-carbon energy.

The International Energy Agency in May 2021 said investors should not fund new oil, gas and coal supply projects if the world wants to reach net zero emissions by the middle of the century to try to slow climate change.

Within the group of leading energy companies, there has been a clear divergence as Exxon, Chevron and TotalEnergies plan to expand output in the coming years, while BP and Shell aim to keep production largely flat.

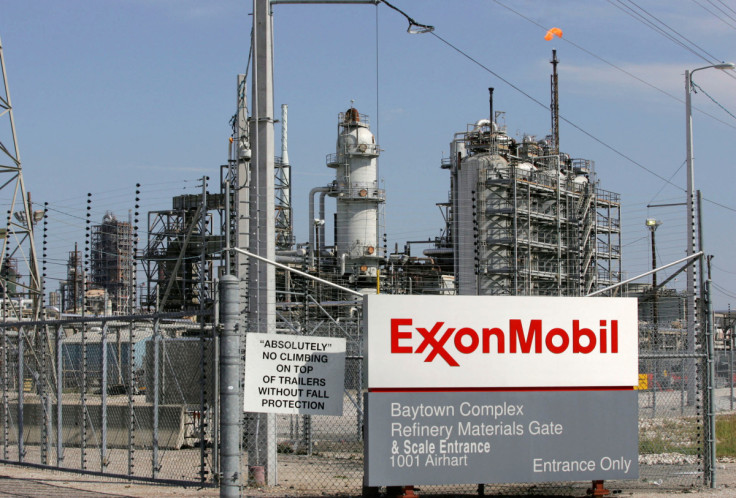

Exxon expects its 2022 production to remain unchanged from a year earlier at 3.8 million boed, but plans to grow its output to 4.2 million boed by 2027, with most of the growth coming from U.S. shale and Guyana.

Chevron, which is investing heavily in the U.S. Permian basin and Kazakhstan, plans an annual growth of 3% over the next 5 years to reach over 3.5 million boed from 2.9 million boed today.

This year's surge in energy prices is in part the result of years of underinvestment, which meant that when demand recovered from pandemic lockdowns, energy markets were very tight even before the disruption caused by war in Ukraine.

Shortly after Russia began the invasion it terms a "special military operation" on Feb. 24, gas prices in Europe touched record highs and international benchmark crude reached 14 year-highs.

The record shareholder returns of $30 billion compare to quarterly pre-pandemic returns of between $16-$20 billion - and they are set to increase again in the third quarter, mainly in the form of buybacks.

Copyright Thomson Reuters. All rights reserved.