Bitcoin use switching from investment commodity to everyday currency, new data reveals

Bitcoin has significantly shifted away from being a commodity traded by investors and towards being used as an actual currency used to pay for goods and services, according to new industry data.

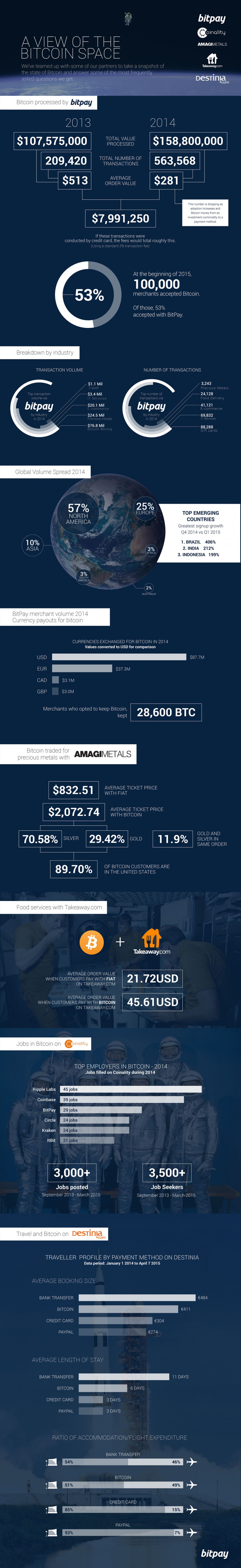

Leading bitcoin payments processor BitPay has shared its latest research exclusively with IBTimes UK, revealing that the total number of bitcoin transactions more than doubled last year as a result of this shift. Learn more about bitcoin payments processor from bitcoin pro.

At the same time, the average order value has dropped by almost half, signifying that as merchant and consumer adoption increases, bitcoin is moving from an investment commodity to a payment method.

"As bitcoin becomes a more established technology, we expect to see more consumers using it," Wouter Vonk, BitPay's European marketing manager, told IBTimes UK.

"The investors are usually the first ones to hop on new technology, but as bitcoin circulates more, and as the amount of transactions increases, we should see bitcoin being used by more and more average consumers."

Industry figures released in February revealed that the number of retailers accepting bitcoin as a payment method has surpassed 100,000. This includes major firms and organisations like Microsoft, Dell, Wikipedia, Twitch, Greenpeace, Expedia and PayPal.

Of these 100,000 companies and organisations, 53% accepted bitcoin using BitPay's payments platform, totalling more than $150m (£102m) worth of bitcoin in 2014.

The latest data from BitPay, which was gathered from some of the largest worldwide bitcoin merchants, also revealed that North America remains the largest bitcoin market, accounting for 57% of global volume.

Only 3% of worldwide transaction volume takes place in South America and Africa, however, the top emerging country in 2014 was Brazil, with 406% merchant signup growth from the previous year.

The Latin American and African markets are expected to be key growth areas for bitcoin in the future due to a large migrant population and the relatively large proportion of people without access to traditional financial services.

"We see bitcoin being used in emerging markets as a supplement to the current banking and monetary systems," Vonk said. "Bitcoin breaks down the barriers to financial tools that many people in emerging countries are facing."

Research highlights have been compiled in an infographic:

© Copyright IBTimes 2025. All rights reserved.