Canadian dollar tests crucial 1.20/$ resistance after jobs report

The Canadian dollar strengthened on 8 May helped by a slight job market positive as broadly in-line US labour market indicators failed to boost the greenback.

USD/CAD slipped to 1.2045 from the previous close of 1.2127 before edging back up to 1.2089. The pair has been unable to break the 1.20 support despite two attempts since earlier in May.

The momentum gained on the labour market data may not easily make it possible but another greenback-negative or loonie-positive in the coming days could see it happening.

Canada's jobless rate stood at 6.8% in April, unchanged from March, and beating market estimates of a rise to 6.9%. The net change in employment was a weaker than expected -19,700 after +28,700 in the previous month while the consensus was a softer -5,000.

Non-farm payroll addition in the US in April was 223,000 almost meeting market estimate of 224,000 and sharply higher than the March reading of 126,000. Also, the unemployment rate slipped to 5.4% from 5.5% as predicted by forecasters.

The slide in the pair was the fourth straight one and over the period, the Canadian currency has strengthened more than 5.1% against its US counterpart as the greenback has been facing a bearish shift ever since data started calling for a postponement of the much anticipated mid-year rate increase by the Fed.

From the multi-year trough of 1.2836 touched against the US currency in March, the loonie was up more than 7% at the lowest in the USD/CAD pair this week.

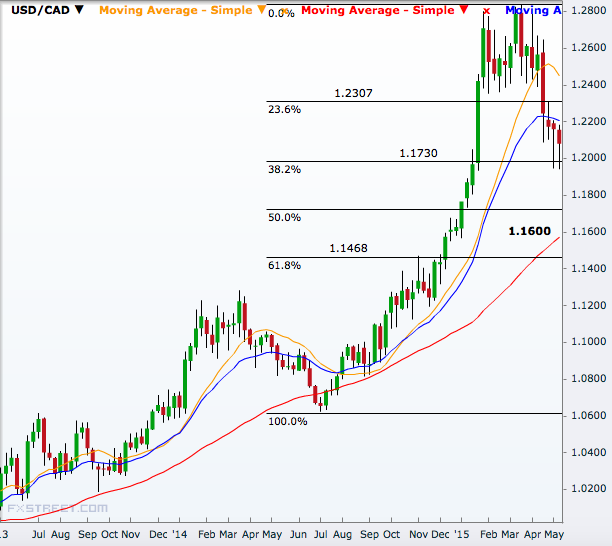

Now with the pair testing the 38.2% Fibonacci retracement of the July-March rally as a support, the levels loom large are the 50% level of 1.1730 and then 61.8% level of 1.1468.

That said, the pair needs such a big downside catalyst to break through the 1.60 support barrier which is strongly endorsed by the 50-period moving average on the weekly chart. That SMA has been held as a very strong support since mid-February in 2013.

If that happens by any chance, then the pair will aim 1.1200 and then 1.1000-1.0800 before the low of 1.0650 in July 2015.

In case of a significantly strong rebound from near the 50-week moving average, USD/CAD will first target 1.2000 and then 1.2400 ahead of a retest of the March peak.

© Copyright IBTimes 2025. All rights reserved.