China's Yuan Rises to 33-Week High as Manufacturing PMI Jumps to 3-Month High

The Chinese yuan has rallied to a 33-week high with data showing manufacturing activity continuing to expand albeit at a slower rate in the world's second largest economy.

Despite the US unit's broad strength, the USD/CNY has slipped to a low of 6.1171, clearing the ground for the third straight weekly gain for the yuan.

The USD index, the gauge that measures the greenback's trade weighted strength against a basket of major currencies, has risen to an eight-day high of 85.83.

The HSBC/Markit manufacturing PMI (purchasing managers' index) for October came in at a three-month high of 50.4 helped by improved employment and inventory indices.

Analysts say although the index remained in the expansion territory, finer details show that the demand outlook is weak and disinflationary pressures are persistent, underscoring the need for further policy easing.

Yuan Technical Outlook

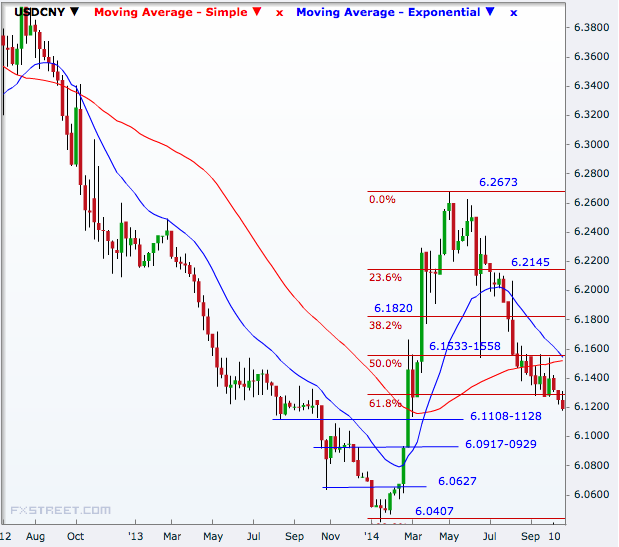

The Chinese currency has been on an uptrend since May this year and by mid-August, the USD/CNY pair had broken below the 50% Fibonacci retracement of its January-April rally.

The pair then found firm support at the 61.8% level of 6.1270 and moved sideways between that base and a high of 6.1558 for about seven weeks.

However, that base was broken on a closing basis last week and the trend is continuing this week. The next downside aim could be the 6.1128-1108 area before the 6.0929-0917 zone. Then 6.0627 will be a level to watch ahead of a retest of the January low of 6.0407.

On the higher side, the first target could be the 6.1533-1558 region. A break of that will open the doors to 6.1820 and 6.2145, the 38.2 and 23.6 Fibonacci levels before a retest of the May peak of 6.2673.

© Copyright IBTimes 2024. All rights reserved.