Edmund Shing: Avoid hedge fund horror and invest in Aberdeen Asset Management

Hedge funds are the very select end of the fund management industry, catering principally to very rich individuals and offering a wide range of often highly specialised investment strategies. Many of the world's billionaires made their money as hedge fund managers: George Soros is probably the most famous of these, making his fortune running his Quantum Fund from 1973.

Soros is most famous for "breaking" the Bank of England in 1992 by betting heavily against sterling with the Quantum Fund and eventually forcing a huge devaluation of the pound as it was forced out of the European Exchange Rate Mechanism. This one bet reputedly made the fund $1bn in profits.

Of course, investing in these highly specialised funds run by extremely talented individuals comes at a price: often as high as a 2% annual management fee and 20% of all annual performance above a certain threshold. But a question that should always be asked, as with any highly priced service or product, is: "Are they really worth it?"

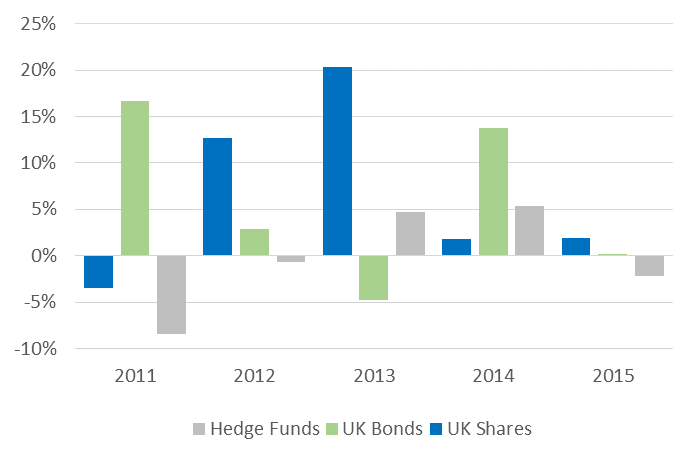

On the evidence of this year's performance, the answer would have to be no. Since 1 January, hedge funds have actually lost over 2%, while an investment in either UK shares or in UK bonds would have made money (Chart 1).

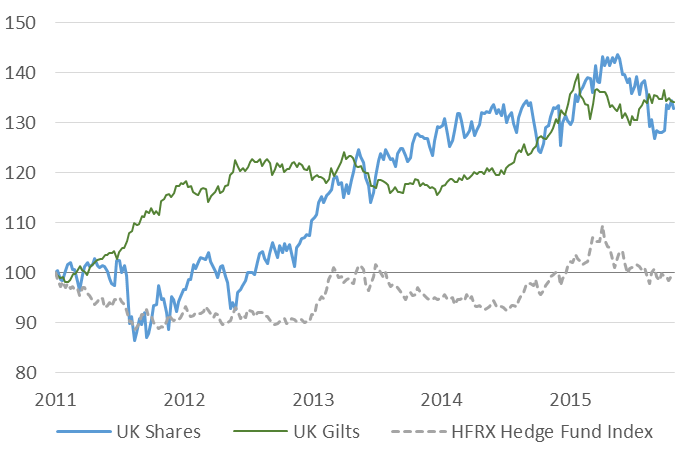

Recent history may not be kind to hedge funds but surely these super-smart guys have made money for their investors in the long run? Well, actually no. It turns out that even in the long run, hedge fund investors in aggregate have not done well.

According to HFR hedge fund research, after fees the average hedge fund investor has seen a small loss from 2011 to today (Chart 2).

But while £100 invested in hedge funds back in 2011 would only be worth £99 today, that same £100 invested instead in UK shares or in UK government bonds would be worth £133.

So what is the moral of this investment story? That for the vast majority of investors, putting money into funds with high fees is a bad idea. In hedge funds as an example, it would seem the only people really making money are the hedge fund managers.

The most important variable in choosing an investment fund: The cost

Lots of research has shown it is very difficult to predict which investment funds are going to do well. Even if a particular unit trust has performed well in the past, that is certainly no guarantee of strong performance in the future.

The one element that is certain when investing in a given fund is its cost: how much you are going to pay in annual charges for your money to be managed. Clearly for you the investor, the lower the cost, the better.

Which is why in general, I advise people to buy low-cost index-tracking exchange-traded funds (ETFs), because they allow you to put your money to work in a diversified fund while paying very low charges, generating investment performance for you rather than making lots of money for the fund manager.

Better usually to invest in fund managers than their in funds

While I am not a fan of expensive investment funds, I am a fan of fund management company shares. These companies make a lot of money and pay generous dividends to shareholders, making them an attractive investment. They also see growth when stock markets rise; as their sales rise and investors then put more money into their funds, they then generate higher fee income.

Man Group (UK code: EMG) is a UK-listed hedge fund manager that manages $79bn in investments across a range of different hedge fund strategies. Profit performance has been strong of late thanks to strong performance at its largest fund, AHL, which has resulted in performance fees boosting overall profits. It remains a relatively cheap share, cheaper on P/E ratio than the UK stock market average, and also a good income payer with a solid 4.2% dividend yield.

Moving away from the hedge fund towards more traditional asset management companies, Aberdeen Asset Management (UK code: ADN) is also interesting. It manages £307bn of assets through a number of brands, such as Scottish Widows, but has suffered in recent years as a number of its funds have not performed well.

Now there could be a big strategic shift within the company, with the chief executive reportedly trying to sell the company to a larger rival. This could lead to a substantial rise in share price should a takeover materialise. In the meantime, Aberdeen is also a generous income payer, with a near-6% dividend yield.

So invest in asset managers such as Man and Aberdeen rather than in their funds.

© Copyright IBTimes 2025. All rights reserved.