Edmund Shing: Gold glitters once again as a hard currency so get hold of the shiny material

"Gold is money. Everything else is credit." So said celebrated banker JP Morgan, founder of the eponymous US investment banks, back in 1912.

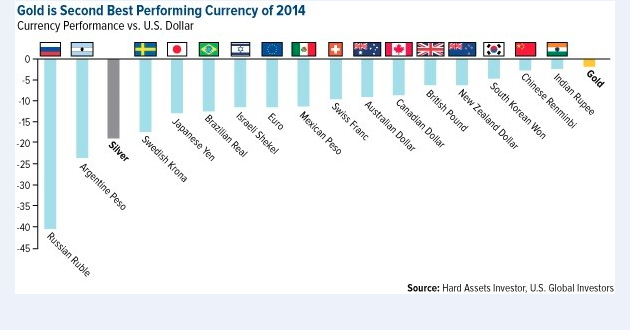

Did you know gold, when treated as a currency, was the second-best currency performer in the world last year after the US dollar (Figure 1)?

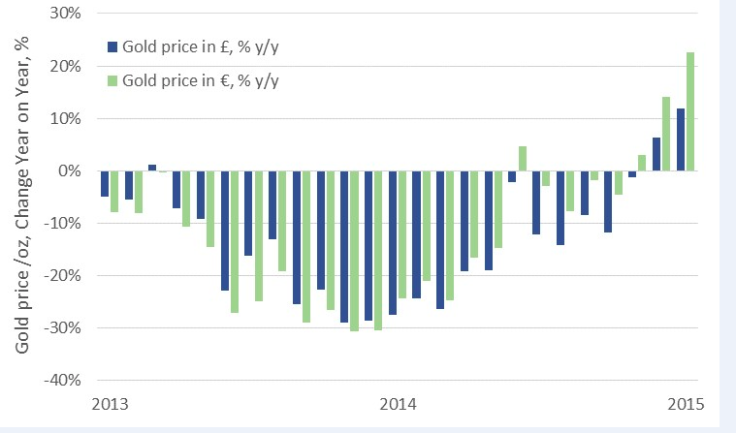

For investors in the UK or the eurozone, gold has been a strong performer over the past 12 months, with the gold price in sterling rising 12% to the end of January, and up an even more impressive 23% in euro terms over the same period (Figure 2).

You might well ask yourself why gold has been such a strong performing asset of late, given that it does not offer an income yield like shares or bond. There are several reasons for gold's comeback after 2014's sharp slump in price, related to:

- Demand from central banks around the world

- Strong gold jewellery demand from emerging markets such as China and India

- Safe haven demand from investors looking to park their savings in a "hard currency" that will maintain its value over time, protecting against currency devaluation.

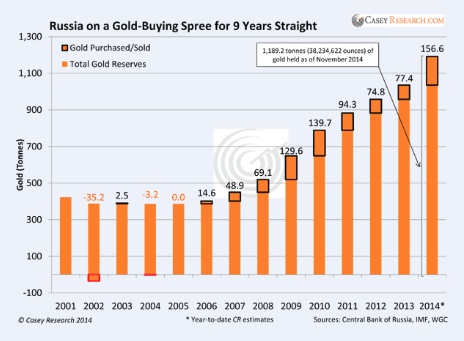

Central banks have been buying gold by the ton

Central banks around the world have proved a large source of demand for the yellow metal over the past 12 months, led by Russia. The Central Bank of Russia bought a record amount of gold in the first 11 months of 2014 spending an estimated $6.1bn (£4bn, €5.3bn) in an attempt to reduce dependence on the US dollar amid geopolitical tension, (Figure 3).

Aside from the Central Bank of Russia, other central banks have also been net buyers of gold, including the People's Bank of China and the Indian central bank (Figure 4).

The investment case for owning some gold exposure in your portfolio

The classic investment case for an investor to own gold is twofold. Firstly, it acts to diversify your overall investment portfolio, which is generally dominated by stocks and shares on the one hand, and various types of bonds (government and corporate) on the other.

Gold tends to appreciate over the long term but does not move together with either stocks or bonds over time, acting to smooth out the overall investment returns from your long-term savings.

Secondly, it acts to protect the value of your long-term savings against the effects of a weaker currency.

In this case, just look at how sterling has lost 12% against the US dollar from peak in June 2014 to today, while the euro has suffered an even more dramatic 19% drop against the US dollar since hitting a peak in March 2014.

Holding gold would have protected you against the bulk of these declines.

So how can you buy gold exposure?

Well, there are a couple of easy ways that you can by exposure to the yellow metal:

- You can buy gold in the form of coins or small gold bars from the Royal Mint (that produces all of our coins) – it is selling a gold sovereign (containing 0.2354 of a troy ounce) for just under £227, with discounts for buying 25 or more. The problem with this is you are effectively paying the Royal Mint a premium of up to 12% over the actual price of gold per ounce to buy these coins.

- You can invest in a gold bullion exchange-traded fund (ETF), which you can hold in a stocks and shares account or stocks and shares Isa. My preferred gold ETF is the ETF Securities Physical Gold ETF (code: PHGP), which buys you direct investment exposure to the gold price in sterling.

So go on, now is the time to look at getting your hands on some of that shiny yellow metal.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.