Edmund Shing: HSBC and Co-op Bank do battle as sub-1% mortgage wars break out

Could the first sub-1% mortgage rate be around the corner? Actually, it is already here. While the Co-op Bank recently launched a 1.09% two-year fixed-rate mortgage (which will move back to the standard variable rate (SVR) at the end of the term), HSBC has beaten this with an initial rate of 0.99% on its two-year discount special mortgage.

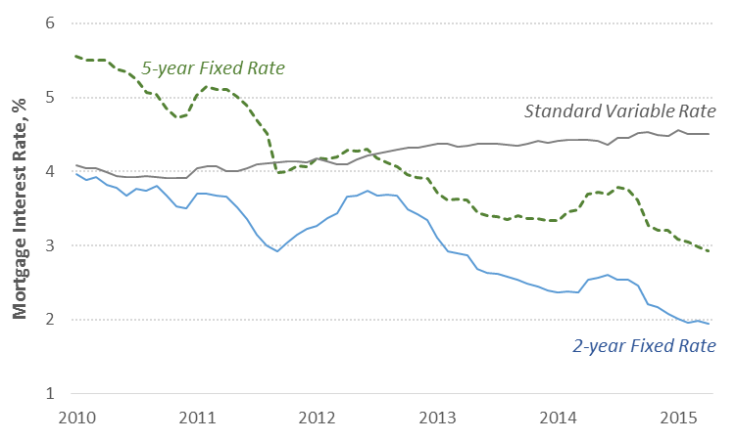

It is hardly surprising then that existing homeowners are thinking about remortgaging to lower their monthly mortgage payments. Surprisingly enough, the SVR on mortgages has actually risen since 2010 and now stands at 4.5%.

The average two-year fixed mortgage rate has fallen to under 2%, while the average five-year fixed rate is under 3% (Figure 1). And if you shop around, you can now find sub-2% five-year fixed rates too.

Nearly one in six homeowners are thinking about remortgaging over the next six months, according to a recent Nottingham Building Society survey.

They are hoping to save on average £99 per month, or nearly £1,200 per year. This is all thanks to the ongoing mortgage price war, driving rates ever lower. Let's face it, with the Bank of England base rate at a historic 0.5% low, interest rates are likely to only go one way in the long-term – up.

So remortgaging with a multi-year fixed rate will at least insulate the homeowner against the risk of higher rates for the foreseeable future.

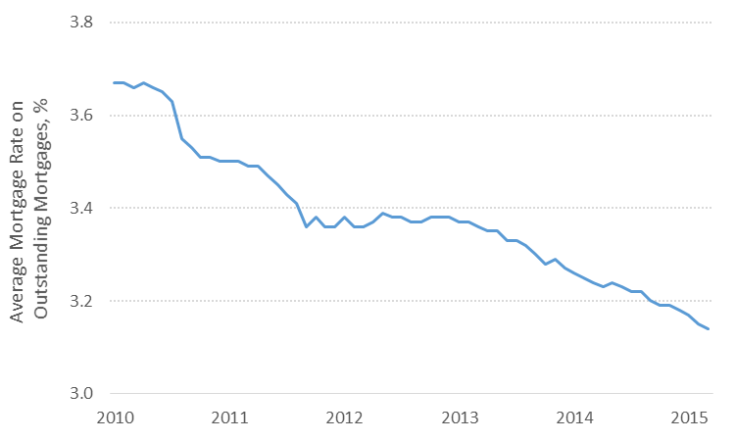

Average mortgage rate on outstanding mortgages

But how much is the average mortgage borrower paying at the moment? The Bank of England says "nearly 3.2%" (Figure 2).

Yes, this average rate has come down over the past five years, but it is still a long way from the current best two and five-year fixed and discount rates on offer today.

Let's say you are interested in remortgaging your house or flat. Where would you start and what should you watch out for?

Firstly, you can go the well-trodden route of checking out the online mortgage best buy tables at MoneySuperMarket.com, MoneySavingExpert.com or MoneyFacts.

Before going any further, it is probably a good idea to sit down with your existing mortgage provider to see what they can offer you.

Then if you're not satisfied, try the banks and building societies at the top of these tables. Or you could go to a specialist mortgage broker such as John Charcol or London & Country Mortgages.

But beware, some of these lowest interest rates come with catches: you may be hit with a high "arrangement fee" that can go as high as £1,499, or there may be penalties for early repayment. So be careful to examine the details.

Investing in the mortgage market: challenger banks, specialist lenders

There are some interesting ways to invest in a post-election pick-up in mortgage demand. Instead of looking at the Big Four UK banks, I would look to the new "challenger" banks that have recently been established, or look to specialist mortgage lenders.

Listed challenger banks that are making a splash on the savings and loans markets include Virgin Money (code VM), Secure Trust Bank (STB), OneSavings Bank (OSB) or Aldermore Group (ALD).

Virgin, OneSavings and Aldermore have all recently listed on the London Stock Exchange and are growing their savings and mortgage businesses quickly as they take business away from the Big Four.

Otherwise, for a really focused mortgage growth play, you could look at the Paragon Group of Companies (code PAG). Paragon specialises in residential mortgages (such as buy-to-let), personal and car loans.

They are forecast to grow profits by more than 10% per year for the next two years and trade on a very reasonable valuation.

Bottom line: if you haven't remortgaged already recently, check out the current best remortgage buys and see if you can save on your monthly payments.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.