Eritrea: London 'diaspora tax' bankrolling al-Shabaab militants investigated by Scotland Yard

The Metropolitan police are looking into allegations the Eritrean embassy is still extorting a controversial 'diaspora tax' from its nationals in the UK and using some of the money raised to support Islamist militants in the region.

A brief statement from a Met spokesman confirmed to IBTimes UK that its parliamentary and diplomatic department are looking into a dossier of allegations filed by a group of Eritreans in March to the Met commissioner Sir Bernard Hogan-Howe.

"The Metropolitan police service have been contacted by members of the Eritrean community regarding the alleged illegal extraction of taxes by their embassy," read the statement. "Officers are assessing the information provided to them to establish whether any offence has been committed."

Eritreans claim the tax is still being raised illegally in London contradicting regime claims that it no longer collects the tax in the UK.

The Met police assessment follows a series of investigations by IBTimes UK into the Eritrean embassy's attempts to levy the tax on the earnings of the Eritrean diaspora.

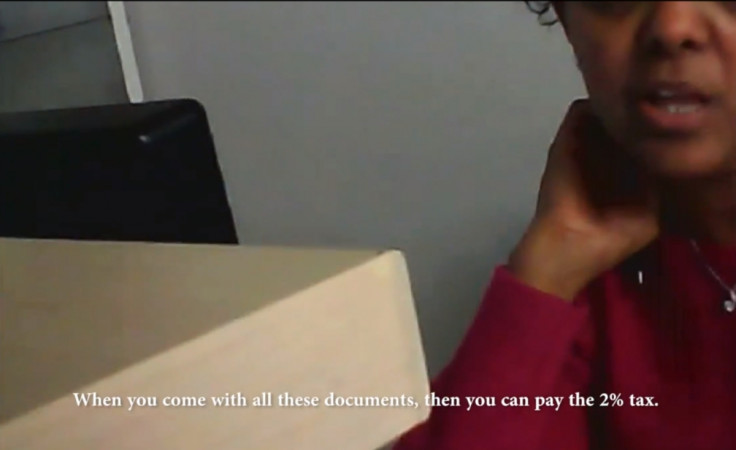

In February 2014, IBTimes UK obtained secret footage filmed inside the Eritrean embassy in London showing one Eritrean, known as Simon T, forced to pay the 2% 'income tax'.

"It is used as a weapon against the Eritrean diaspora to keep a leash on the community," says Feruz, a UK-based Eritrean human rights activist. "Anybody who doesn't make this kind of payment is not allowed to do anything back home. Anybody who is against that payment like me, we have no rights in our own country.

"It's blackmail, coercion, intimidation and extortion. Anybody, and I mean any Eritrean who has to pay that payment are not happy, they have to undergo huge financial pressure."

Funding African militants

The collection of a diaspora income tax on Eritrean nationals living abroad violates UN resolution 2023 which condemns Eritrea's use of the tax to "destabilise the Horn of Africa region and to violate the sanctions regime".

The UN claims some of the money is being used to procure weapons for Islamist militants.

The UN Security Council hardened sanctions against Eritrea in December 2011 over its alleged support for Islamist militant groups such as Somalia's al-Shabaab. The resolution called on Eritrea to "cease using extortion, threats of violence, fraud and other illicit means to collect taxes outside of Eritrea from its nationals or other individuals of Eritrean descent".

Whitehall officially supports a series of UN resolutions imposing sanctions against Eritrea.

The Foreign and Commonwealth Office (FCO) had earlier sought to curb Eritrean diplomats who were collecting the tax in the UK from up to 40,000 refugees in the UK on the grounds that the money was used by the Eritrean government to destabilise the region.

In May 2011, the Eritrean ambassador in London was informed that the collection of the tax could be unlawful and breach the Vienna Convention on Diplomatic Relations. The Foreign Office told the ambassador to stop all activities relating to its collection.

IBTimes UK investigation

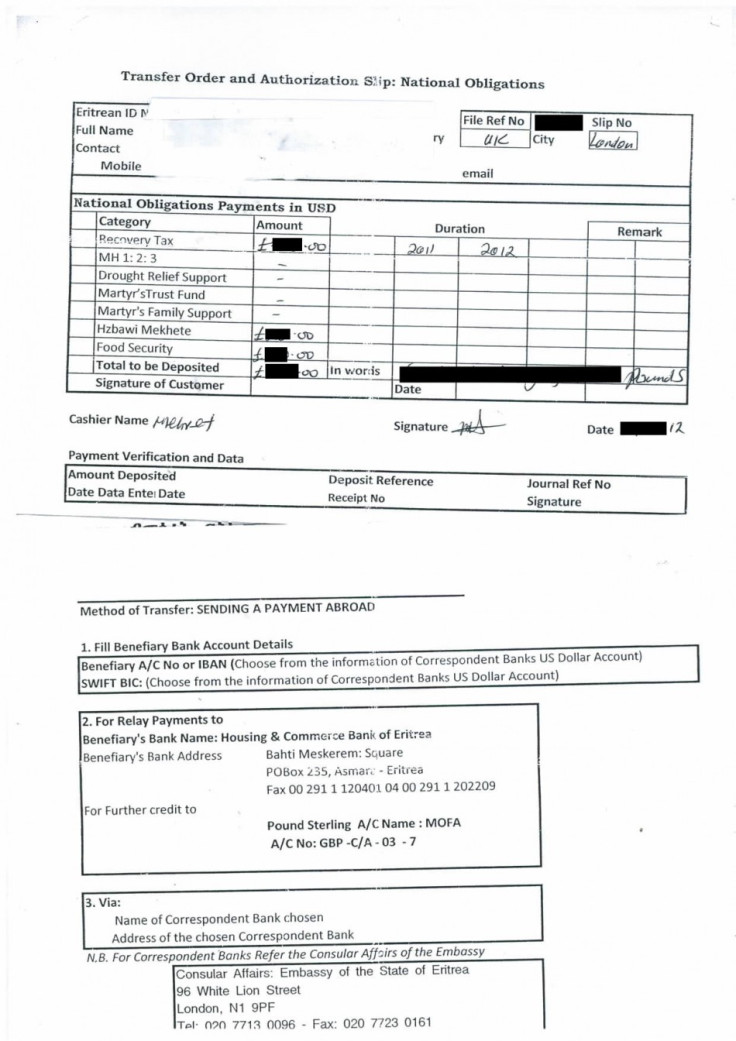

But in July 2013 a special investigation by IBTimes UK, supported by copies of an order transfer, order slips and payment confirmation, appeared to reveal the practice was still ongoing in Britain.

Eden (not her real name) was forced to pay thousands of pounds in diaspora tax after authorities threatened her parents in Asmara that their family business licence would not be renewed.

The FCO told IBTimes UK at that time: "We are aware of allegations over the use of harassment to collect revenue from members of the Eritrean diaspora in the UK.

"On 20 December, 2012, FCO officials raised these concerns with the Eritrean ambassador and reminded him of UN Security Council resolution 2023. [The UK supports the resolution] which condemned Eritrea's use of the diaspora tax to destabilise the Horn of Africa region and decided that Eritrea should cease using illicit means to collect the tax," the spokesperson said.

Several Eritreans have described the tax as a "consular service" for any citizen wishing to renew their passport or Eritrean holders of foreign passports requesting a visa to visit Eritrea. Every national must produce documentation of the tax payments they made in their host country and on this basis the 2% tax is calculated.

Without the tax certificate, it is impossible to get a passport renewed or an entry or exit visa. It is also impossible to undertake a number of unofficial transactions, such as remitting the money back to the families or simply sending old clothes.

Crimes against humanity

A UN report published on Monday said the Eritrean government may be guilty of crimes against humanity.

The report, compiled over a period of 12 months, chronicled several crimes including extrajudicial executions, torture, sex slavery, forced labour and mass killings against certain ethnic groups.

"The commission finds that systematic, widespread and gross human rights violations have been and are being committed in Eritrea under the authority of the Government," the report said, adding that the human rights violations "may constitute crimes against humanity."

The authors also concluded that the Eritrean Government "is accountable for the widespread torture inflicted on Eritreans throughout the country". Specific torture methods included electric shock, near-drowning, sexual abuse and forcing people to stare at the burning sun for long periods of time.

© Copyright IBTimes 2025. All rights reserved.