EU referendum: Brexit worries offer British bargains to investors

The most important statement that can be made on the subject of Brexit's impact on financial markets is that no one knows for sure.

A whole host of economists and stock market commentators (see the Financial Times' Brexit page for a sample of these opinions) have come up with widely differing estimates of the potential impact of a British exit from the European Union, ranging from virtually no impact to a very sizeable hit to the economy.

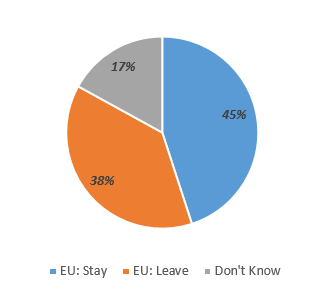

The latest Brexit poll of polls (as of 25 February 2016) indicates that the British voting public would currently vote 45% to 38% to stay in the EU (with 17% unsure; Chart 1).

For an accurate view, follow the money

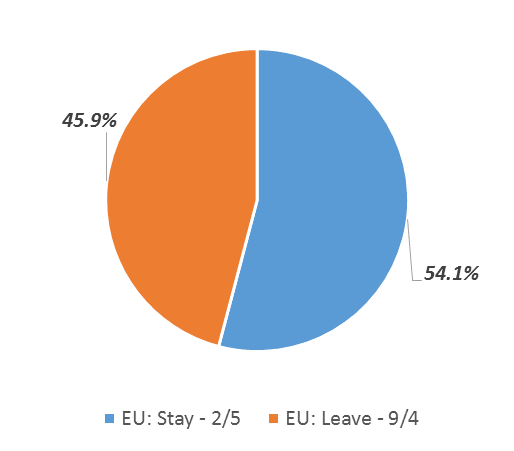

Another way to look at how people view the probability of a British exit from the EU is via the online betting markets: ie to see how people are voting with their own cash.

According to the betting aggregator website oddschecker.com, the average odds offered by online betting sites are currently 2/5 to stay in the EU, and 9/4 to leave. So when looking at how people are placing their own money, there is a strong bias towards staying in (Chart 2).

Financial markets dislike uncertainty: Sterling the big casualty

In financial markets like the stock, bond and currency markets, one thing that investors always dislike is uncertainty. In this case, the economic and political uncertainty surrounding the Brexit issue has already taken a heavy toll on sterling in currency markets.

This is important to note, as the currency markets are after all by far the largest financial markets in the world by daily value traded.

Since the pound sterling's high point in the middle of 2015, holders of pounds have seen the value of their currency fall by over 12%. Today, one pounds buys you just $1.39 in the wholesale currency market (Chart 3), largely due to fears over a potential Brexit.

Hunting for opportunity among the falls

Sterling has not been the only casualty of the fast approaching 23 June Brexit referendum, however.

The FTSE 100 stock index has also suffered, in part due to Brexit-related uncertainty. From a peak of 7.100 touched back in April of 2015, the FTSE hit a low earlier in February of just 5,500 (Chart 4).

The FTSE has since recovered to a shade under 6,100 as of end-February, but this level is still 14% below 2015's 7,100 peak.

Certain sectors have suffered even more, namely banks and insurance companies in the financial sector. Barclays (UK code: BARC), for instance, has lost 36% over the last year, compared with a 12% loss for the FTSE 100 (Chart 5).

So where are some of the best bargains to be found right now in UK financial markets?

Starting with financial stocks like banks and insurance companies, I would point to Legal & General (UK code: LGEN).

Legal & General is a very successful life insurance company, which provides life insurance, pension and unit trust products to UK clients. Profits are projected to grow steadily this year and next, driving dividends significantly higher too.

The income from this share is attractive too, with a dividend yield of 6.3%, far higher than from most other UK companies. The average broker target for Legal is 19% higher than the current 226p share price, pointing to attractive potential upside.

Secondly, UK companies who generate the majority of their sales abroad should benefit from the competitive benefits of cheaper sterling to make greater profits.

Such a company is ARM (UK code: ARM), which designs the microprocessor brains of nearly 60% of all the smartphones in use today. A fast-growing company which converts a very high 40%+ proportion of their sales into profits, ARM generates most of their sales in US dollars and related Asian currencies.

This high level of profitability has been converted over time into a cash pile worth £670m currently. The average broker target for ARM is 16% above the end-February level of 978p per share.

Lastly, a UK company that benefits not only from a weak pound but also from low oil prices is International Consolidated Airlines (UK code IAG), the parent holding company for the three flag carrier airlines British Airways, Iberia and Aer Lingus. A large slice of their revenue comes in the form of US dollars as their most profitable single route is London-New York, particularly from business class passengers which has much higher profitability than economy class.

Currently very cheap in terms of its price/earnings ratio, and with fast earnings growth predicted this year and next, IAG will be helped by a weak pound following wind. The average broker target is 45% above the current 541p share price.

Bottom line: Brexit has thrown up a number of opportunities in UK shares – I would look at Legal & General, ARM and International Consolidated Airlines in particular.

Edmund Shing is Global Head of Equity Derivative Strategy at BNP Paribas in London. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.