Forget Brexit, it's Europe's geopolitical kerfuffle that's spooking investors

Research suggests investors are increasingly worried about Brexit aftermath and populist movements in Europe.

The eerie calm with which the global markets responded to the UK's formal invocation of Article 50 – a first step on the path to Brexit – is akin to the calm before the storm, with investors fretting over its domino effect on European geopolitics, according to new research.

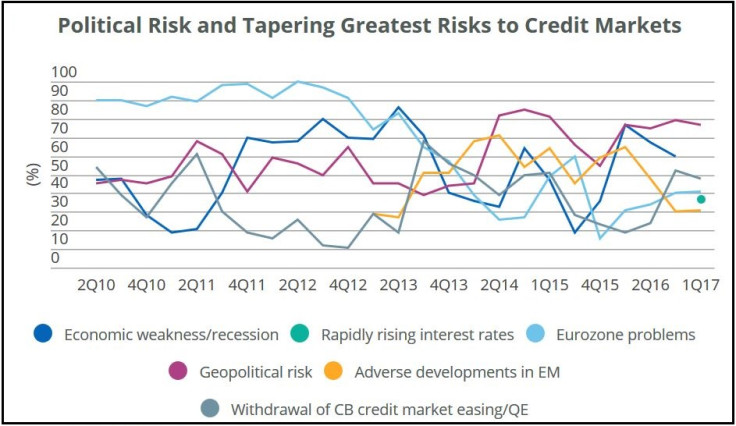

Surveying the opinion of 62 high net-worth investment managers of an estimated €5.8trn (£4.98trn) of fixed-income assets, including representatives of Europe's top 50 asset management groups, Fitch Ratings found that 77% see high geopolitical risk as the biggest threat to European credit markets.

The global ratings agency said such concerns have risen since the Brexit vote. While the vote's aftermath has been priced in by the market to a degree, the agency said its survey respondents were far from certain about politics on the wider continent given "Europe's busy election calendar."

Outcome of the recent general election in the Netherlands stopped short of giving the far right a governing platform, but severely diminished the clout of the governing parties.

In Austria, the far right also failed to grab the presidential office, but the outcome could not detract from the truth, that all of the country's hitherto mainstream parties did not even make the final round, leaving a right-wing populist toughing it out with a Green party candidate who narrowly prevailed.

Italy saw its Europhile leader booted out over a constitutional referendum, with two-thirds of his opposition parties having an anti-EU stance. France has seen the resurgence of the Marine Le Pen's far right Front National with presidential elections slated for April – though she is unlikely to win outright.

Analysts are talking up the prospects of a 'Frexit' (France) and chances of 'Grexit' (Greece) remain odds on as the latter struggles to manage its debt. Meanwhile German Chancellor Angela Merkel's future is far from certain as she faces the electorate in September.

According to Fitch, investors are fretting that such rising political risks in the eurozone could spark "renewed financial stress in the currency bloc" which could have a significant adverse impact on region-wide growth, although it is not the agency's base case scenario.

If that was not enough of a worry for investors, US policy predictability has diminished under the Trump administration, says Monica Insoll, head of credit market research at Fitch Ratings.

"There are elements of President Trump's economic agenda that would be positive for growth, but the present balance of risks points toward a less benign global outcome. The sovereigns most at risk are those with close economic and financial ties with the US that come under scrutiny due to existing financial imbalances or perceptions of unfair frameworks or practices in their bilateral relations."

Several European manufacturing hubs, especially Germany, have a heavy exposure the US market. As for the direction of Brexit talks versus investor sentiment, Fitch found many respondents were "cautiously optimistic" over the outcome of negotiations.

Nearly half (47%) expect a mutually acceptable UK exit agreement to be inked in the next two years, including a transition agreement to allow continued access to the Single Market.

Additionally, 29% expect a Brexit deal, but no transition agreement, and but a sizeable 18% see the UK leaving the EU without any deal. A handful of Fitch respondents also hope the UK would still be an EU member come 2020.

Nonetheless, Fitch believes the aim to agree a new UK-EU relationship by March 2019 is ambitious given the complexity of the negotiations. "This includes the fact that the outcome will depend not just on the UK's objectives but on those of EU negotiators and member states, which may themselves differ," Insoll adds.

Among other concerns flagged up investors, nearly half (48%) told Fitch the withdrawal quantitative easing (QE) by the European Central Bank and others could be risky too, while a minority (25%) see inflation as high risk.

© Copyright IBTimes 2025. All rights reserved.