Go-Ahead Group Bets on Olympic Games, Rail and Bus Business to Drive Full-Year Earnings Higher

Go-Ahead Group Plc bus market share increases to 23 percent with the acquisition of Northumberland Park Bus Depot and the group expects to profit while playing a substantial role in providing transport services for the Olympic Games.

"We have great confidence in the London bus market and our management team in London and this acquisition provides the opportunity to operate in a new area of the capital. Northumberland Park is located near both Tottenham Hale and White Hart Lane, where regeneration is either planned or already underway," said CEO David Brown while commenting on the acquisition.

The provider of passenger transport services expects to deliver full-year results in line with management expectations and is scheduled to release its interim management statement on Thursday.

The London's bus and rail operator reported revenues of £1,199.5 million for the first quarter compared with £1,132.2 million a year ago and profit before tax was down 13.2 percent at £44.0 million. With its good financial position, the group also proposed a dividend of 25.5 pence per share.

"Looking ahead, we expect that the bus business will deliver a solid performance, despite some headwinds and we now expect that operating profits in this unit will (be) slightly down" in 2012, said Investec in a note to its clients.

Investec lowers its full-year pre-tax profit forecast to £94.0 million for 2012, down from previous £95.7 million and to £94.1 million for 2013, down from previous £96.1 million. The broker reduces its sum-of-the-parts-based target price to 1,600 pence from 1,770 pence, while retaining its "Buy" rating on the stock.

Looking ahead, although it remains suitably cautious about the wider economic outlook, in rail it expects first half revenue growth trends to continue in the second half and in bus it expects a solid performance despite an impact from the implementation of a new contract.

"We still believe that the group is well placed to deliver a good return for shareholders over time. The DPS (dividend per share) is now well funded (circa 6 percent yield) and the present share price is assuming virtually no value for any of the existing rail businesses, we believe," Investec added.

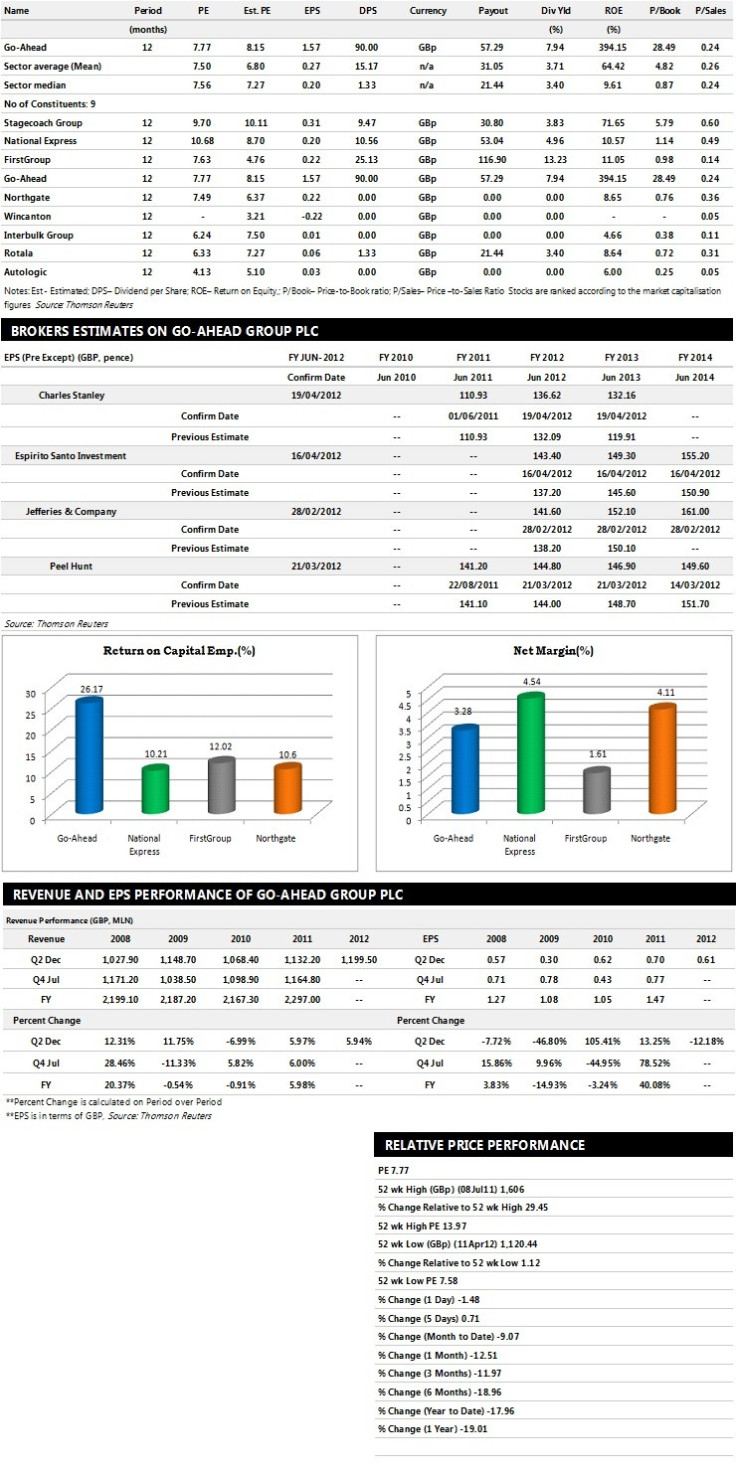

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents nine companies based on market capitalisation.

Brokers' Views:

- Espirito Santo Investment gives 'Outperform' rating on the stock with a target price of 1600 pence per share

- Peel Hunt assings 'Hold' rating on the stock

- Jefferies recommends 'Hold' rating with a target price of 1350 pence per share

- Shore Capital Stockbrokers assigns 'Underperform' rating

Earnings Outlook:

- Charles Stanley estimates the company to report revenues of £2,507.84 million and £2,431.55 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £96.40 million and £90.60 million. Earnings per share are projected at 136.62 for FY 2012 and 132.16 for FY 2013.

- Espirito Santo Investment projects the company to record revenues of £2,206 million for the FY 2012 and £2,276 million for the FY 2013 with pre-tax profits (pre-except) of £95 million and £99 million respectively. Profit per share is estimated at 143.40 pence and 149.30 pence for the same periods.

- Peel Hunt expects Go-Ahead to earn revenues of £2,347.90 million for the FY 2012 and £2,445.80 million for the FY 2013 with pre-tax profits of £94.40 million and £98.10 million respectively. EPS is projected at 144.80 pence per share for FY 2012 and 146.90 pence per share for FY 2013.

© Copyright IBTimes 2025. All rights reserved.