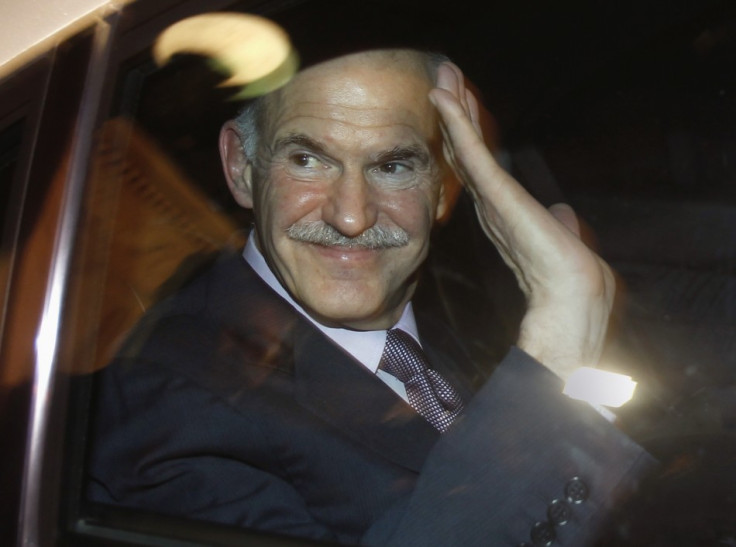

Greek Crisis: George Papandreou's Battle With The Oligarchs

As the final twilight of George Papandreou's premiership dims for good, The IBTimes reveals in an exclusive interview with a source close to the former prime minister, what life was like for the Pasok leader.

The out-going Greek prime minister George Papandreou, who led the country for two years, did so "with a pistol to his head" according to a source close to the former premier.

Papandreou has been branded capricious, unreliable and ideologically driven, but on the eve of his end in power leaks have emerged of the battle that Papandreou faced on a frequent basis with Greek oligarchs and the global banking system.

"He was forced to accept measures from the IMF, the European Central Bank and the eurozone," said the source. "Over the last two years, he has been trapped by having to accept the measures that went with the loans."

Greece needed two bailout packages over the course of Papandreou premiership that to help continue to pay the escalating debts and to essentially "keep the country working". Greece needs to ratify a third before Dec. 16 before the coffers run dry again.

The unnamed source says: "Ideologically, Papandreou was ideologically closer to the protesters in Wall Street and St Pauls Cathedral. He supported the EU wide transaction tax, which infuriated banks, especially in London."

The Greek Oligarchs

But in his final swansong speech to parliament, Papandreou revealed the deep corruption that exists in Greece and in her politics. He highlighted a pan-Balkan fuel smuggling operation that was costing the country "about €3bn annually" and all but named those involved.

But a crackdown is not possible.

According to an article by the British journalist Misha Glenny, the oligarchs, which hold so much wealth and capital, shared between only a handful of families, have a strangle hold over so much of what goes on in Greece, with business, finance, media and politics all heavily influenced.

They have, in the short term, reacted in two ways.

First, huge amounts of capital have been withdrawn from Athens and invested into London property, with 2010 seeing a surge of Greek money pouring into the UK capital's housing market.

Secondly, the oligarch-run media set to undermine and denounce Papandreou, so much so that it in effect led to the reduction in value of national owned assets such as the national grid and lottery. Oligarchs are hoping to be able to buy these assets at a cut price once the new government takes the inevitable step of nationalisation.

Where the bailout money goes

According to a recent study for every euro that Greece received in the bailout, just 19 cents went to the Greek government to continue to allow its overspending.

"Many people ask why Greece needs all this money and why the loans are not improving the situation," said the source. "The truth is that many of these bailouts go straight to pay off old debts, and not to Greece to help her get the economy back on track and to help fix infrastructure."

The breakdown is as follows:

- ECB holds 55 billion of Greek Bonds - 18pc

- Non-Greek banks and other financials- 40pc

- Greek banks and other financials - 23pc

In the end, nearly 80pc of the bailout went to privately owned lenders and businesses, leaving Greece with a fraction of the money to pay for a system that was already over-heating.

When Papandreou was faced with another round of austerity cuts following the EU Summit in Brussels on Oct. 27 he made the decision to let the people vote on it, much to the anger of the other EU leaders. But as the source reveals, the Greek parliament, even those within his party threatened to overrule it.

The source says: "He [Papandreou] announced the referendum for tactical and ideological reasons. Though everyone said they were against the agreement, when they were confronted with the referendum they realised that the people would vote in favour and that they'd have to vote in favour. You could say that Papandreou was calling their bluff."

A Greek default

Although economists have made the recommendation that Greece should accept defeat and default, the country would effectively go back 30 years.

"Foreigners would come in and buy up everything at knock-down prices, from homes on islands, to islands themselves," the source said. "It would be very profitable for other nations and individuals but it would be catastrophic for us."

But as Papandreou adviser, Richard Parker, said in an article in the German FT, a default is "seemingly becoming a reality". "Even the agreement of October 27 hides a fatal flaw: The new "plan" is basically an outline of a rescue plan but no plan per se. Important details are missing and should have been resolved in 60 days. But for Greece and Papandreou this period was too long - almost an unbearable eternity."

He adds: "European banks, it turned out later, have actually never fully agreed to the voluntary debt cut by 50pc. Papandreou stood in a fire storm."

© Copyright IBTimes 2025. All rights reserved.