Indian e-commerce start-up Snapdeal secures $500m from Alibaba, Foxconn, SoftBank and others

Indian e-commerce start-up Snapdeal has raised $500m (£320m, €452m) from global investors in its latest funding round, valuing the firm at an estimated $5bn.

The investors in the latest round include China's Alibaba, Taiwan's Foxconn and Japan's SoftBank. Existing investors Temasek, BlackRock, Myriad and Premji Invest also contributed.

Snapdeal did not disclose the individual investments of the backers. The company has a valuation of $5bn at present, according to media reports.

Meanwhile, US-based eBay, which has earlier supported the company, announced that it was selling a part of its stake in Snapdeal and focus on its own business in the country.

Foxconn said it was investing $200m for a 4.27% stake in Snapdeal's parent Jasper Infotech.

The investment has been in the pipeline for long and was delayed due to differences in valuation, according to the Economic Times.

"Alibaba was quite adamant in its position of not writing a cheque at that valuation, and that has, perhaps, played a role in Snapdeal not getting valued at a figure it was looking at," the newspaper quoted a source as saying.

Snapdeal primarily competes with Flipkart and Amazon in the fast-growing Indian online retail market. Online sales in the country are expected to surge to more than $100bn in 2020 from $2.9bn in 2013, according to a Morgan Stanley report.

In 2014, the company raised $627m from Japanese technology giant SoftBank to become a prominent Indian start-up with the backing of a number of foreign investors.

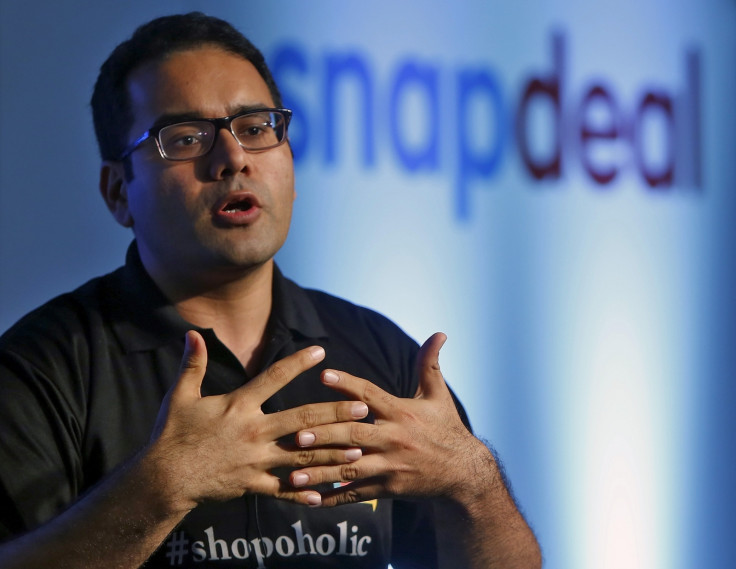

"Welcoming Alibaba and Foxconn to the @Snapdeal family. We never thought we'd come this far. Team super energised to create impact for India," CEO Kunal Bahal said in a tweet.

Welcoming Alibaba and Foxconn to the @Snapdeal family. We never thought we'd come this far. Team super energised to create impact for India.

— Kunal Bahl (@1kunalbahl) August 18, 2015© Copyright IBTimes 2025. All rights reserved.