Indian rupee defends 64/$ ahead of 2015-16 federal budget

Amid strong expectations of a reform-rich Modi Budget for 2015-16, India's rupee has been stuck in a range of 62.0-64.0 per US dollar.

On Monday (23 February) as the Budget session began, the rupee strengthened slightly to 62.11 from the previous close of 62.29.

The USD/INR had rallied to a 15-month high of 64.09 in December last year before making a January retreat to as low as 61.26, meaning a 4.6% rupee rally in the first month of this year.

So far in February, the pair has held a one rupee range of 61.56-62.56, with all eyes on the Budget, which will be presented by Finance Minister Arun Jaitley will present on 28 February.

Although it is a Saturday, a market holiday, Indian financial markets will remain open, the market regulator has announced.

Along with the share markets, the rupee is likely to react decisively to the announcements as the market has almost priced in a reformist Budget especially considering Prime Minister Narendra Modi's announcement of a "Make In India" policy in September.

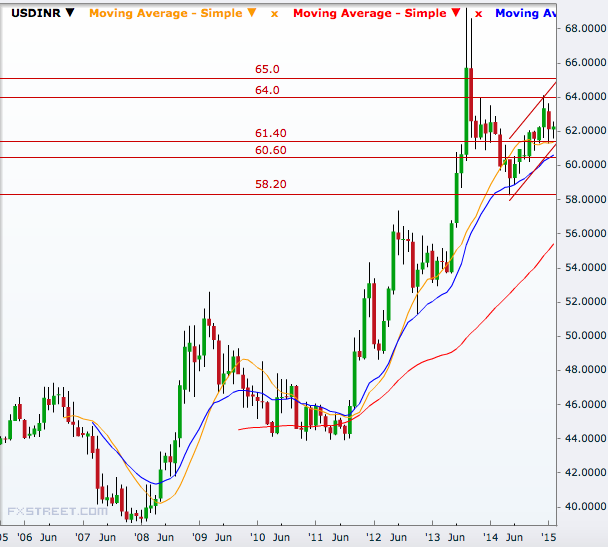

Rupee technicals

The USD/INR had risen to a more than one-month high of 62.56 on 12 February from a three-month low of 61.26 on 28 January but then eased to 62.0 levels ahead of the big event.

The pair has held a very narrow one-rupee range so far in February and the immediate resistance and support are just 50 paise away from the current level. Further south, the January low is to watch out for, and on the higher side, 63.0 will be in focus after this month's high.

The 14-day exponential and simple moving averages meet near 62.0 keeping the current level a good support for the pair while the fact that it is holding below the 50-day SMA makes the same a reasonable resistance benchmark for the time being.

On the monthly chart, the pair is still keeping the uptrend that dates back to May last year when it hit an 11-month low of 58.23.

The 14-period simple moving average shows a very near support of 61.37 while the exponential one shows support near 60.50. On the higher side, the first level to watch out for is the December peak of 64.09 and then 65.0 where it is likely to face channel resistance.

© Copyright IBTimes 2025. All rights reserved.