Interserve FY Earnings Preview: Chance of doubling EPS over five years

Interserve Preliminary Results

Interserve, the support services and construction company, is conscious of the continuing risks to global economic recovery and believes that it has the capability to double earnings per share over five years. The group is scheduled to release its preliminary results for the year ended December 31, 2011 on February 29, 2012.

Looking ahead, Interserve with its proven strategy, attractive mix of end-markets in outsourcing and infrastructure and its strong financial position anticipates that increasing pressure on the UK public sector spending will provide it with further outsourcing opportunities, helping to offset a reduction in construction activity. Internationally it is well-positioned both to grow its existing businesses and to expand the range of its offerings in some of the world's fastest-growing economies.

The group is conscious of the continuing risks to global economic recovery. It considers that its particular mix of markets and geography offers good prospects for sustained medium-term growth at attractive margins. It believes that its strategy of concentrating on long-term client relationships in its core sectors of expertise is a key strength, given the visibility of future workload it brings, and is particularly pleased by the extension of its successful partnership with the Defence Infrastructure Organisation during the period. It is also proving its ability to capture emerging new opportunities in outsourcing and infrastructure, as demonstrated by its joint venture with the Rehab Group winning two contracts on the Department for Work and Pensions' Work Programme.

In the UK Interserve foresees structural growth and the development of outsourcing over the coming years, particularly in the public sector where the benefits of outsourcing as a means of reducing costs and improving service delivery will be essential in enabling the UK government to meet its expenditure objectives. While the UK construction market will likely experience a softening in the near term, the medium-term drivers remain positive as an increasing and ageing population puts additional pressure on the country's infrastructure.

The support service company's international reach is a major strength and its strategy includes the export of its skills and capabilities to high-growth international markets. Around a third of the group's profits are currently derived from outside the UK, predominantly from its established markets in the Middle East and Australia. It is looking to build on this strong base and develop its international presence further, with Qatar and India in particular likely to form key drivers of its medium-term growth ambitions.

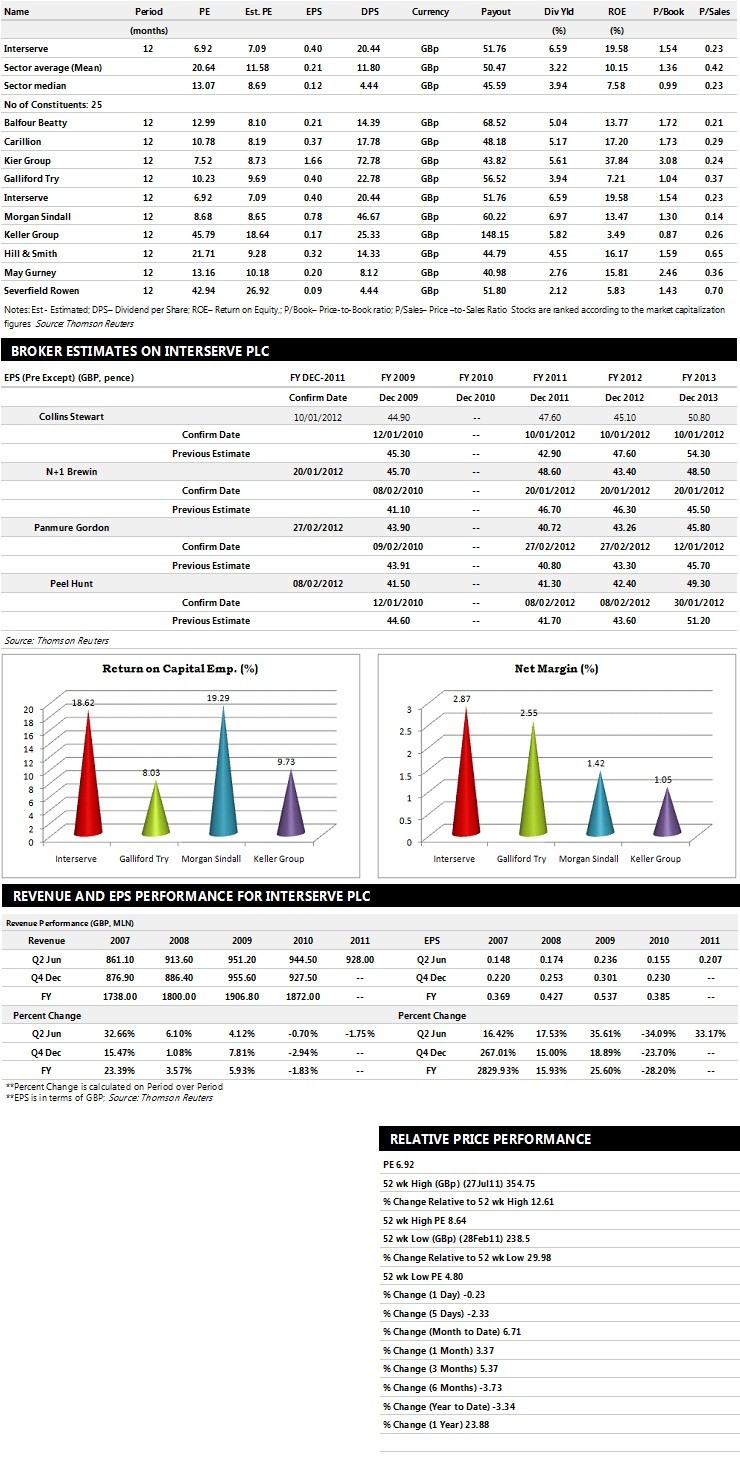

Brokers' Views:

- Panmure Gordon gives 'Sell' rating on the stock

- Peel Hunt recommends 'Sell' rating on the stock

- N+1 Brewin gives 'Out Perform' rating on the stock with a target price of 347 pence per share

- Collins Stewart recommends 'Buy' rating on the stock with a target price of 450 pence per share

- Canaccord Genuity recommends 'Buy' rating on the stock with a target price of 397 pence per share.

Earnings Outlook:

- Panmure Gordon estimates the company to report revenues of £1,840.00 million and £1,888.50 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £71 million and £76 million. Profit per share is projected at 40.72 pence for FY 2011 and 43.26 pence for FY 2012.

- Peel Hunt estimates the company to post revenues of £1,775.30 million and £1,728.10 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £69.50 million and £72.00 million. EPS is estimated at 41.30 pence for FY 2011 and 42.40 pence for FY 2012.

- N+1 Brewin expects the company to earn revenues of £1,855 million for the FY 2011 and £1,860 million for the FY 2012 respectively with pre-tax profits of £71.50 million for both the periods. Profit earnings per share is projected at 48.60 pence for the FY 2011 and 43.40 pence for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.