J D Wetherspoon Moderate on 2012 Outlook, Expects Continuing Cost Pressures

J D Wetherspoon, the developer and manager of public houses, which is scheduled to release its 2012 interim results on Friday, has moderate views for 2012 outlook, due to cost pressures resulting from government legislation, including further increases in excise duty, business rates and carbon tax.

The group has opened 18 new pubs and closed two since the start of the financial year and has a number of sites under development; it intends to open approximately 50 pubs in the current financial year.

Wetherspoon's sales, profit and cash flow remains strong. The main challenges for the group will be the continuing cost pressures and as previously stated, pubs pay Vat on food, whereas supermarkets do not, and also pay far higher rates of Vat in Britain than similar businesses in Ireland and France. In spite of these issues, Wetherspoon is aiming for a reasonable outcome in the current financial year.

Like-for-like sales of Wetherspoon in 2011 increased by 2.1%, with total sales, including new pubs, increasing by £75.7 million to £1,072.0 million, a rise of 7.6%. Profit before tax and exceptional items decreased by 5.9% to £66.8 million with earnings per share before exceptional items declined by 1.9% to 35.3p for the same period.

While commenting on the Wetherspoon's pre-close trading, Shore Capital said: "We continue to like JDW's cash flow characteristics and the valuation based on a cash PER of 7.5x appears attractive. However we are increasingly concerned by the declining margins at Wetherspoon. We therefore downgrade our stance from "buy" to "hold."

According to Investec, the group's cash flows are good, with a well invested estate and meaningful rollout plans. This provides the group resilience and growth despite an uncertain macro environment. While Citigroup analyst, James Ainley said he expected the rate of expansion to slow thereafter, forecasting 30 new openings in 2013 and none in 2014. "The market may take such news favourably if it increases the potential for cash returns," he added.

The well-documented increases in areas such as utilities and bar and food supplies, combined with ongoing pressure on consumers' income continue to make a tough trading environment. However, given Wetherspoon's strong sales and profit positions, together with the prospects to open new pubs, the board is aiming for a reasonable outcome in the current financial year.

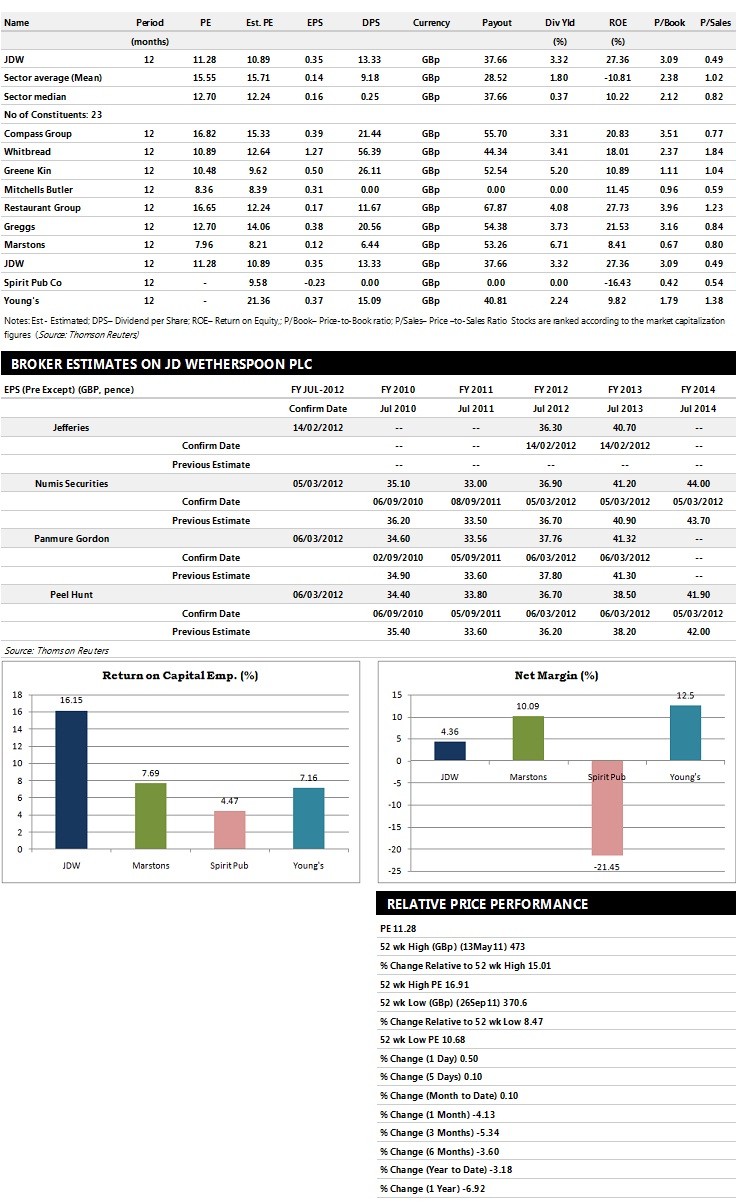

Brokers' Views:

- Peel Hunt recommends 'Buy' rating on the stock with a target price of 490 pence per share

- Panmure Gordon assigns 'Hold' rating with a target price of 424 pence per share

- Numis Securities gives 'Hold' rating

- Charles Stanley recommends 'Hold' rating

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £1,177.30 million and £1,221.90 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £68.10 million and £70.80 million. Earnings per share are projected at 36.70 pence for FY 2012 and 38.50 pence for FY 2013.

- Panmure Gordon projects the company to record revenues of £1,191 million and £1,263 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £70.70 million and £76.30 million. Profit per share is estimated at 37.76 pence and 41.32 pence for the same periods.

- Numis Securities expects JD Wetherspoon to earn revenues of £1,165 million for the FY 2012 and £1,251 million for the FY 2013 respectively with pre-tax profits of £67.70 million and £74.60 million. EPS is projected at 36.90 pence for FY 2012 and 41.20 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.