Budget 2017: National Insurance hike U-turn? Number 10 fails to rule out review of Hammond's tax change

Pressure mounts on chancellor after breaking Tory manifesto pledge with 2017 Budget.

Number 10 has reportedly refused to rule out a review of Philip Hammond's controversial National Insurance Contributions (NICs) rise for more than 2.4 million self-employed workers in the UK, it emerged on Thursday (9 March).

The development comes just a day after the chancellor unveiled his 2017 spring Budget to the House of Commons.

Hammond faced a backlash from business groups and some Tory MPs for planning to scrap class two NICs for self-employed workers from April 2018 and increase the main rate (class four) of NICs by 9% to 10%, with an additional 1% hike in April 2019.

A Downing Street spokesperson told reporters: "The prime minister and the chancellor have agreed on this Budget". But Number 10, in a move that will spark speculation of an embarrassing climbdown, refused to say four times whether the NICs hike would be reviewed.

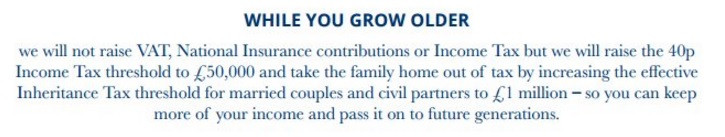

The tax rise has proved controversial because the Conservatives promised in their 2015 general election manifesto not to increase VAT, income tax or NICs.

Hammond, who is in Dudley unveiling £392m package for the Midlands, was forced to defend the move on Thursday morning.

"It's only right and fair we should take a small step to closing the gap between the treatment of employed and self-employed people," he told Sky News.

"No conservative likes to increase taxes, National Insurance, anything else. But our job is to do what needs to be done to get Britain match-fit for its future."

Mike Cherry, the national chairman of the Federation of Small Businesses (FSB), said: "This measure is a tax grab on middle income self-employed people, who are just about managing. Class four NICs will apply from about £8,000 to £45,000 in profits.

"Millions of self-employed will now face this tax hike, including plumbers, hairdressers, designers, musicians and many others in all our local communities.

"There are many areas where the self-employed don't receive the same provision as employees to government funded benefits. Self-employed people also face higher barriers to entry, for example, in relation to access to income protection or mortgages."

© Copyright IBTimes 2025. All rights reserved.