Nokia Share Price Dives As Company Lowers Q1 2012 Expectations

Nokia shares have dropped over 14 percent to just $4.30 following the company announcing its results for the first three months of 2012 will be lower than expected, despite the company being pleased with the sales of its Lumia smartphones.

During the first quarter 2012, multiple factors negatively affected Nokia's Devices & Services business, according to its stock exchange release today, to a greater extent than previously expected and the company now expects the operating margin to be approximately "negative three percent" where it previously expected a break-even quarter.

The factors which have affected the results for the Finnish manufacturer, included so-called "competitive market dynamics" which negatively affected net sales for both the general mobile phone division and the smart devices business unit, particularly in India, the Middle East and Africa and China.

And things are not going to get better for the under-pressure manufacturer any time soon, with the company predicting its second quarter results will be "similar to or below the first quarter 2012 level."

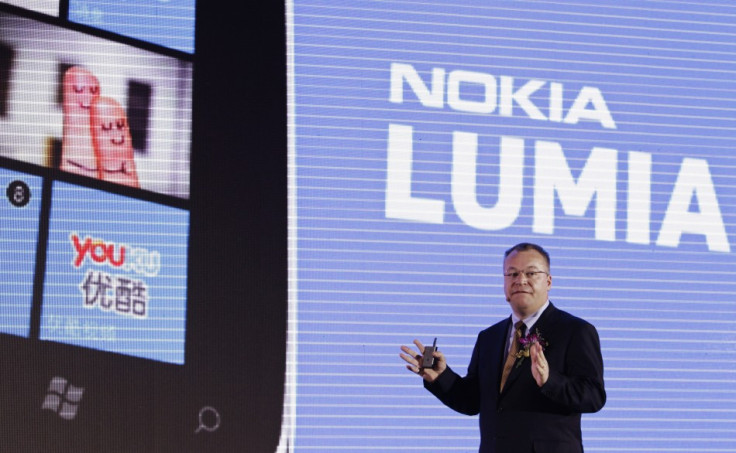

CEO Stephen Elop said: "Our disappointing Devices & Services first quarter 2012 financial results and outlook for the second quarter 2012 illustrates that our Devices & Services business continues to be in the midst of transition.

"Within our Smart Devices business unit, we have established early momentum with Lumia, and we are increasing our investments in Lumia to achieve market success. Our operator and distributor partners are providing solid support for Windows Phone as a third ecosystem, as evidenced most recently by the launch of the Lumia 900 by AT&T in the United States."

According to the release, Nokia sold 12 million smartphones in the first three months of 2012, two million of which were Lumia smartphones, including the Nokia Lumia 710, Nokia Lumia 800 and the recently released Nokia Lumia 900. The average selling price of the Lumia smartphones was €220 (£181).

Nokia predicts that net sales in the first quarter were €4.2bn, with feature phones still making up the majority of this figure, coming in at €2.3bn or 71m mobile phones. Nokia estimates its gross cash and other liquid assets were approximately €9.8bn at the end of Q1, 2012.

During a conference call relating to the new figures, Elop claimed that the Lumia brand was "gaining traction with consumers" and the brand was on sale in 42 markets around the world. Elop even said he had been very pleased with the initial response to the Lumia 900 which went on sale last weekend, despite lukewarm reviews and a software problem affecting data connection. Then Lumia 900 is set to launch in the UK on 27 April.

Among the challenges facing Nokia and which have been blamed for the poor results, are the lower and lower cost of Android phones coming on the market, as well as Nokia not having products at certain price points and therefore being unable to compete. Elop also mentioned white-label Chinese manufacturers which are pushing low-cost products onto the market.

The full results will be published next week, on 19 April, when we should learn more.

© Copyright IBTimes 2025. All rights reserved.