Oil prices might be struggling but Shell and BP could benefit from the industry's renaissance

The collapse in oil prices worldwide over the past few months from $60 (£41, €54) a barrel to as low as $28 a barrel has proved to be very painful for oil-producing nations such as Russia and Saudi Arabia, while in contrast a huge benefit to Western consumers.

After all, petrol prices are effectively a tax on the West, with the wealth being transferred to the oil-producing countries in OPEC, plus Russia and Norway.

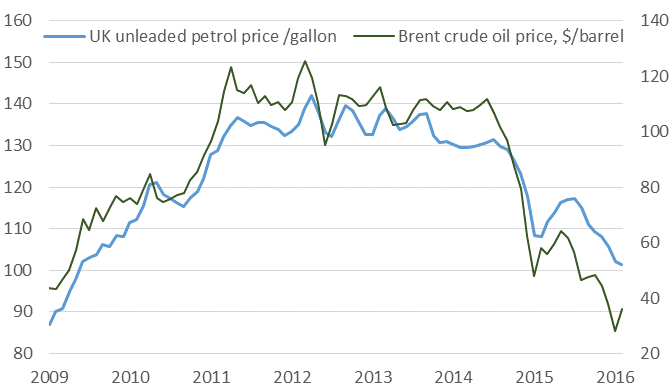

Since the middle of 2014, British drivers have benefited from a 30p a litre drop in petrol prices from 130p to 101p today, on the threshold of dropping under £1 a litre for the first time since 2009 (Chart 1).

This has been for the strong growth in consumption on both sides of the Atlantic over 2015, as the savings from lower petrol prices have been spent elsewhere.

Too much oil, not enough demand?

Why have oil prices dropped so precipitously since the middle of 2014? The clear answer is a mismatch of supply and demand of crude oil. While global demand for oil grows relatively steadily over time, the level of oil supply varies much more.

In recent years, there has been a massive increase in supply coming from drilling of oil shale formations in the US, leading to the growth in supply of crude oil outstripping demand. And in comes the first law of economics – which dictates that price is determined by supply and demand: so more supply than demand drives prices lower. And that is exactly what has happened (Chart 2).

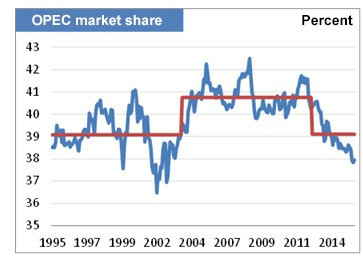

In the past, this would have been corrected by OPEC (the Organization for Petroleum-Exporting Countries). But given that it controls less and less of the world's oil production (around 38%; Chart 3), it cannot so easily exert the power over the oil price that it has demonstrated in the past.

Oil price on the turn?

In recent days, however, Russia has signalled it is ready to meet OPEC to discuss a combined production cut in order to boost the oil price.

Remember, the oversupply of crude oil relative to demand worldwide is only of the order of one to two million barrels – about 2% of current world oil production – so it would not take that big a coordinated production cut in order to bring oil supply more in balance with demand.

On the back of this news, crude oil prices have already rallied from below $30 a barrel to $36 a barrel for Brent crude. If a coordinated production cut is agreed, oil prices could move quite a bit higher still.

After all, Brent crude was as high as $60 a barrel earlier in 2015, so there is still potentially a long way to go. The US Energy Information Administration has an average 2016 Brent crude oil forecast of over $40 a barrel, suggesting further upside over the year from current levels.

On top of this, US oil production is estimated to have dropped by 600,000 barrels per day already over 2015, and could fall by another 900,000 barrels over 2016 as US oil wells start to see falling rates of production, partly due to the lack of new investment.

This natural decline in oil production could also help to bring oil supply and demand back closer to balancing, and thus support oil prices this year.

Top oil picks for 2016

For an investor who wants to invest in oil stocks to benefit from any lasting rebound in oil prices, there are two ways to go. The first is to invest in a broad diversified fund that takes exposure to a range of European oil companies. For this, I would suggest buying the following exchange-traded fund (ETF): Amundi ETF MSCI Europe Energy UCITS ETF (code: ANRJ).

This is an ETF that gives the investor cheap exposure (0.25% annual management charge) to all the large oil and gas companies in Europe, including Total, Royal Dutch Shell, BP and ENI. The current price of a share in this ETF was 169p as of 29 January.

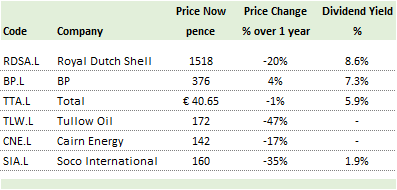

The second way is to invest in individual oil companies listed in London – I have listed six (Chart 4).

Of these six companies, I would prefer to invest in high-yielding integrated oil companies such as Royal Dutch Shell and Total.

Bottom line: While oil companies have taken a beating over the past year, now may be an opportune time for long-term investors to look at this sector again.

Edmund Shing is Global Head of Equity Derivative Strategy at BNP Paribas in London. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.