The power of healthcare tech and why Fitbit, Shire and GlaxoSmithKline are ones to watch

We seem to spend our lives wedded to our mobile phones these days. In fact, if you are 35 years old or younger, your phone is fast becoming your primary means of accessing the internet, more than via a desktop PC, laptop or tablet.

In fact, let's face a simple truism: without being unkind, the smartphone is fast becoming something of a permanent attachment to most youngsters and is always in use, like an extra limb.

The smartphone's capabilities when it comes to keeping in touch with our friends on social media, buying things online, ordering Uber cars or finding the nearest Chinese restaurant are clear. But these devices also provide a whole host of other life-changing technologies at our fingertips.

One such increasingly important area is the field of healthcare.

The era of Fitbit

Look around today's workplace, and you will likely find a number of your colleagues wearing a rubbery watch-like wristband in a bright, cheerful colour.

This piece of nifty kit is more likely than not a Fitbit – an activity tracker that tells you how much physical activity (such as steps taken when walking) you've done in a day. The central idea of the device is to encourage you to stay fit by engaging in the minimum amount of physical exercise that's required for the average person.

This is something that more of us are adopting in an effort to live a healthier lifestyle. In some cases, it can lead to behaviour that borders on obsessional ("have I achieved my daily 5,000-step goal yet?")

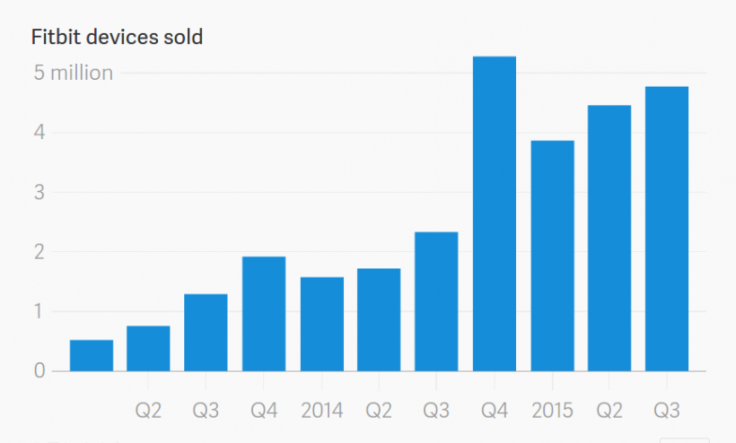

The rising popularity of the Fitbit can be measured easily by the surge in downloads of the free Fitbit app for iPhones on the iTunes store. The free Fitbit iOS app topped Apple's app chart on Christmas Day, according to QZ. The sudden explosion in downloads of the app suggests that many people were activating the fitness tracker on Christmas Day last year, and, in fact, it was also one of the most downloaded health and fitness apps that month, according to App Annie. So it certainly seems that we are embracing activity tracking as part of our overall goal for better health.

But it's early days for constant healthcare monitoring and there is still a lot more that this type of technology can help us achieve, especially in the area of preventative medicine. And it's important to note that a proactive approach to our wellbeing is not only important to our health, it's also less costly on the national healthcare system and the private insurance sector.

In the end, it is very likely that eventually, those with private healthcare will be incentivised financially to wear healthcare monitors, so as to give early warnings of life-threatening conditions such as impending heart attacks.

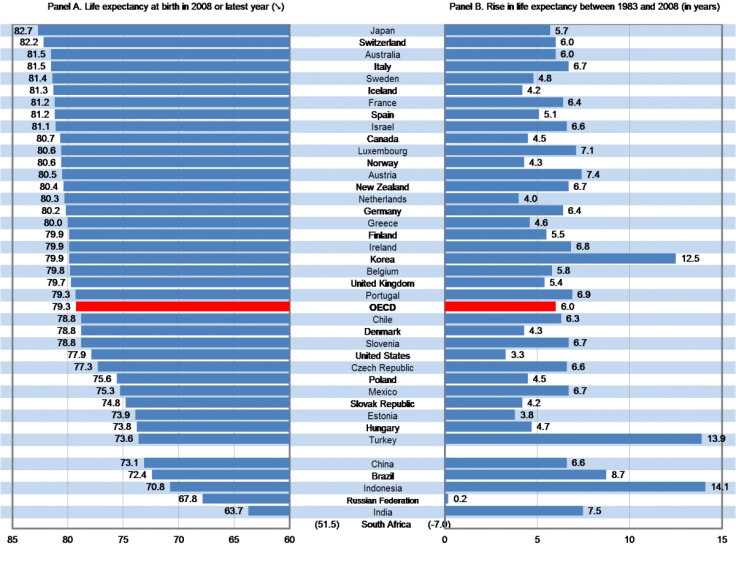

The average British adult is living longer these days thanks to better healthcare provision (despite what you may think about the shortcomings of the NHS), to nearly 80 years old on average (as seen in chart 2). However, the UK is still lagging behind most other advanced economies in terms of average lifespan, and is still some way behind Italy, France and Germany, so there is room for improvement.

Technology is not just about silicon chips: it is about better drugs too

But we should not take such a narrow view of technology – it is not all about silicon chips. Technological development is also advancing apace in the pharmaceutical arena with the development of better prescription drugs which better treat disease and chronic health conditions such as asthma and diabetes.

This is actually one of my favourite areas for investing in the stock market. Why? Well, simply because over the long term, drug companies like GlaxoSmithKline and AstraZeneca have proved to be such good long-term investments. Since 2011, the European healthcare sector (including these drug companies; blue line in Chart 3) has beaten the overall European stock market by 70% in total (orange line in Chart 3).

So we are all living longer, but becoming increasingly prone to lifestyle diseases such as asthma (due to pollution), diabetes (due to obesity) and heart disease (diet, drinking and smoking). We are bound to continue to spend more on healthcare as a result, especially in tech such as the Fitbit.

What to do today:

Buying healthcare exposure in the UK stock market can be easily achieved via an investment trust such as the Worldwide Healthcare Trust (WWH), a fund run by Frostrow Capital and Orbimed Healthcare Fund Management, which is listed on the London Stock Exchange.

This fund holds a number of healthcare companies in the US, and Europe, including such heavyweights as Bristol-Myers Squibb, Amgen and Novartis.

Performance of this fund has been impressive over the long-term +130% over the past five years (see the blue line on Chart 4), compared with a FTSE 100 index (orange line) that has actually fallen over the same period.

What is even better, at a discount to the underlying asset value of 7%, you can effectively use this fund to buy £1 of healthcare company shares for 93p today – a veritable bargain.

For those who like to invest in specific healthcare companies, I would suggest that you look at Shire Pharmaceuticals (SHP), a UK-listed company that was not so long ago the target of the US pharmaceutical giant Pfizer at over £50 per share.

Today, Shire's shares sit at about £36, so close to 30% lower than Pfizer's bid price; but Shire remains a relatively fast-growing drug company that has recently completed the takeover of rival Baxalta, which should boost sales and profit growth going forward.

Edmund Shing is Global Head of Equity Derivative Strategy at BNP Paribas in London. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.