Raise Your Glass to Profit with Wine and Whiskey Investments

Explore the world of wine and whiskey investments and discover how to raise your glass to profitable opportunities.

Wine and whiskey – two unconventional and age-worthy assets – offer a unique opportunity to add to an investment portfolio aside from the more popular stocks and bonds.

These aged libations, cherished for their cultural significance, are fast gaining traction as alternative investment options.

This article introduces how you can take advantage of such alternative investments, realise their potential for delivering attractive returns and consider platforms such as Vinovest to get you to start investing.

Why invest in wine and whiskey

Wine and whiskey investments possess a distinctive allure, merging rarity and artisanal craftsmanship with the potential for return on investment.

What drives collectors, enthusiasts and investors to pay through their noses for these prized bottles include factors such as:

Limited availability

Fine wines and aged whiskeys are often produced in limited quantities and require years, if not decades, of careful and graceful ageing to achieve the right taste and aroma. Collectors and connoisseurs bid on rare bottles, often at staggering prices.

For instance, Burgundy-based DRC only made 600 bottles of France Romanée-Conti in 1945. Because of its rarity, it fetched $558,000 at an auction in 2018.

Appreciates in value

Most wine and whiskey have a track record of steady appreciation. Rare and well-maintained bottles tend to increase in value over time, often outperforming more mainstream investments.

In 2023, the Knight Frank Luxury Investment Index (KFLII) reported that Burgundy prices had jumped by 367 per cent by the early autumn of 2022. Rare whiskey, on the other hand, has increased its value by 322 per cent over a ten-year period.

Tangible asset

A bottle of aged wine or whiskey allows investors to own a physical asset, unlike stocks and bonds. Tangibility also brings a sense of connection to the rich history of every bottle.

Investment diversification

Any investment portfolio benefits from diversified assets. In times of economic crisis, the value of wine and whiskey investments may remain stable or even appreciated because they don't move along with stocks and bonds.

According to Vinovest, the Liv-ex Fine Wine 1000 index, which monitors 1,000 wines across the world, was less affected by the Great Recession in 2008 unlike the S&P 500.

Global demand

Wine and whiskey continue to appeal to collectors and enthusiasts from across the world. Enthusiasts and travellers explore wine regions, vineyards and wineries through wine tourism tours.

Visitors immerse themselves in the rich culture and history of winemaking, partake in tastings of local wines and often enjoy tours that showcase the wine production process, from grape to bottle.

Can anyone invest in wine and whiskey?

Wine and whiskey investing is often perceived as exclusively for the wealthy because the most sought-after bottles come with intoxicating price tags.

In addition, potential investors need to invest in storage facilities to maintain the quality and value of the product, as well as authenticity verification and due diligence processes, which can be costly and time-consuming.

But technology is changing all these.

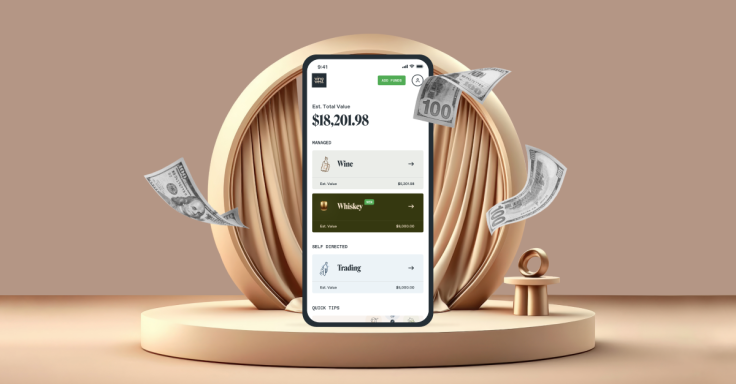

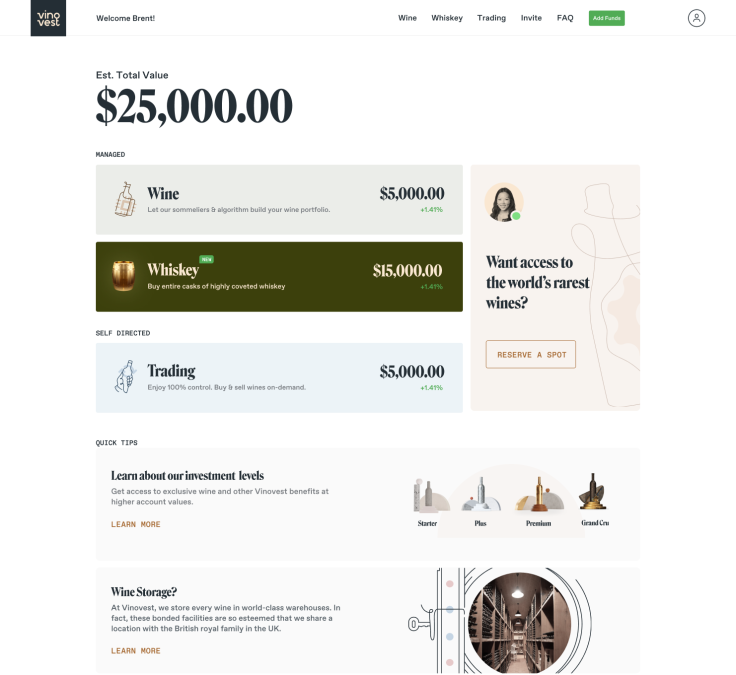

Investment platform Vinovest is dedicated to facilitating every potential investor's journey into the world of wine and whiskey investing.

How Vinovest Works

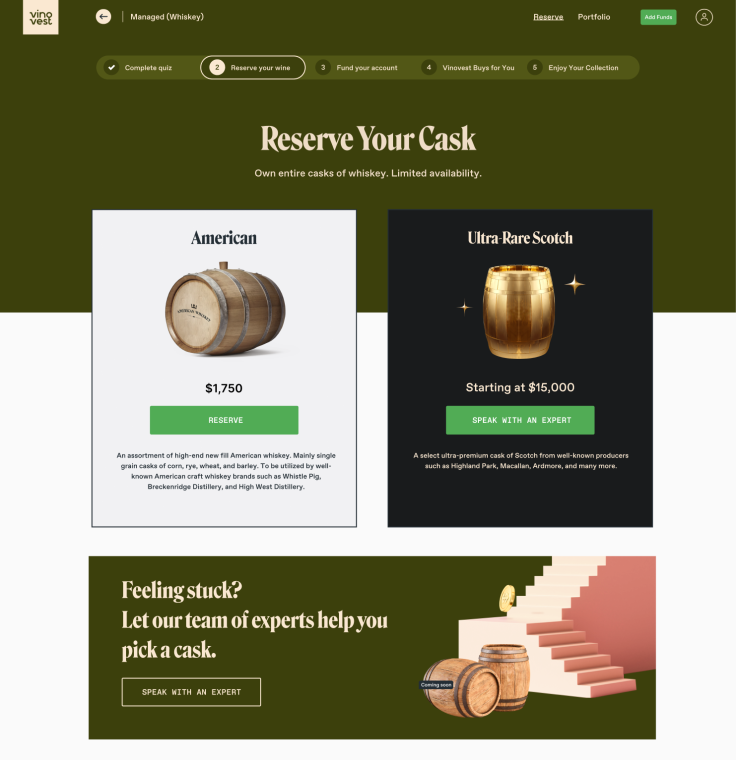

For too long, fine wine investment has been the exclusive domain of the ultra-wealthy. But by leveraging technology to provide access, liquidity and transparency to many investors, Vinovest became known for democratising investing in the wine industry in 2019.

The platform combines the expertise of wine connoisseurs and tech professionals, allowing everyday investors to own some of the finest wines from regions as far as Burgundy and Bordeaux.

What Does Vinovest Offer?

More stable returns

Wine and whiskey investors take advantage of these assets' market performance, making them mostly immune to the wild swings of the stock market. While others may see their portfolios falter during downturns, enthusiasts can continue to enjoy stable returns.

Full ownership

When you invest in stocks and bonds, you own them on paper. But with Vinovest, you possess your wine and whiskey, with the added convenience of doorstep delivery should you decide to savour your investment in style.

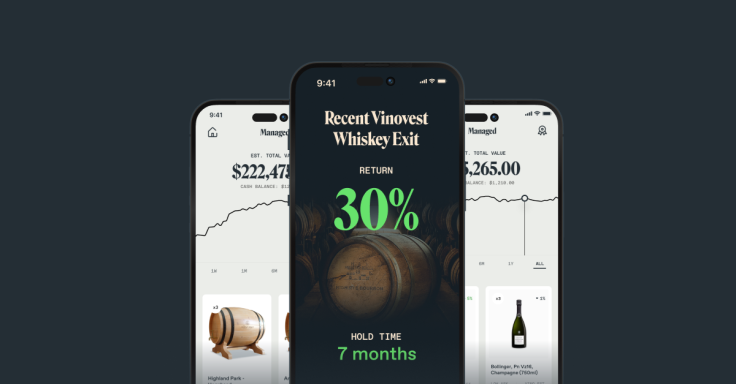

Proven performance

Fine wine has delivered impressive annualised returns of 10.6 per cent for over two decades, consistently outpacing global equities. Not to be outdone, whiskey earned the title of "the best-performing collectable of the decade" by Knight Frank, further validating its investment potential.

Secure storage

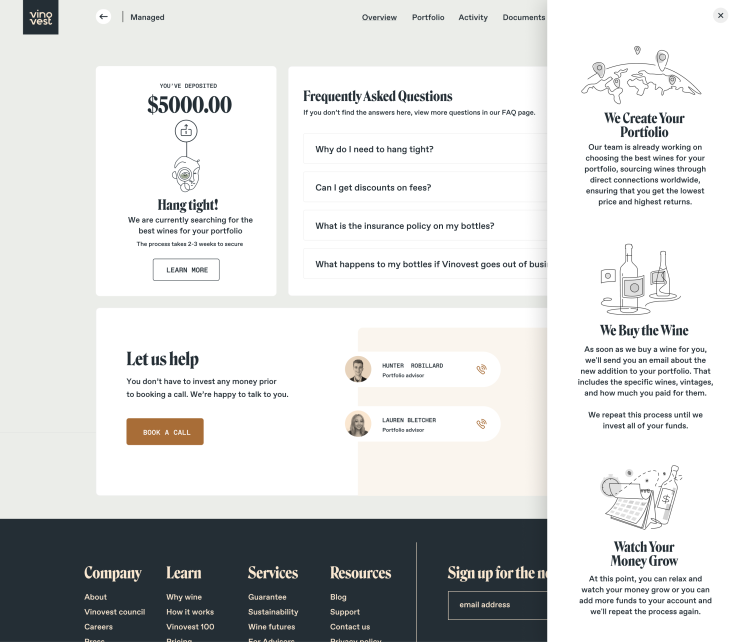

Vinovest takes care of the heavy lifting for each client whether a newbie or a seasoned investor. Its range of services includes secure storage, insurance and authentication in its bonded warehouses.

Curated portfolios

Vinovest understands every investor's has unique goals. Clients receive tailored wine and whiskey selections to match their specific needs, ensuring that every portfolio aligns perfectly with investment goals.

Now that more investors are raising their glasses to the opportunities that assets offer, wine and whiskey can be a valuable addition to your portfolio, providing both financial returns and the satisfaction of owning something valuable.

So, whether you're a seasoned investor or a passionate enthusiast, consider exploring the world of wine and whiskey investments – you just might discover a taste for profit through Vinovest. Cheers to that!

© Copyright IBTimes 2025. All rights reserved.