Serco in Top UK Brokers' 'Buy' List; FY Earnings Expectations In Line

Serco Preliminary Earnings

Serco, a FTSE 100 international service company, has been added to the "Buy" list by all top UK brokers as it is expected to deliver the full-year results in line with expectations on Tuesday, February 28, 2012.

According to the company's report, the group expects good organic revenue growth and further progress in operating margins assuming the blow of continuing economic challenges is manageable; guidance remains that by the end of 2012, it expects increases in revenues to approximately £5.00 billion and in adjusted operating profit margins to approximately 6.3 percent (excluding material acquisitions, disposals and currency effects). Strong longer-term growth opportunities remain across the group.

Last month, the company signed an agreement with the UK Ministry of Defence (MOD) to provide training and support to the British Army prior to deployment on operations around the world, which will start in April 2012. The contract has a total value to Serco of approximately £55m through to December 2014. The Group has also been awarded a new prime contract by the UK Ministry of Defence to further deploy innovative radar technology to prevent wind farms interfering with the UK's air defence radars.

Serco has previously been awarded a contract to support the introduction of new radar technology at RRH Trimingham, Norfolk. The new contract is valued at £27m over two years and the total combined contract value to Serco is approximately £45m over a three-year period.

In the first half of the year, the company acquired Intelenet, a leading provider of Business Process Outsourcing (BPO) services to the private sector around the world and in the domestic Indian market, for up to £386m. The deal completed after the half-year balance sheet date, with £285.7m of cash consideration and £50.8m of acquired net debt being accounted from July 2011. There remain contingent deferred consideration cash payments of up to £49.8m through to December 2013.

It has also made two other small acquisitions during the second half of the year to date for a total consideration of £20m and a combined total annual revenue of £35m. The Group acquired Excelior Pty Ltd in Australia and Philips Collection Services Ltd in the UK. In August, the group signed a new 10-year hospital services contract in Australia for A$1.3bn.

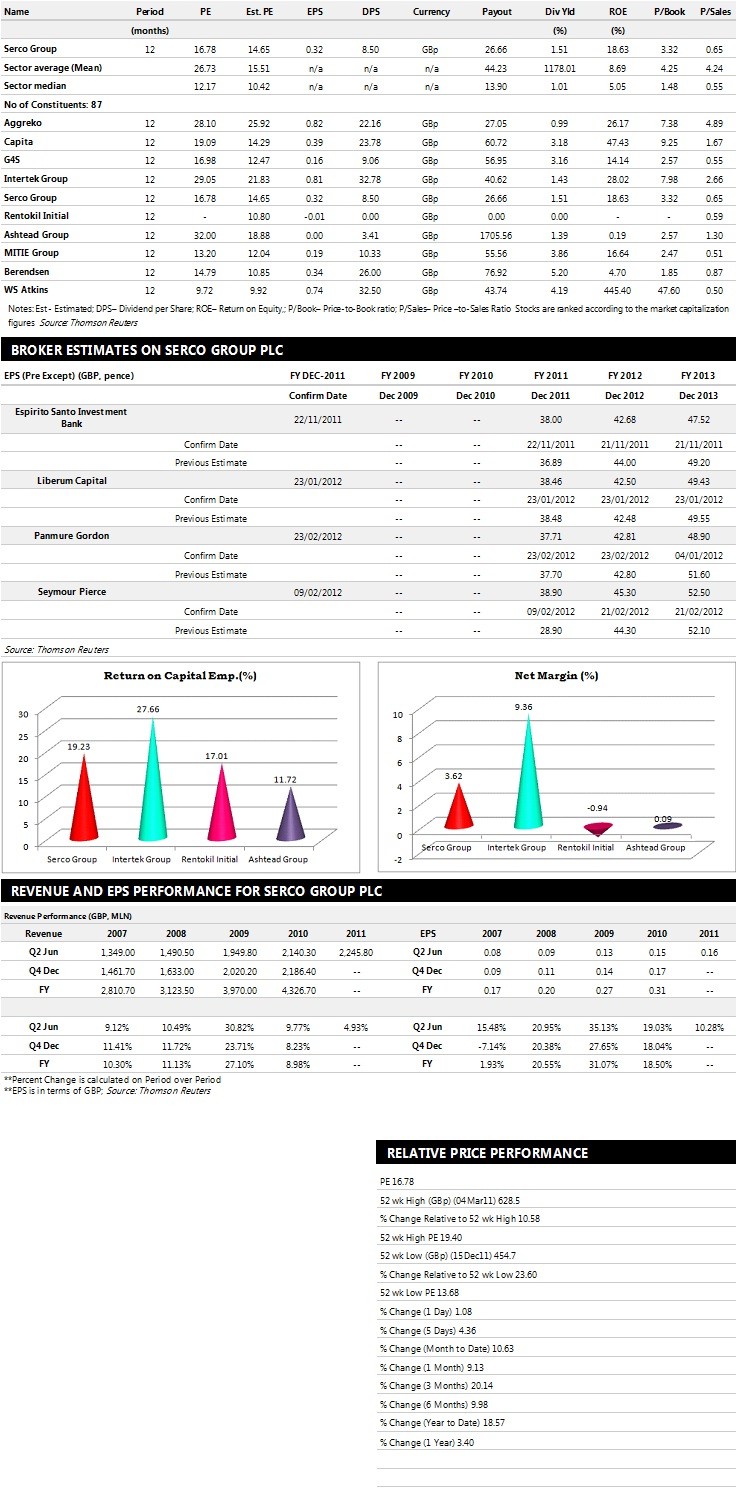

Brokers' Views:

- Panmure Gordon gives "Buy" rating on the stock with a target price of 600 pence per share

- Seymour Pierce assigns "Buy" rating on the stock with a target price of 700 pence per share

- Liberum Capital recommends "Buy" rating on the stock with a target price of 600 pence per share

- Espirito Santo Investment recommends "Buy" rating on the stock with a target price of 560 pence per share.

Earnings Outlook:

- Panmure Gordon estimates the company to report revenues of £4,603.80 million and £4,993.30 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £255.80 million and £290.40 million. Profit per share is projected at 37.71 pence for FY 2011 and 42.81 pence for FY 2012.

- Seymour Pierce estimates the company to post revenues of £4,526.80 million and £5,092.70 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £258.80 million and £301.80 million. Earnings per share are estimated at 38.90 pence for FY 2011 and 45.30 pence for FY 2012.

- Liberum Capital expects the company to earn revenues of £4,615.46 million and £4,979.82 million for the FY 2011 and FY 2012 respectively, with pre-tax profits of £261.30 million and £291.12 million. EPS is estimated at 38.45 pence and 42.49 pence for the same periods. Expected DPS for the periods are 8.29 pence and 9.15 pence per share.

© Copyright IBTimes 2024. All rights reserved.