Million Dollar Bonuses: RBS Stephen Hester and Global Income Inequalities

How much money did each of us make in 2011? The chances are, no matter how much each of thought we made, it would have been peanuts compared to the big bucks that Chief Executive Officers (CEOs), Presidents of the Board and Company Directors would have pocketed!

In pure hard numbers, the U.S. Bureau of Labor Statistics, in a May 2009 report, indicated that CEOs from nearly 300 companies in the S&P500 received an average of $11.4 million in 2010. To make the point about disparities in pay clearer, consider this - In 1980, CEO pay in the U.S. was 42 times that of a blue-collar worker; by 2010, it was 343 times (source: IBusiness Week and AFL-CIO). That translates to an eight-fold increase in 30 years.

As it turns out, however, $11.4 million is only the tip of the iceberg.

Stephen Hester's (the CEO of the Royal Bank of Scotland) decision to renounce a £963,000 shares-only bonus... reports that Philippe Dauman (the CEO of Viacom Inc.) would be paid $43 million (down from $84.5 million in 2010)... and a Los Angeles Times report that suggested Apple Inc.'s CEO, Tim Cook, could be paid a staggering $378 million for 2011, have re-focused attention on the fact that there are a number of incredibly large pay packages being offered for executives who are, as the UK's Shadow Business Secretary said in a BBC report, doing "things you expect" to be done... run a company successfully.

Consider the following table, sourced from Forbes, which lists the highest paid CEOs in the U.S. for 2011 and then consider this report from The Telegraph, which lists the six highest paid CEOs of the UK, for 2010 - the lowest figure is roughly £13 million (approx. $20 million).

Then consider the fact that median annual wages in the U.S. fell (for 2010), according to a Reuters blog post, to $26, 364 (the lowest since 1999) and a BBC report stated that average wages in the UK (for 2011), were £25,900 (a miniscule threefold increase since 1980).

The numbers speak for themselves.

At the other end of the spectrum are people categorized as poor - the poverty stricken.

In the U.S., for example, according to a report by the United States Census Bureau, the poverty rate increased from 14.3 percent in the 2009 American Community Survey briefs (ACS) to 15.3 percent in the 2010 ACS. The number of people in poverty increased from 42.9 million to 46.2 million during the same time period.

In terms of money, guidelines issued by the U.S. Health and Human Services in 2011 say a four-member family is declared to be in poverty if they earn less than $22,350 per year (which, incidentally, is only marginally lower than the median annual wage from a year ago).

The UK doesn't fare that much better.

In its 13<sup>th annual report, "Monitoring Poverty and Social Exclusion 2010", the New Policy Institute states that for the year 2008-09 approximately 13 million people were living "below contemporary income thresholds. The number may be three years old but consider that the report also says "the the number of people deepest in poverty, with a household income below 40% of the median (£80 a week for a single adult), rose again, to 5.8m".

The point here is not to castigate any one section of society.

Indeed, one section of a discussion such as this will inevitably suggest that such gigantic incomes, even if only for a small portion of a society, will have a trickle-down effect on salaries, employment figures and general productivity margins for those less fortunate. The argument, therefore, will be that the fact Tim Cook may well be paid a few hundred million dollars, since his company (well... all right, Steve Jobs' company) has generated so much more, in terms of revenue, sales, jobs. Moreover, it could also be said that a certain divide, as cruel as it sounds, must be in effect for maximum economic efficiency.

However, as logical as the above argument seems (and by extension capable of supporting the idea of multi-million dollar/pound rewards for CEOs), a study by the International Monetary Fund (IMF), placed against the backdrop of the Occupy Wall Street (OWS) movement , may provide a different perspective.

In the Sept. issue of "Finance & Development", Andrew G. Berg and Jonathan D. Ostry posit the basic argument from Arthu Okun's "Equality and Efficiency: The Big Tradeoff" (1975) - that "any attempt at pursuing equality can reduce efficiency (the total output produced with given resources)". Their (Berg and Ostry) own work reveals the opposite.

It suggests, in fact, "equality appears to be an important ingredient in promoting and sustaining growth... taking a historical perspective, the increase in U.S. income inequality in recent decades is strikingly similar to the increase that occurred in the 1920s. In both cases there was a boom in the financial sector, poor people borrowed a lot, and a huge financial crisis ensued..." A report inThe Washington Post suggests a similar scenario.

Why is income inequality considered a stumbling block to sustained (and that is the important word) economic growth?

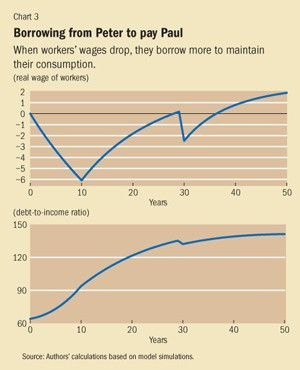

An earlier report published in "Finance & Development" (in December, 2010, by Michael Kumhof and Romain Rancière) suggests "long periods of unequal incomes spur borrowing from the rich, increasing the risk of major economic crises". Essentially, when workers' wages drop (or fail to increase sufficiently rapidly to maintain pace with the pressures of everyday life - read, inflation), they are forced to borrow to maintain minimum consumption standards.

This leads them into a trap - of continuing indebtedness - something farmers in India for example, know all too well, as these reports from The Business Line, The Financial Express and CNN will attest.

The point isn't to lavish money on the poor. It cannot help situations if we were to suddenly gift bagfuls of money to all the poor people in the world... economics being the game it is, very simply, the extra money will fuel another price rise and the divide between the rich and the poor will re-establish itself at a higher plane.

At the risk of sounding Marxist, the answer must lie in a system of distribution of wealth that identifies different aspects and end results of production equally. Essentially, Sony should not be rewarded more for producing and selling the PlayStation 3 (PS3) than farmers in India are for the rice that feeds the engineers who build the PS3.

© Copyright IBTimes 2025. All rights reserved.