Sterling holds near 17-month low ahead of BoE minutes, ECB policy eyed

Sterling showed some strength during early trades of Wednesday helped by the overall dollar weakness, but with the BoE minutes due on the hour, the UK currency stood not far away from the 17-month low it touched earlier this month.

At 8:00 GMT, GBP/USD was at 1.5160, off day's high of 1.5180 but higher than the previous close of 1.5154. The pair had traded at a low of 1.5034 on 8 January, its lowest since July 2013.

The dollar was down on Wednesday as the Bank of Japan announced some measures to boost bank lending after leaving main rates and asset purchase pace unchanged as expected. The yen rallied on the BoJ policy.

The Bank of England had left the benchmark interest rate, the Bank Rate, steady at 0.5% and kept the asset purchase target at £375b at the 7-8 January meeting.

Voting pattern and various remarks of the policy makers will be crucial for the markets especially given the vote split over the decisions for the last five months.

Starting the August meeting, two of the nine-member BoE Monetary Policy Committee (MPC), Ian McCafferty and Martin Weale, have been voting for a hike in the Bank Rate even as the rest continued to support keeping the rates and the asset purchase target unchanged.

Considering the disinflation trend in the UK, deflation risks in Eurozone, sharp slide in crude prices and weak outlook for global growth, rate setters are likely to have moved more to the dovish side, which could reflect in the remarks and even in the voting pattern.

Such a dovish surprise is all likely to push sterling further lower even as the market is waiting for the European Central Bank's first monetary policy of the new year scheduled on 22 January.

The ECB is widely expected to announce expansion of its bond buying program as the region is reeling under risks of deflation as well as recession.

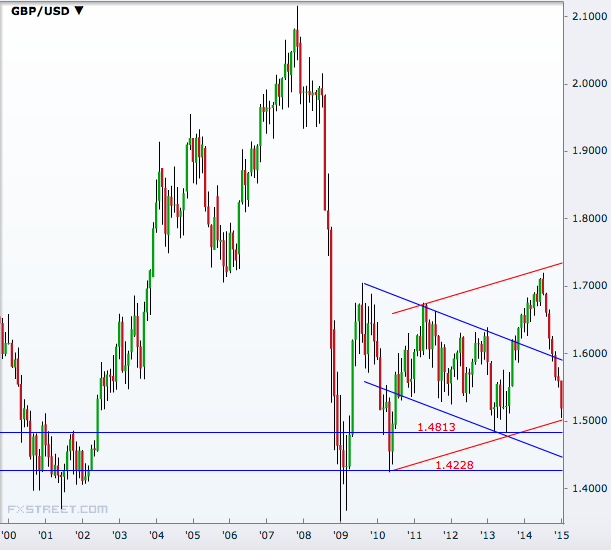

According to technical analysis, the GBP/USD pair is testing a channel support currently, which if broken, the next support will be 1.4813, the 2013 low.

Further south, the pair will aim 1.4228 as a different channel support, ahead of lows below the 1.40 mark.

© Copyright IBTimes 2025. All rights reserved.