SThree Uncertain About Market Conditions in 2012

SThree, the permanent and contract staffing group, says that the GDP growth and the staffing market are not linearly related and given the current levels of global economic and political uncertainty, it is difficult to foretell the kind of market conditions the group will face during 2012 with any accuracy.

The group posted strong results with a gross profit margin of 36 per cent for the year 2011 and is scheduled to release its Q1 interim management statement on Friday.

SThree reported a rise of 14.3 per cent in its revenue to £542.5 million from £474.5 million with gross profit of £195.5 million. Profit before tax increased by 40 per cent to £30.3 million as the group benefitted from positive operational gearing from the business expansion and investment in 2010 and early 2011. Basic earnings per share were 16.8 pence, up 41.2 per cent for the group for 2011.

While commenting on the final results, Chief Executive Officer Russell Clements said: "The well documented decline in global economic sentiment has in recent months weakened demand for the group's services in a number of markets. However, we are a cash rich and agile business, with a twenty-five-year track record of profitability and a seasoned management team. As such, we are well placed to maximise the potential of whatever market conditions prevail in 2012."

Robert Morton from Investec Securities also commented on the results saying that "It is no surprise that it (trading update) confirms that the recovery in trading slowed down significantly in the final months of the year." The brokerage firm has reduced its forecasts for full year 2012 and 2013 to reflect the impact of the financial turmoil of recent months.

SThree is confident that it is well-positioned to make the best of whatever 2012 has in store for the group. "We will manage the business prudently but we will not lose sight of the great medium-term prospects for our business and where appropriate we will invest to ensure that the group's future lives up to its potential," says Russell Clements.

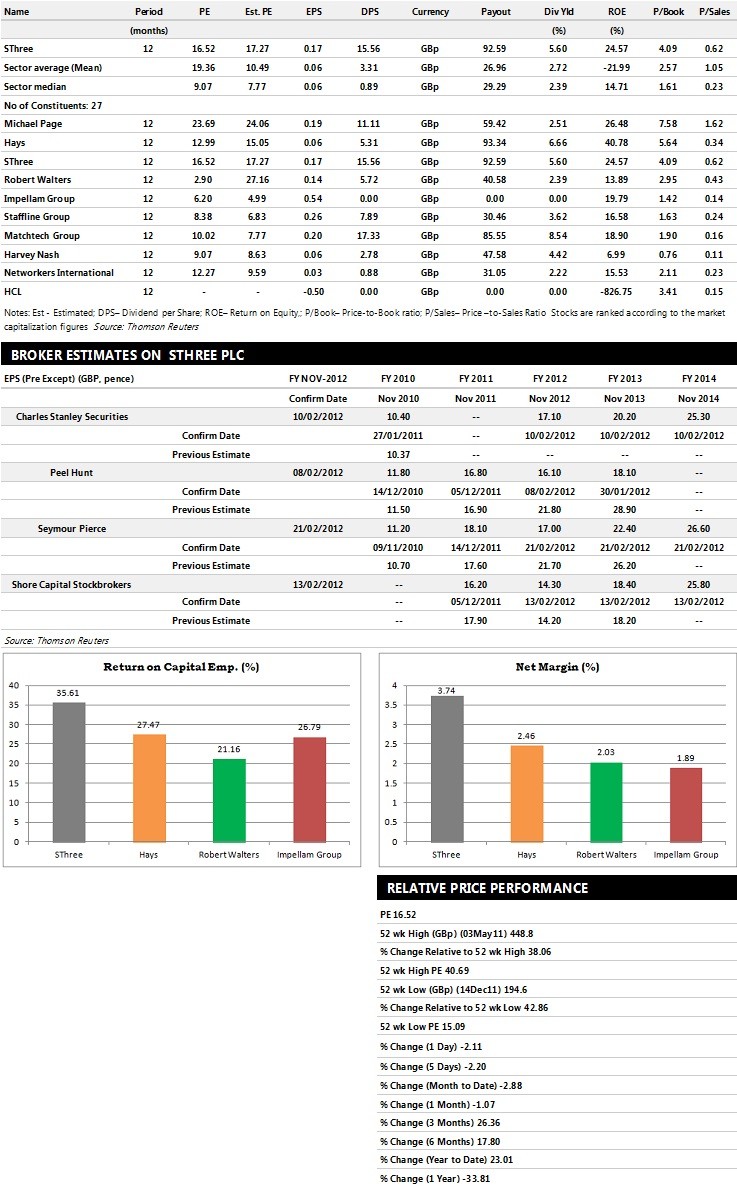

Brokers' Views:

- Seymour Pierce recommends 'Outperform' rating on the stock

- Shore Capital Stockbrokers assigns 'Outperform' rating

- Peel Hunt gives 'Buy' rating

- Collins Stewart gives 'Buy' rating with a target price of 300 pence per share

- Jefferies & Co assigns 'Buy' rating with a target price of 365 pence per share.

Earnings Outlook:

- Seymour Pierce estimates the company to report revenues of £579.80 million and £629.60 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £30.60 million and £40.40 million. Earnings per share are projected at 17 pence for FY 2012 and 22.40 pence for FY 2013.

- Shore Capital Stockbrokers projects the company to record revenues of £791.40 million for the FY 2013 with pre-tax profits (pre-except) of £26.10 million and £33.10 million. Profit per share is estimated at 14.30 pence and 18.40 pence for the same periods.

- Peel Hunt expects SThree to earn revenues of £201.70 million for the FY 2012 and £219.70 million for the FY 2013 respectively with pre-tax profits of £29.20 million and £33 million. EPS is projected at 16.10 pence for FY 2012 and 18.10 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.