Tech IPO Market Faces Worst Year Since Global Financial Crisis

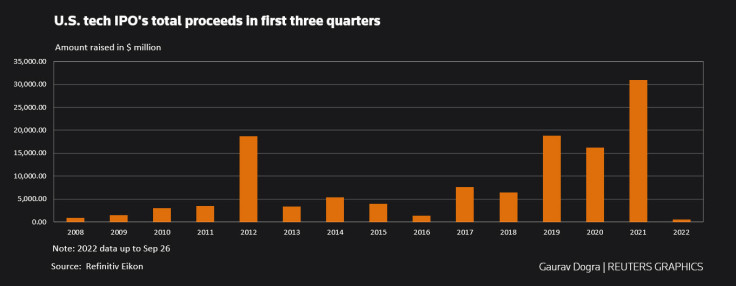

Initial public offerings by U.S. tech companies have sunk to their lowest levels since the global financial crisis of 2008, as stock market volatility, soaring inflation, and interest rate hikes have soured investor sentiment towards new listings.

According to Refinitiv data, only 14 tech companies have floated their shares on stock exchanges so far this year, compared with 12 in 2009. The IPOs this year have raised $507 million, the lowest amount that has been raised through flotations since 2000.

Total IPO volumes fell 90.4% in the first nine months of this year, compared with last year.

(GRAPHIC: US tech IPOs total proceeds in first three quarters -

)

Analysts interviewed by Reuters said a steep drop in stock market valuations has deterred tech firms from pursuing stock market launches.

The forward P/E (price-to-earnings) ratio of the S&P Information Technology index was trading at 20.18 -- the lowest level since April 2020.

(GRAPHIC: S&P 500 information technology index's price to earnings -

)

"Institutional investors have been shifting capital allocations while retail investors have been licking their wounds," said James Gellert, chief executive officer at Rapid Ratings.

"This is a terrible backdrop for IPOs, in particular tech IPOs, which rely on bull markets and momentum investors to bolster their market entries."

The Renaissance IPO index, which captures the largest and most liquid U.S IPOs, has slumped 50.4% this year, compared with the S&P 500 index's drop of 23%.

(GRAPHIC: YTD performance of the Renaissance IPO index and S&P 500 index -

)

Shares of Corebridge Financial Inc, which launched the largest IPO in the U.S. this year, were trading about 4% below its offer price of $21 on Wednesday.

Rachel Gerring, Americas IPO leader at Ernst & Young, said the poor after-market performance of 2021 IPOs has dampened investor appetite for new stocks.

"Tech has been impacted in an outsized way by the market-wide drop in valuations. There was significant fundraising throughout 2021 across the sector, providing tech IPO-aspirants with the necessary capital to weather this volatile time in the market," said Gerring.

Greek yogurt maker Chobani withdrew its plans for a U.S. IPO earlier this month, while several other big names such as Reddit and ServiceTitan have delayed their plans to go public this year.

In the United States, sectors including financials and healthcare were among the bright spots for IPOs, followed by energy & power.

Jennifer Post, partner at Thompson Coburn, said energy markets continue to be active due to disruptions in global supply and distribution channels, while electric vehicle adoption is also driving deals.

"These areas should see IPO candidates in 2023 as the urgency for capital investment will be more pressing and growing commercial and consumer demand should remain strong," said Post.

Copyright Thomson Reuters. All rights reserved.