Home

> Bank of England

Bank of England

Bank Holidays Cost UK Exchequer £19 bn Annually

For the service sector dependent Britain, each holiday costs the economy £2.3 billion.

Geetha Pillai Apr 09, 2012

European Markets Extend Losses After Soft German Data

Bond yields rise, shares slump as Europe's problems appear to deepen

Martin Baccardax Apr 05, 2012

Bank of England Holds Interest Rate at Record-Low 0.5%; £325bn Quantitative Easing Target Unchanged

MPC's key lending rate unchanged for 37th consecutive month

Shane Croucher Apr 05, 2012

BoE Rate Decision: A Test of Governor's "Maradona Theory"?

Governor Mervyn King and the MPC face growth and inflation dilemma

Martin Baccardax Apr 05, 2012

Recession Avoided? Service Sector Data Suggests UK Economy on the Mend

Service sector growth builds on positive data from the construction, manufacturing sectors.

Shane Croucher Apr 04, 2012

UK House Prices Rise Fastest in Three Years: Halifax

Mortgage lender's results show marked contrast to predictions of further slump in the market.

Nicholas Edmondson Apr 04, 2012

UK Consumer Confidence Dips Surprisingly on Increased Pessimism, Smashes BoE Expectations

The British consumer confidence unexpectedly fell to a three-month low in March as Britons grew increasingly worried about the outlook for their finances and for the economy as a whole.

Naresh Kumar Mar 30, 2012

Average UK Adult's Savings Fell 14% Last Year

Survey warns that more than a quarter of people have no savings amid fears over second recession.

Nicholas Edmondson Mar 29, 2012

Double Housing Market Blow as Prices and Mortgage Approvals Drop

Figures from the Bank of England and Nationwide show that people are struggling to find mortgages, while property owners are losing value on their homes.

Shane Croucher Mar 29, 2012

Osborne’s Budget Adds Further Challenge to UK Inflation Targets

ONS report estimates 0.17% rate increase in 12-month Consumer Price Index following budget.

Nicholas Edmondson Mar 28, 2012

Sterling Dips as Economy Shrinks Faster than Expected in Final Months of 2011

The Office for National Statistics has revised its growth figures down for the final quarter of 2011 - to an even bigger 0.3% contraction.

Shane Croucher Mar 28, 2012

BoE Asks Banks to Beef Up Capital

British banks are required to raise more capital at the earliest as the strength of the worldwide financial markets remains weak.

Naresh Kumar Mar 24, 2012

No Bonus This Year for Bankers, Says Bank of England

Bank of England asked the banks not to distribute huge amounts in bonuses because of the tight financial situation.

Geetha Pillai Mar 24, 2012

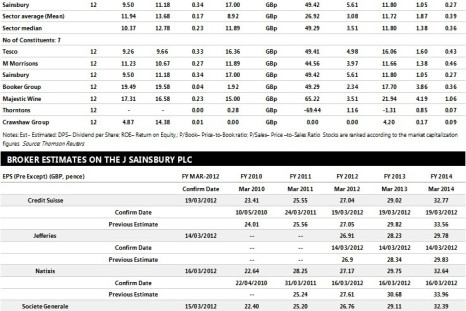

Sainsbury To Ramp Up Investments, Expects Good Progress In Difficult Consumer Environment

J Sainsbury, the retailing and financial services and property investment group, expects customers to spend cautiously in 2012, particularly in first half of the year. Although the short term remains challenging, key events later in the year, such as the Queen's Diamond Jubilee and London 2012 Olympic and Paralympic Games provide opportunities for growth.

Naresh Kumar Mar 20, 2012

UK Economy on Slow and Steady Growth Path

Britain's slow and steady economic growth helps it in avoiding recession, followed by upbeat data and last week's Greek debt restructuring. The Bank of England holds its asset purchase programme at £325 billion, as economists predicted 0.2 per cent growth in the current quarter.

Naresh Kumar Mar 16, 2012

Retail Sales Show 'Staggeringly Strong' Growth of 1.2%

Economists and financial analysts caught out by surprise surge of retail sales figures across UK despite gloomy outlook.

Shane Croucher Feb 17, 2012

Britain 'Unprepared' for Greek Meltdown, Warns Mervyn King

Eurozone crisis following Greek default would put UK economic recovery at risk, says Bank of England.

Shane Croucher Feb 15, 2012

UK Inflation Falls to 3.6% in January

Inflation at lowest point since November 2010.

Shane Croucher Feb 14, 2012

Big Banks Fall Short by £1bn on Lending to Small Firms

UK's five biggest banks miss lending targets for smaller businesses, says Bank of England.

Shane Croucher Feb 13, 2012

UK Will Dodge Recession and Economy will Start to Grow: CBI

Confederation of British Industry predicts Britain will avoid recession and see growth in second half of 2012.

Vinod Yalburgi Feb 13, 2012

Bank of England Expands Quantitative Easing by £50bn

£50bn QE 'printing money' programme to boost economy by buy up high-quality company assets, Monetary Policy Committee announces.

Shane Croucher Feb 09, 2012

George Osborne Tells Davos: I'll Control Bank of England in Crisis

Bank of England to lose independence during economic crisis under new government proposals.

Shane Croucher Jan 27, 2012

UK GDP Contracts Adding to Double-Dip Recession Fears

Britain's economic growth contracted by 0.2 percent in the last quarter of 2011, fuelling fears that Britain is tumbling into a double-dip recession.

Shane Croucher Jan 25, 2012

UK High Street Sales Creep up by 0.6%

Retail sales crept up 0.6 percent in December from previous month, amid widespread price drops by struggling retailers.

Shane Croucher Jan 20, 2012

UK Inflation Falls to 4.2% for December

UK inflation has fallen to 4.2 percent for December, in the Consumer Price Index's third consecutive drop.

Shane Croucher Jan 17, 2012

Bank of England Keeps Interest Rate at 0.5%

Bank of England Monetary Policy Committee hints it will increase quantitative easing while base rate stays unchanged.

Shane Croucher Jan 12, 2012

UK Inflation Falls to 4.8%, Bringing Relief to Bank of England

UK inflation has fallen from the 5.2 per cent mark in October to 4.8 per cent last month bringing a welcome respite to the Bank of England.

Tom Nicolson Dec 13, 2011

Germany Calls the Tune, so Forget 'Quantitative Easing'

The eurozone rescue deal briefly outlined Friday by the German chancellor and French president hasn't gone down well with Standard & Poor's, but the "Big Bazooka" Summit? Not if Bundeskanzlerin Merkel has her way.

Graeme Mackay Dec 12, 2011

UK Businesses that Went Bust in 2011

2011 was a very difficult year for business and there are few signs that 2012 will be any better.

Shane Croucher Dec 08, 2011

Europe’s Central Banks Disaster Plan to Print Deutsche Marks, Francs and Lira

The central banks of Europe have begun preparing contingency plans to re-print old currencies should the euro perish amidst the eurozone crisis.

Tom Nicolson Dec 08, 2011

Pages

- PREV

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- NEXT