Home

> Citigroup

Citigroup

US Quarterly Earnings and Retail Sales Push Asian Markets Up

Nikkei gains 0.94 percent while KOSPI is up 0.32 percent. Shanghai Composite index and Hang Seng trade 0.02 and 0.05 percent higher.

Prasanth Aby Thomas Oct 16, 2012

Iran Blocks Google and Gmail

Iran is preparing to create its own private internet and in the process has added Google and Gmail to its list of blocked sites.

Margot Huysman Sep 24, 2012

Japan Airlines Cancels Flights to China Due to Travel Boycotts over Island Row

Row over East China Sea islands hits airlines resulting in major carriers in both countries reducing their flights.

Geetha Pillai Sep 21, 2012

UBS Sued Over Pre-Crisis Mortgage-Backed Securities Sales

US regulator sues UBS over the sale of mortgage-backed securities to two credit unions before the credit crisis emerged.

Lianna Brinded Sep 07, 2012

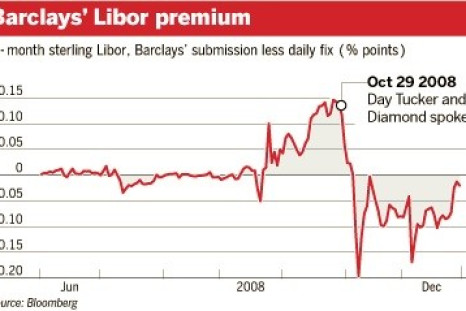

Libor Fixing Scandal: Barclays Axes US Manager and Trader

Barclays discharged Ritankar Pal and Dong Kun Lee in July due to their role in the Libor scandal, say Reuters citing regulatory filings.

Lianna Brinded Sep 05, 2012

Antony Jenkins: Should Barclays Have a Retail Chief as Leader? [ANALYSIS]

IBTimes looks at whether Barclays appointing head of consumer banking as CEO is right move for the bank.

Lianna Brinded Aug 30, 2012

Barclays Retail Chief Antony Jenkins Replaces Bob Diamond as CEO [VIDEO]

Outgoing chairman Marcus Agius says Jenkins 'excellent track record and intimate knowledge' were the clinching factors.

Lianna Brinded Aug 30, 2012

Exclusive: Wall Street Crackdown is Race for US Regulators

Former New York prosecutor Robert Juman says US regulators compete to become first to finalise charges against banks.

Lianna Brinded Aug 21, 2012

From Libor to Money Laundering: Time to Tidy up Fragmented US Legal System [ANALYSIS]

Numerous probes into money laundering and rate fixing scandals highlight need for fewer watchdogs.

Lianna Brinded Aug 20, 2012

Libor Fixing Scandal: Lloyds among 7 Banks Subpoenaed by Florida State

Bank of America, Societe Generale, Credit Suisse, Credit Agricole, Royal Bank of Canada, Rabobank Groep and Lloyds Banking Group hit by Florida attorney general Pam Bondi.

Lianna Brinded Aug 17, 2012

Libor Fixing Scandal: Seven Banks Receive Subpoenas from US Attorneys General

Deutsche Bank, Barclays, JPMorgan Chase, RBS, HSBC, UBS and Citigroup named in papers.

Lianna Brinded Aug 16, 2012

UK Faces Risk of Losing AAA Rating

Credit rating agencies Moody's and Fitch also put warnings on Britain's triple-A rating

Geetha Pillai Jul 27, 2012

Greece Finds €11.7bn in New Cuts as Cash Runs Dry and Default Looms

Prime Minister Samaras is set to meet EU Commission President Thursday as Troika continues to doubt Greece's ability to get back on track with its promised reforms.

Martin Baccardax Jul 26, 2012

Citigroup Raises Chances of Grexit to 90%

Citi also expects Britain to lose its AAA rating over the next two to three years due to the continued economic weakness.

Geetha Pillai Jul 26, 2012

Libor Fixing Scandal: Hunt for New Barclays’ CEO and Chairman Continues

As Barclays’ deputy chairman Sir Michael Rake turns down the role of taking over from Chairman Marcus Agius, the race to fill the senior positions including ex-CEO Bob Diamond’s role at the embattled bank continues.

Lianna Brinded Jul 23, 2012

Libor Fixing Scandal: Arrests Imminent As Police Close-In

US and European prosecutors are close to individual traders at banks for colluding to manipulate key global lending rates, says a Reuters report.

Lianna Brinded Jul 23, 2012

Libor Fixing Scandal: Global Banks and Brokers Will Not Join Forces to Reach Settlement

Market sources tell IBTimes UK that banks and brokers under investigation for Libor fixing are unlikely to join forces in reaching a settlement.

Lianna Brinded Jul 20, 2012

European Scorecard: A Country-by-Country Guide Guide to the Debt Crisis

Outlining the politics, economics and finances of the key players in the Eurozone debt crisis

Martin Baccardax Jul 11, 2012

Bank of China Shrouded in Mystery: The Least Transparent Global Corporation

Norway's Statoil is right on top while Barclays is in the 71st position, ahead of Citigroup, JP Morgan Chase, Goldman Sachs and Bank of America.

Staff Reporter Jul 10, 2012

Libor Scandal Goes Global as US, European Regulators Vow Action

Deutsche Bank reportedly suspends two dealers, US investor files class action

Martin Baccardax Jul 09, 2012

Amazon Plans Smartphone to Rival Apple iPhone and Google Android Devices [VIDEO]

Online retailer Amazon is developing a smartphone to rival the Apple iPhone and Google Android handsets.

Matthew Chapman Jul 06, 2012

Barclays in Crisis: Short-List of Potential Successors to Bob Diamond

Candidates include current and former Barclays executives as search campaign begins

Martin Baccardax Jul 03, 2012

Barclays Chief Marcus Agius Officially Steps Down Over Libor Scandal [VIDEO]

His resignation comes after the bank was fined £290 million for trying to tweak Libor.

Staff Reporter Jul 02, 2012

Former Citigroup VP Gets 8 Years in Prison for Stealing $22mn

Foster evaded detection for several years as he continued to wire money to his personal account by making false account filing.

Geetha Pillai Jun 30, 2012

Libor Rate Fixing Scandal: Barclays Shares Lead Banks Down on FTSE 100

Shares in British banks took a dive on the FTSE 100 in morning trading a day after the Libor rate fixing scandal involving Barclays broke.

William Dove Jun 28, 2012

Libor Rate Fixing Scandal: UK Government's Osborne and Labour's Miliband Call for Criminal Investigation into Barclays

The British finance minister George Osborne and and Leader of the opposition call for a criminal investigation into the Barclays Libor rate fixing scandal that saw the group being fined a record amount by UK and US authorities.

Lianna Brinded Jun 28, 2012

Libor Rate Fixing Scandal: RBS, Lloyds, HSBC Investigated Following Barclays' Settlement

Three of Britain's biggest lenders, RBS, Lloyds and HSBC are among the 17 banks and one broker that are being investigated, following Barclays' involvement in fixing two of the most important interest rates in the global financial markets which resulted in a record fine.

Lianna Brinded Jun 28, 2012

Collateral Damage: Moody's Bank Downgrades May Hit Balance Sheets [VIDEO]

As slew of global bank downgrades by Moody's will add billions in collateral, meaning banks may have to scramble to shore-up their balance sheets.

Lianna Brinded Jun 22, 2012

Moody's Downgrades Top 15 Banks, Including Barclays and RBS [VIDEO]

Banks responded strongly to Moody's analysis, saying the ratings are backward looking.

Vasudevan Sridharan Jun 22, 2012

Euro or Drachma? Greeks Set to Decide on the Fate of Single Currency

The crucial Greek vote will set the stage for the country's continuation or exit from the single currency zone.

Geetha Pillai Jun 17, 2012

Pages

- PREV

- 3

- 4

- 5

- 6

- 7

- 8

- NEXT