Home

> Federal Reserve

Federal Reserve

Bloomberg Under New Pressure as Bank of Japan Probes Snooping

Bloomberg journalists had reportedly access to its financial information terminals

Umberto Bacchi May 14, 2013

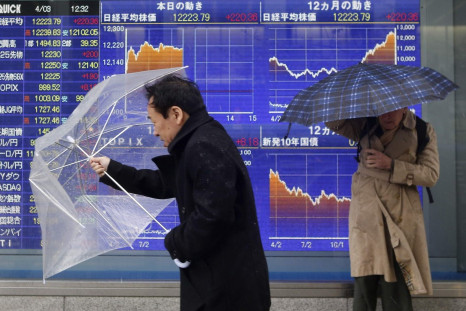

Asian Markets Weekly Report: Nikkei Surges on Yen's Continued Weakness

Nikkei gains 3% in the last four days of the week on robust employment report from the US.

Jerin Mathew May 11, 2013

European Shares Soar to 5 Year Highs

Bullish sentiment prevails across European markets as investors look for cues from policy measures and corporate earnings.

M Rochan May 10, 2013

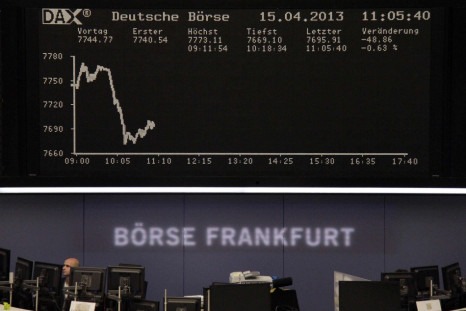

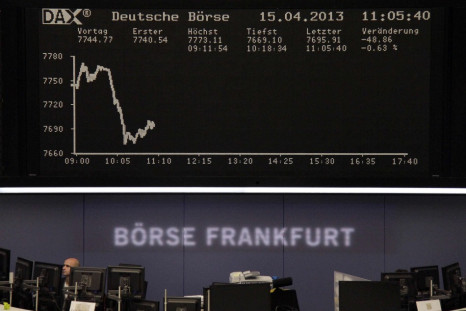

European Markets Retreat Ahead of Retail Sales Data

The European Central Bank head Mario Draghi will address the media later in the day.

Jerin Mathew May 06, 2013

Asian Markets Gain on Wall Street Cues

An unexpected improvement in the US labour market lifts Asian market sentiments.

Jerin Mathew May 06, 2013

US Growth Concerns Ease as Unemployment Rate Slips to Four-Year Low

Non-farm payrolls increase by 165,000 in April, above analysts expectations of 145,000.

Jerin Mathew May 04, 2013

Asian Markets Rise on Upbeat US Jobs Data and ECB Rate Cut

The ECB's rate cut and an unexpected decline in US jobless claims revive investors' hopes for global recovery.

Jerin Mathew May 03, 2013

Asian Markets Down on Weak Data from US and China

Asia has shed previous week's gains after weak data from the US and China brought back global growth concerns.

Jerin Mathew May 02, 2013

European Markets Rise Ahead of US and European Central Bank Meeting

Investors expect the ECB and the US Federal Reserve to continue their growth-supportive monetary policies.

Jerin Mathew Apr 30, 2013

Asian Markets Except Nikkei Gain on Central Bank Stimulus Hopes

The central banks across the globe are expected to continue their growth-supporting monetary policies.

Jerin Mathew Apr 30, 2013

European Markets Gain Ahead of Italian Government's Policy Announcement

Italy's new coalition government is set to announce its economic policies and growth agenda.

Jerin Mathew Apr 29, 2013

Asian Markets Mixed as Investors Await Key Economic Events

Investors awaiting data including central bank policy meetings in eurozone and US.

Jerin Mathew Apr 29, 2013

European Markets Gain as Investors Await UK Employment Data

Wall Street's strong gains on positive economic data help European markets to open on a higher note.

Jerin Mathew Apr 17, 2013

London Finance Job Vacancies Rise on Risk Management and Compliance Demand

Pressure from regulators to increase risk management and oversight departments leads to 25% vacancy surge

Lianna Brinded Apr 11, 2013

Asian Markets Weekly Report: Nikkei Surges on Bank of Japan Stimulus

Asian stocks outside Japan retreat on weak economic data, Korean tensions and China bird flu fears.

Prasanth Aby Thomas Apr 06, 2013

European Shares Fall Sharply After Dismal US Jobs Data [VIDEO]

Non-Farm payrolls in the US and employment figures from Canada raise key questions about the global economic recovery.

Martin Baccardax Apr 05, 2013

European Stocks Forge Ahead as Cyprus Strikes Bailout Deal [VIDEO]

European markets rise, mirroring Asian stocks, as Nicosia's last-minute bailout deal boost sentiments across the region.

Prasanth Aby Thomas Mar 25, 2013

Standard Chartered Chairman Retracts 'Both Legal and Factual Incorrect Statements' On Money Laundering Scandal

Chairman Sir John Peace admits he was legally and factually incorrect on sanction busting.

Lianna Brinded Mar 21, 2013

European Stocks Weak as Cyprus Fears Persist

European markets open lower as the continuing Cyprus bailout concerns offset improved China manufacturing PMI data.

Prasanth Aby Thomas Mar 21, 2013

European Stocks Dip on Cyprus Bailout Fears [VIDEO]

European markets open weak as investors await Cypriot parliament's final decision on the crucial bailout package.

Prasanth Aby Thomas Mar 18, 2013

Asian Markets Weekly Roundup: Stocks Weak but Japan Surges

Most Asian markets retreat but Japan continues to trade higher as parliament approves Bank of Japan governor.

Prasanth Aby Thomas Mar 16, 2013

Standard Chartered Posts 10th Consecutive Year of Profits Despite Fines

Emerging markets bank posts nearly $7bn of profits despitehuge money laundering-related fines.

Lianna Brinded Mar 05, 2013

Asian Markets Weekly Roundup: Stocks Gain Despite Economic Concerns

Asian stocks advanced this week as Japan's central bank chief nomination cheered investors despite European and US concerns

Prasanth Aby Thomas Mar 02, 2013

European Stocks Gain on Central Bank Reassurances

Markets open higher as Mario Draghi and Ben Bernanke reaffirm stimulus continuity.

Prasanth Aby Thomas Feb 28, 2013

European Stocks Recover as Fed Defends Stimulus Plans

Markets pick up from previous session's drop as Ben Bernanke's stimulus reassurances ease US economic concerns.

Prasanth Aby Thomas Feb 27, 2013

Asian Stocks Recover on Bernanke's Reassurances

Markets pick up from slump following Italy election deadlock as US Federal Reserve chief defends monetary stimulus plan.

Prasanth Aby Thomas Feb 27, 2013

European Stocks Fall Sharply After Italy Election Gridlock

Markets plunge as the inconclusive Italian election results raise fresh concerns on eurozone's recovery efforts.

Prasanth Aby Thomas Feb 26, 2013

Asian Stocks Gain on Bank of Japan Chief Speculation

Reports that ADB chief Haruhiko Kuroda could be next BoJ chief push yen down against dollar.

Prasanth Aby Thomas Feb 25, 2013

Asian Markets Weekly Roundup: Yen and China Property Concerns Weigh on Sentiments

Asian stocks posted mixed performance this week, as yen remained volatile and global concerns rebounded

Prasanth Aby Thomas Feb 23, 2013

European Stocks Tumble on Fed Minutes Concerns

Markets open on weak sentiments as US Federal Reserve's meeting-minutes point to stimulus measure concerns.

Prasanth Aby Thomas Feb 21, 2013

Pages

- PREV

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- NEXT