Home

> Inflation

Inflation

Singapore Set to Record Strong Growth on Global Demand Recovery

Singapore largely depends on external trade for its economic growth.

UK Retailers Slashing Prices at Record Rate

British Retail Consortium shows shops continuing to cut prices because of consumer finance squeeze, despite UK recovery.

ECB Feels Pressure as Eurozone Inflation Hits Four Year Low

Recession hit eurozone takes a slight knock as inflation decreases.

Lady Gaga Ticket Prices Same as Australia's Average Weekly Wage

Higher inflation in Australia is outpacing cost of living increases in biggest developed economies, according to Bloomberg.

Moody's: India Less Vulnerable to Global Shocks Due to Lower CAD

India's CAD declined to $4.2bn or 0.9% of GDP for fiscal quarter ended in December.

UK Cost of Living Eases as Wage and Inflation Gap Narrows

The ONS says that CPI inflation dropped to 1.7% in February, down from 1.9% in January.

Labour's 'Cost of Living Crisis' Attack Line Has Crumbled

Ed Miliband needs to adopt a new riff to take on Cameron and Clegg as wages catch up with inflation.

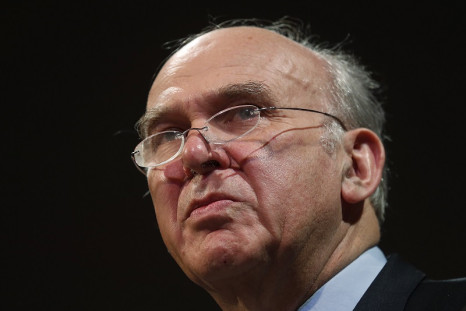

UK Government Hikes Minimum Wage to £6.50 Per Hour in Inflation Beating Move

Business Secretary Vince Cable says the move marks the start of a welcome new phase in minimum wage policy.

Cost of Living: UK Real Wages to Remain Below Pre-Crisis Peak Until 2020

PWC says the economic recovery so far has been rich in jobs, but poor in productivity and wages.

Cost of Pint Soars by 1,948% in 40 Years

The average price of a pint is £2.87, a huge hike due to inflation in the UK

David Cameron Backs Inflation-Busting Minimum Wage Hike

Prime minister 'looking forward' to accepting recommendation of Low Pay Commission

UK Minimum Wage: Low Pay Commission Suggests Above-Inflation 3% Hike

Business Secretary Vince Cable reveals LPC recommendation on UK minimum wage rise to £6.50.

UK Retail Sales Growth 'Clear Sign of Sector's Improving Health'

ONS reports UK retail sales rising 4.8% across year in January amid economic and consumer revival.

Cost of Living: UK Family Spending Power Continues to Rise

Asda says the rise was driven by a fall in the rate of CPI inflation.

UK Employment Surge to Slow Amid Productivity Hangover

The CIPD says the vast majority of organisations expect to give pay awards below inflation.

UK Interest Rate Hike Delayed as UK Recovery 'Neither Balanced Nor Sustainable'

Bank of England Governor Mark Carney rejigs forward guidance away from unemployment rate as it falls below 7%.

Fed Chair Janet Yellen: US Labour Market Recovery 'Far From Complete'

US Federal Reserve chair Janet Yellen says too many long-term unemployed in labour market.

UK Recovery: Retail Sector Bosses Bullish Despite Continuing Consumer Squeeze

Korn Ferry survey of retail sector chairmen and chairwomen finds 73% optimistic about economic outlook.

Cost of Living Crisis 'Highly Unlikely' to End Before 2015 General Election

Institute for Fiscal Studies shoots down Conservative hopes that UK recovery will filter down to masses before election.

UK Shop Prices Fall at Fastest Pace in Seven Years on Deeper Discounts

Shop price deflation accelerated to 1% in January from 0.8% in December, according to the BRC.

Dogecoin Circulation to Grow by Five Billion Annually

Most digital currencies including bitcoin are designed to be deflationary.

UK Wages: Over Half of Firms Plan Pay Rises in 2014

As politicians debate the UK 'cost of living crisis', Barclays survey reveals business plans to boost workers' wages.

Cost of Living Crisis: No George Osborne, UK Pay isn't Rising in Real Terms

UK Treasury claims take home pay rose in real terms for 90% of people, but is this true?

Mission Impossible: Can Fed's Janet Yellen Understand the US Economy?

Latest nonfarm payrolls have made the discussion about the correct direction of monetary policy more difficult

Eurozone Could be Entering Deflation Spiral

Eurostat indicates annual inflation is down to 0.8% in December 2013.

Turkey Raises Consumption Taxes on Alcohol, Cigarettes and Cars

Government increases VAT on goods after wave of economic and political instability

Higher Inflation and Lower Wages To Hit Japan's Household Spending Power

Consumer prices rose 1.2% in November.

Japanese Stocks Lead A Bulk of All Asian Markets Higher

Japan's Nikkei share average finishes at its highest in six-years.

BOJ Policymakers Expect Japan's Economic Recovery to Continue in 2014

Several policymakers of Bank of Japan still concerned about pace of growth.

The 12 Days of Christmas Costs 7.7% More in 2013

PNC's Christmas Price Index shows gift costs from 'The Twelve Days of Christmas' surge year-on-year